HIGHLIGHTS:

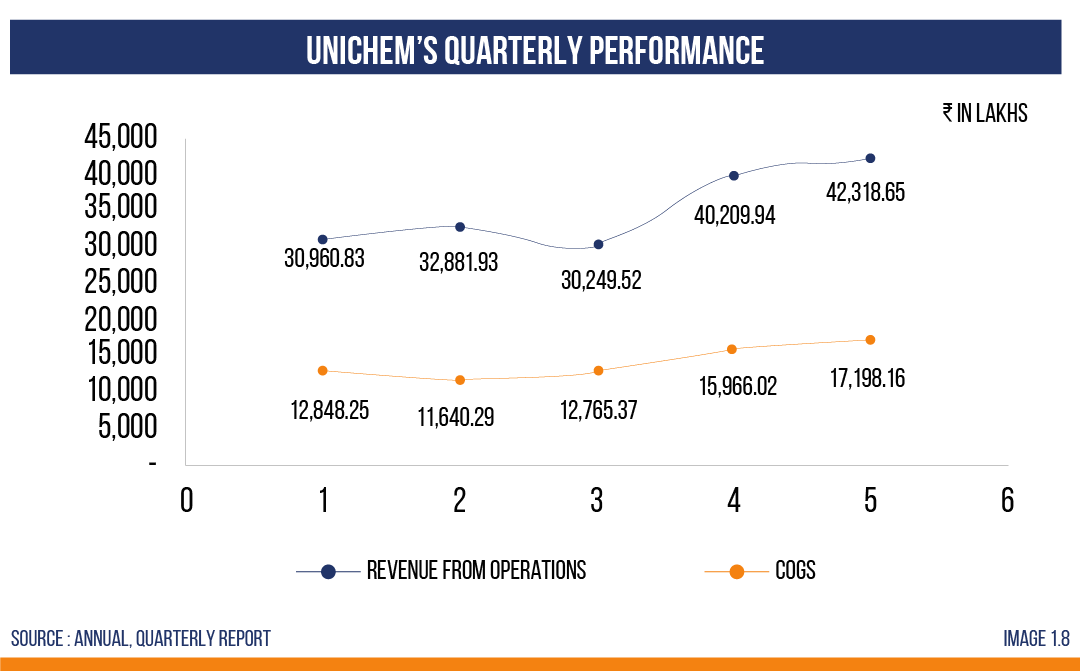

- Unichem Laboratories Ltd.’s June ’23 Quarterly Revenue is Rs 432 Cr. which is a growth of 36.7% YoY.

- There has been a noticeable increase in revenue from operations every quarter for the past 2 quarters.

- The Company has incurred Rs. 1,268.74 lakhs (including capital and recurring expenses) towards Research and Development.

