HIGHLIGHTS

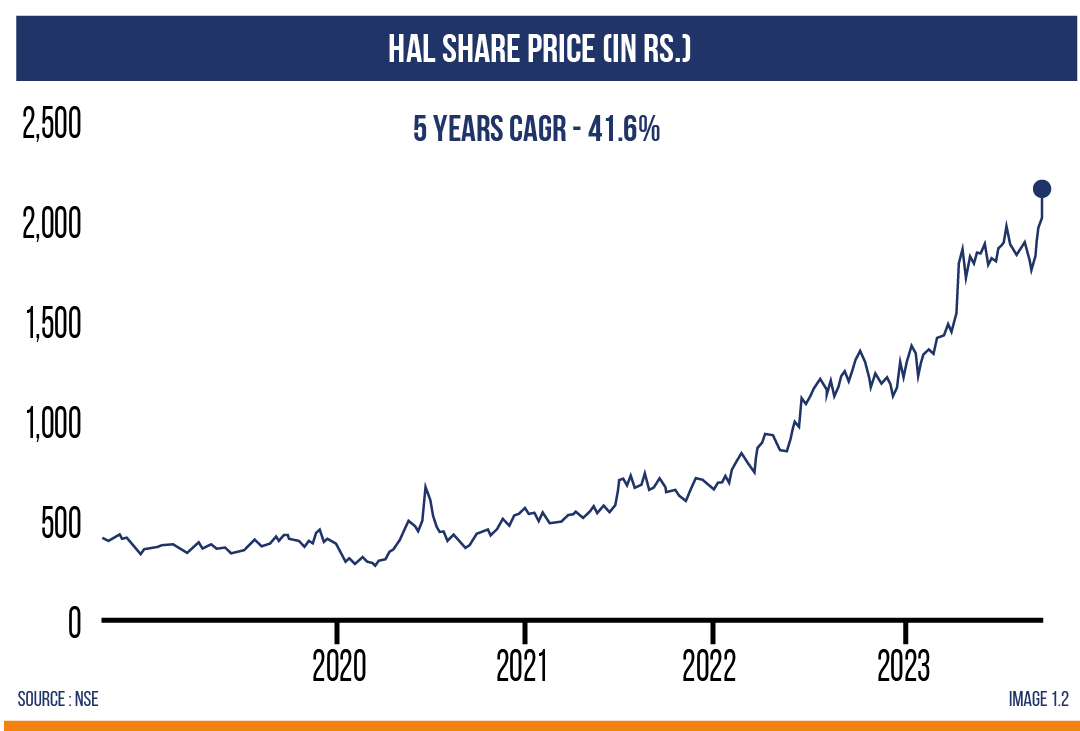

- HAL has recorded its highest ever annual turnover for the last 2 consecutive years with the TTM consolidated turnover standing at Rs. 29,810 cr. In Q2 of FY 2024 as well, the company maintained its growth trajectory with a 9.5% increase in turnover Y-o-Y.

- As of 31st March 2023, the order book of the company stood at a lofty Rs. 81,784 cr.