INDUSTRY OUTLOOK

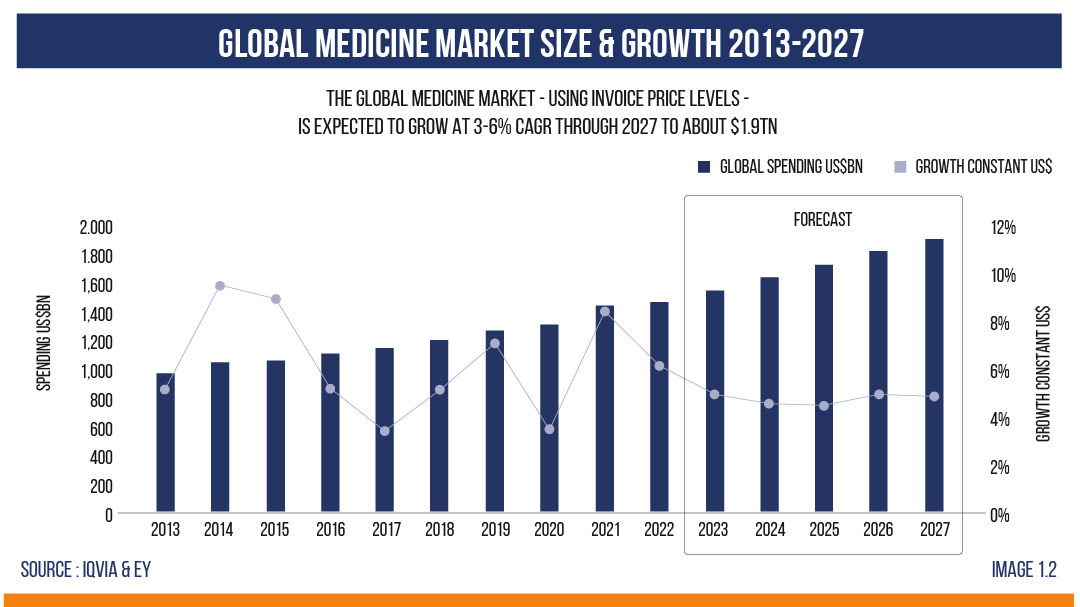

The pharmaceutical sector has experienced rapid growth in recent years, and there is a projection to reach a substantial market value of US$ 1.5 trillion by 2023. This remarkable expansion is driven by the adoption of cutting-edge digital platforms, big data analytics, cloud computing, and Artificial Intelligence (AI), which are transforming the industry.

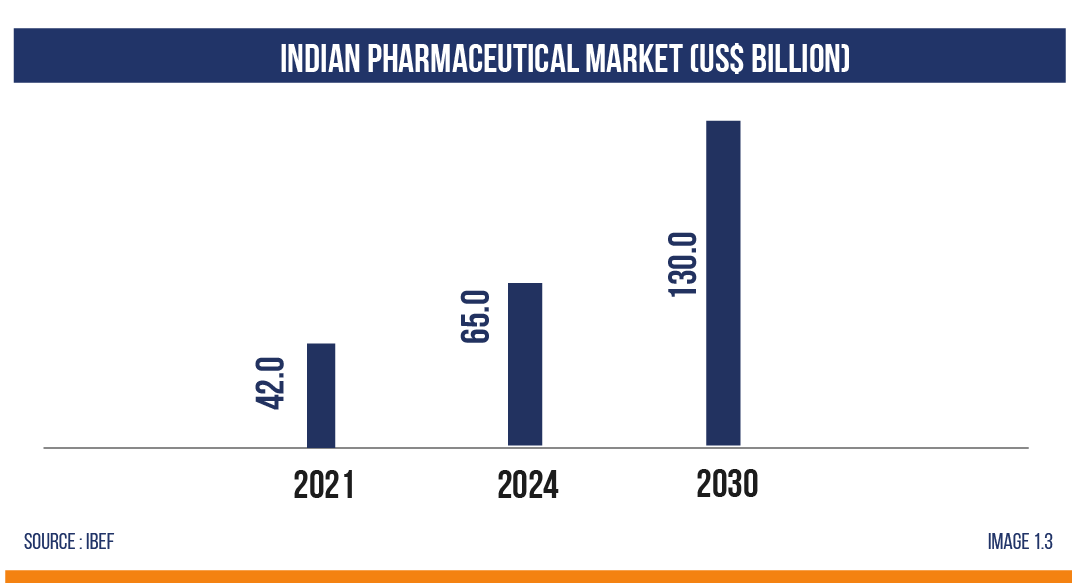

India’s pharmaceutical industry has emerged as a global leader, earning the title ‘the Pharmacy of the World.’ It currently ranks third in terms of pharmaceutical production by volume. The Indian pharmaceutical market is expected to grow significantly, reaching US$ 65 billion by 2024 and an impressive US$ 130 billion by 2030. Government data indicates that the Indian pharmaceutical sector is valued at ~US$ 50 billion, with exports contributing over US$ 25 billion. India plays a substantial role in meeting global demand for generic drugs, accounting for about 20% of global generic drug exports. India is a prominent leader in the global pharmaceutical landscape, particularly in pharmaceutical formulations. An estimated 40% of generic formulations supplied to the United States originate from India.

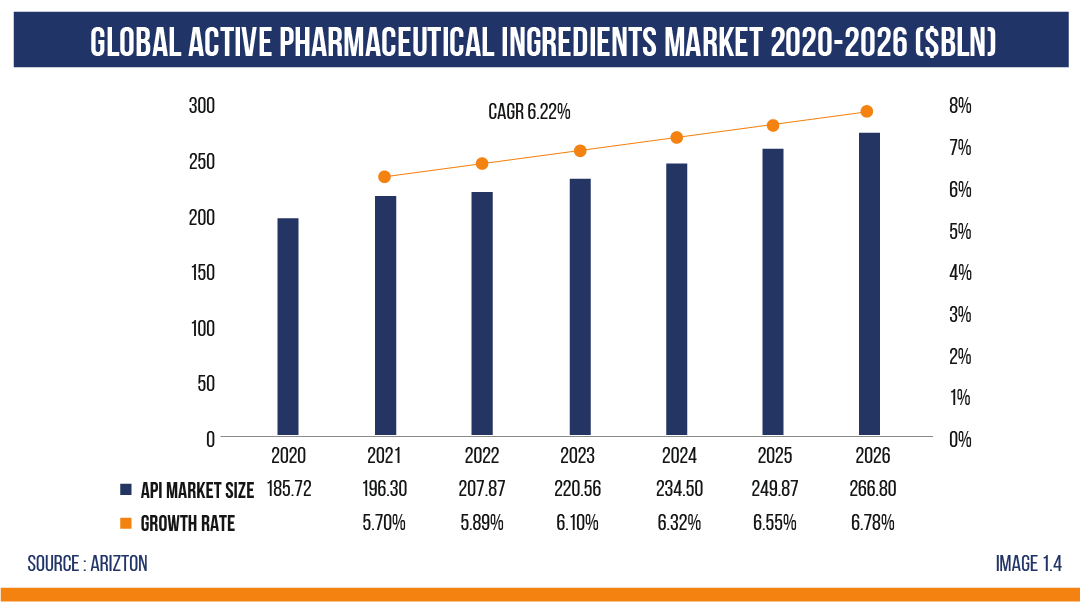

Factors such as the aging population, lifestyle-related diseases, demographic shifts, and new product innovations will drive the industry’s demand. IQVIA has predicted the loss of exclusivity (LOE) to significant- ly impact the industry, as the US alone is expected to face LOE to the tune of $141 billion by 2027. This will open the door for generic players and can act as a great stimulant. Companies producing generic APIs, like Unichem Laboratories Ltd., Divi’s Laboratories Ltd., Glenmark Life Sciences Ltd (GLS), etc., will be significant benefactors. Divis’ Lab is one of the API’s leaders, the world’s largest producer of 10 out of the 30 Generic APIs it manufactures. GLS is another big player with 139 API molecule product portfolios sold in India and exported to multiple countries. Unichem Lab is correct at the intersection of the growth path. Multi-decadal experience, a robust research team, and innovation-driven management are some of the pivotal points for the Company.

BUSINESS DESCRIPTION:

Unichem Laboratories Limited, led by Dr. Prakash Mody, is a pharmaceutical company founded in 1944. The Company has engaged in Contract manufacturing, API manufacturing, and formulation generation. The Company has seven decades of experience and 3 Formulation plants and 3 API plants. Unichem manufactures and markets a wide range of APIs and pharmaceutical formulations globally, catering to various therapeutic areas, including cardiology, gastroenterology, psychiatry, neurology, anti-infective, and pain management.

Unichem targets America, aiming for a prominent role with high-quality, cost-effective generics driven by vertically integrated products and a dynamic R&D pipeline. Niche Generics Limited and Unichem Laboratories Limited, Ireland, have bolstered Unichem’s European expansion since 2006. Niche Generics focuses on generics development, licensing, and European collaborations. ACASIA’s extensive reach encompasses Africa, the CIS (Commonwealth of Independent States), and Asia. Its growing international presence includes a 100% subsidiary, Unichem SA (Pty) Ltd., based in Cape Town, South Africa, with a strategic focus on tapping into the regulated South African market.

FINANCIAL PERFORMANCE:

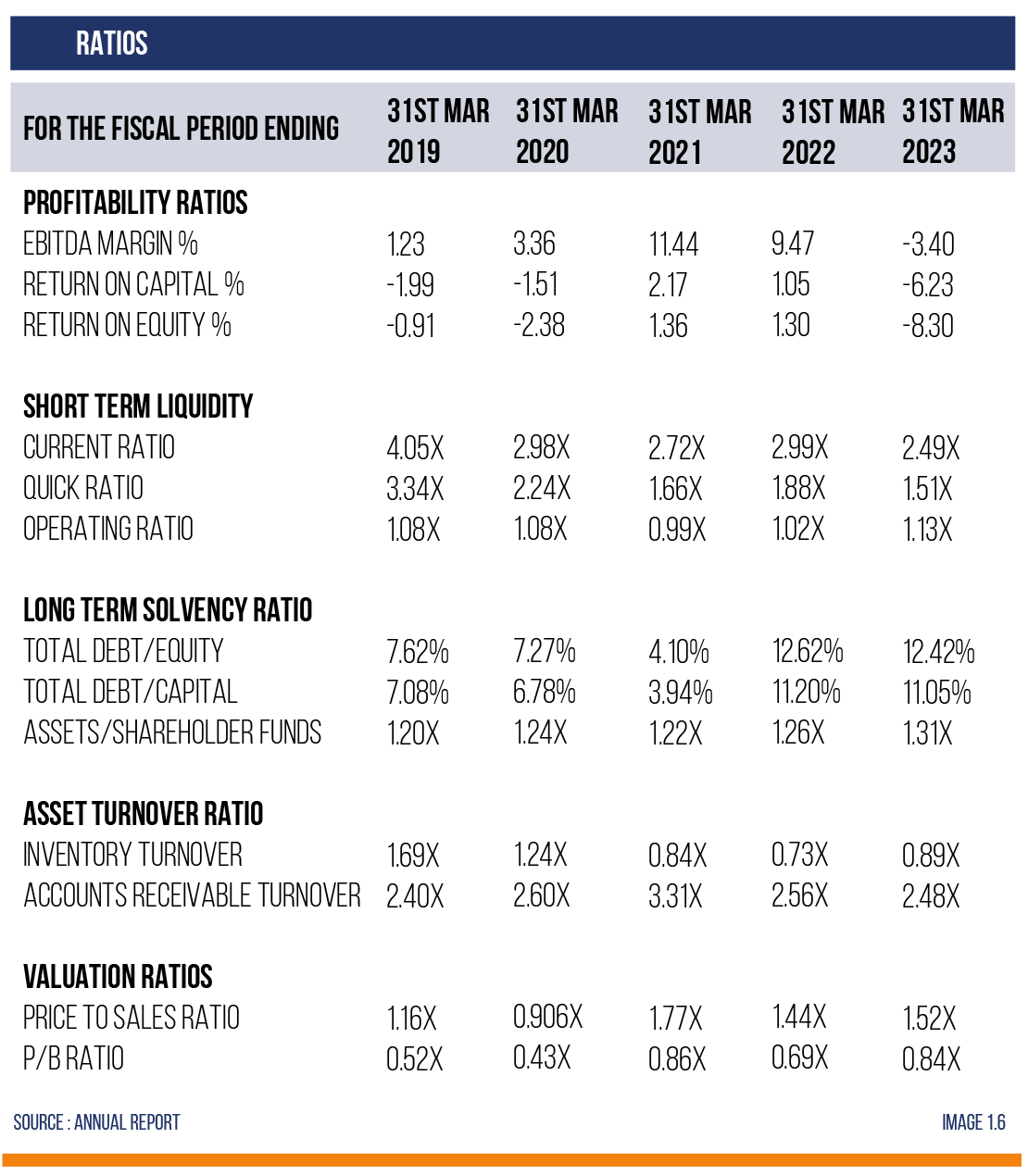

Unichem Ltd. has demonstrated a noteworthy financial performance recently. Its quarterly revenue showed a substantial YoY increase of 36.7% to reach Rs 431.8 Cr. This achievement significantly exceeded the sector’s average quarterly revenue growth YoY, which stood at 14.3%. Furthermore, the Company’s brief overview of financial performance during the previous five years is shown in the table alongside image 1.6.

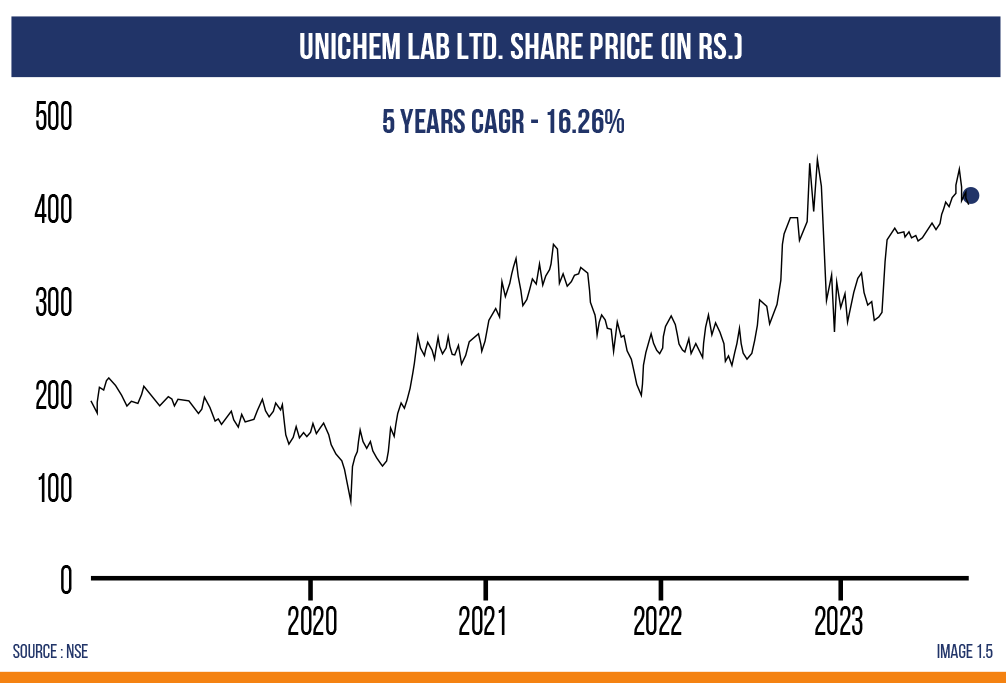

The annual revenue grew by 4.9% compared to last year, totaling Rs 1,381.5 cr., this growth rate is marginally below the sector’s average revenue growth of 8.6% for the same fiscal year. However, the revenue is growing at a brisk 5% CAGR over the last 3 years. The 5-year EBITDA CAGR of 43% shows a business that is growing. Last year, the profitability took a hit due to exceptional expenses, but one can expect management to turn things around this fiscal year. The US segment is vital for Unichem, generating over 57% of its revenues and serving as a primary growth catalyst. As and when the situation improves in America, the Company is expected to perform better than it has been doing for the past quarters.

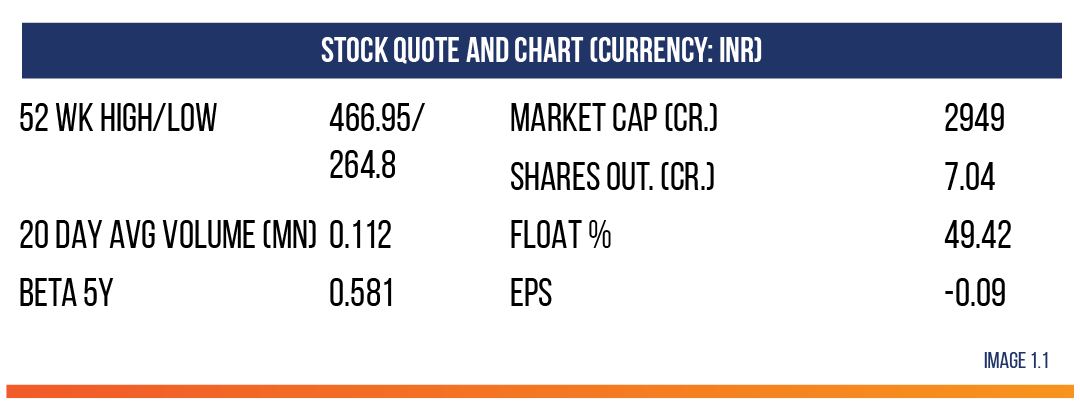

The price-to-sales ratio at 1.52x is around the 5-year trailing average of 1.5x. The Price Book ratio at 0.84x is also close to its 5-year trailing average of 0.67x. Thus, the Company is comfortably placed in terms of valuation metrics. Debt to Equity Ratio is at 12.42% and decreasing Y-o-Y. This implies that its assets are financed mainly through equity, and there isn’t an excessive debt burden, which gives management leeway to expand and explore different opportunities. The Company’s current ratio stands at 2.49x and remains a strong indicator for short-term liquidity. The Company’s Enterprise Value has grown to Rs. 2,147.1 Cr. levels with a robust.

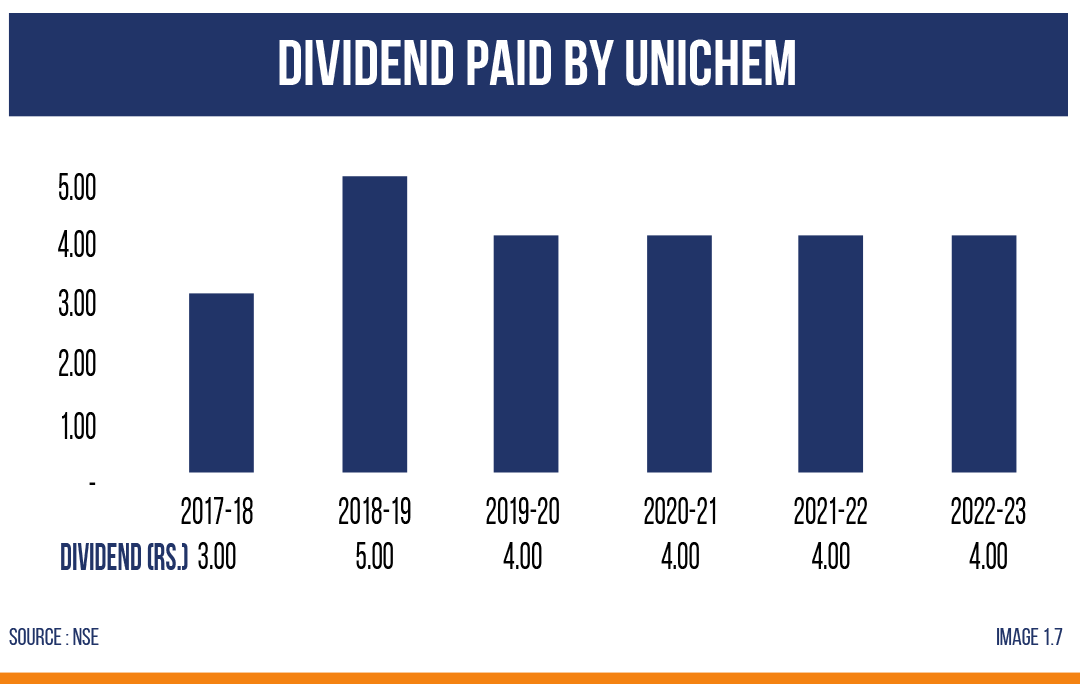

3-yr CAGR of 28.3%. Unichem has a solid history of paying dividends – something investors love! Unichem has zero promoter pledges, which provides additional confidence to the stakeholders.

3-yr CAGR of 28.3%. Unichem has a solid history of paying dividends – something investors love! Unichem has zero promoter pledges, which provides additional confidence to the stakeholders.

Though the last few quarters have been a rough ride, with extreme efforts, India is offering itself as an alternative manufacturing base in a growing list of industries, which will help strengthen supply chains and help companies grow.

CURRENT DEVELOPMENTS AND FUTURE EXPECTATIONS:

Financials – Unichem Ltd. has experienced consistent revenue growth over the past few quarters. Starting at Rs. 30,960.83 Cr. in Q1FY22, the Company saw a steady increase, reaching Rs. 32,881.93 cr. in Q2FY22, reflecting an approximate 9.47% rise. Although Q3FY22 witnessed a slight dip, with revenue at Rs. 30,249.52 Cr. the Company had a remarkable surge in Q4FY22, where revenue soared to Rs. 40,209.94 Cr. indicating- ing an impressive approximately 32.93% increase. This positive trend continued into Q1FY23, with a 5.25% rise compared to the previous quarter, resulting in Rs. 42,318.65 Cr. revenue. The Gross Profit Margin, representing COGS as a percentage of Revenue from Operations, varied between 35.53% and 42.23%. It remained reasonably stable, indicating consistent profitability and cost efficiency despite fluctuations in revenue. Stable or improving Gross Profit Margins are positive signs for investors, demonstrating the Company’s capacity to maintain profitability while growing. Unichem Ltd.’s performance underscores its ability to maintain consistent growth with notable spikes during specific periods. In FY22, Unichem devoted 10% of its revenue, approximately 119 Cr. to R&D. This substantial investment in innovation, compared to the industry-try an average of 1.9% for major players, positions Unichem for long-term by expanding its product portfolio and boosting revenue.

Business and Future Expectations – Unichem has invested substantial- ly in Research and Development (R&D), establishing cutting-edge facilities. Since 2012, it has centralized its Generic research efforts at the Goa Centre of Excellence (CoE), incorporating API Process Research, Analytics, and Formulation Development. Unichem’s API unit is pivotal and is known for its world-class quality and transparency. Their diverse API portfolio spans numerous therapeutic fields, boasting 76 USDMFs and 27 CEPs. With three advanced Indian facilities, they hold a collective capacity nearing 600 KL. Unichem’s R&D has successfully developed over 72 ANDAs and 76 DMFs spanning various markets and therapeutic categories. Anticipated growth includes a rise in filings and approvals in the future. They also specialize in contract research, development, and manufacturing, and they’ve established strategic alliances with pharma- ceutical giants. Unichem’s 6 GMP-certified manufacturing facilities in India and their R&D centre in Goa ensure adherence to rigorous global quality standards. IPCA has acquired a significant 59.38% stake in Unichem, which would enable IPCA’s re-entry into the US generics market and aid synergy through cross-selling of the portfolio in the export market.

Recent events –

- Following the conclusion of FY22, the Company signed a Share Purchase Agreement with Sekhmet Pharmaventures Private Limited to divest its 19.99% shareholding in Optimus Drugs Pvt. Ltd.

- During FY22, the Company secured approvals for 5 ANDAs and successfully launched 5 products in the USA’s largest generic market. Additionally, it introduced 2 products in Brazil and submitted 6 dossiers in various emerging markets, reflecting its global expansion efforts.

- In April 2023, IPCA Laboratories Ltd. acquired a 33.38% stake in Unichem for Rs. 402.23 per share, amounting to Rs. 945.35 Cr. Recently, IPCA received approval to purchase an additional 26% stake in Unichem, increasing their total stake in the Company to 59.38%. The stake acquisition would benefit IPCA as Unichem has a sturdy presence in some of the world’s biggest ‘Pharma’ zones.

Strengths –

- Unichem is a company with zero promoter pledges. Also, the amount of debt has remained stable and within limits.

- The number of FII/FPI investors increased by 25% in June ’23.

- The stock price is above short, medium & long-term averages on the technical front, which shows strength.

- Unichem has a strong presence in highly regulated markets through six Wholly Owned Subsidiaries in the USA, UK, Ireland, Brazil, South Africa, and China.

- Unichem Laboratories Ltd. has consistently declared 26 dividends since Aug. 17, 2001, giving investors visibility and confidence.

- ICRA has rated the Company’s long-term rating to A- (Stable). This rating indicated adequate safety regarding the payment of financial obligations.

CONCLUSION:

Unichem Laboratories Ltd. is an exciting company in a sector that has good tailwinds. Loss of exclusivity in the upcoming years across many markets will bode well with Generic API companies. This industry is heavily regulated, and entry to markets like America, Europe, etc., is challenging, but Unichem has a solid and long presence in such markets. Ipca Lab, now amongst its promoter group, will provide guidance and further strengthen the Company’s position in the market. Managing debt, lowering input prices, and better inventory management will help the Company progress further.

UNICHEM LABR LTD.