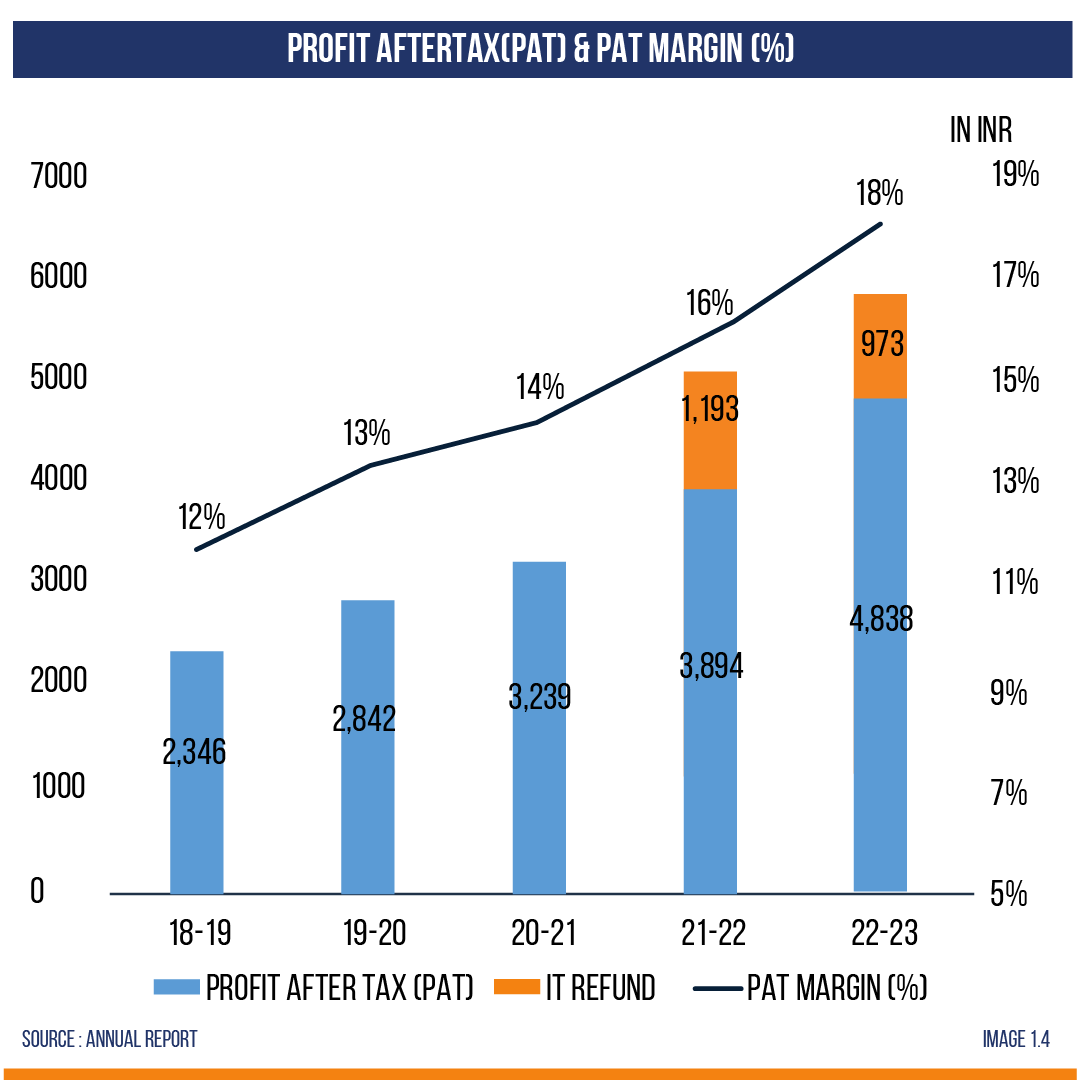

- The company performed better than what was estimated at the beginning of FY 2023 and closed the year with a 14% increase in Standalone PAT to Rs. 5,811 cr.

- The prospects of the company look bright as the company is continuously investing in research and development and will be a major beneficiary of significant transformation in the Indian Aerospace and Defense sector.

The aerospace & defense (A&D) industry is a vast one that encompasses Military Aircraft, Space Systems, Commercial and General aviation, Ground defense and Shipbuilding. As per the Business Research School, the global A&D industry is expected to reach $855.62 billion in size in 2023 from $795.92 billion in 2022 registering a 7.5% growth rate. This growth has been a result of countries increasing their Defense Budget allocations as a result of the Russil-Ukraine war. On similar lines, the industry’s size is expected to grow to $1,076.56 billion by 2027 at a CAGR of 5.9%.

As per an IBEF study, India is one of the strongest military forces and is amongst the top 4 highest budgetary military spending countries in the world. Defense allocation for FY 2023-24 has been increased to Rs. 5.94 lakh cr which is about a 13% increase compared to last year. The Indian Defense sector which has been a strategic sector for the past many decades has now been seen in a new light as an economic sector too. Under the Atmanirbhar Bharat initiative, the Ministry of Defense (MoD) has taken several positive steps like the release of four Indigenisation lists with the latest being released in October 2022 which will continue to provide impetus towards self-reliance and growth of Indian defense companies. In addition to provisions for maintenance, repair and overhaul, a total allocation of Rs. 28,211 cr has been provided under the “Aircraft and Aero-engine” category to the 3 divisions of Indian armed forces. By 2025, MoD has set a target of achieving a target of turnover of $25 billion in aerospace and defense manufacturing including $5 billion in exports. Over the next 5-7 years, GoI plans to spend $130 billion in fleet modernization across all armed services.

HAL is the market leader in the country in the A&D industry. Other major companies involved in this industry are BEML, BEL, Data Patterns, etc. HAL does not have direct competition in the domestic landscape but the threat of competition pertains from foreign companies like Boeing who have been a key supplier to India over the years. With its vision to become a global leader in the A&D industry, sky is the limit.

BUSINESS DESCRIPTION

Hindustan Aeronautics Ltd (HAL) established in the year 1963 is engaged in the design, development, manufacture, repair, overhaul, upgrade and service of a wide range of products including aircraft, helicopters, aero-engines, avionics, accessories, aerospace structures and Industrial marine gas turbines. The company was conferred the “Navratna” status by the Govt in 2007 which provides it with strategic and operational autonomy. The company has been continuously receiving an “Excellent” rating from GoI for its performance since the year 2002.

The company has 20 Production and 10 R&D centres co-located with the production divisions. These divisions are located at 10 geographic locations spread across seven states. The operations are organized into 5 complexes namely the Bangalore complex (primarily involved in the Production and ROH of Fixed-wing aircraft/engines of Indian and Western origin), the MiG complex (primarily involved in the Production and ROH of Fixed-wing aircraft/engines of mainly Russian origin), Helicopter complex (Production and ROH of Helicopters), Accessories complex (primarily involved in Production and ROH of Transport Aircraft, Accessories and Avionics) and Design complex (primarily involved in R&D of Fixed wing and Rotary wing Aircraft, Unmanned Aerial Vehicles, etc.)

FINANCIAL PERFORMANCE

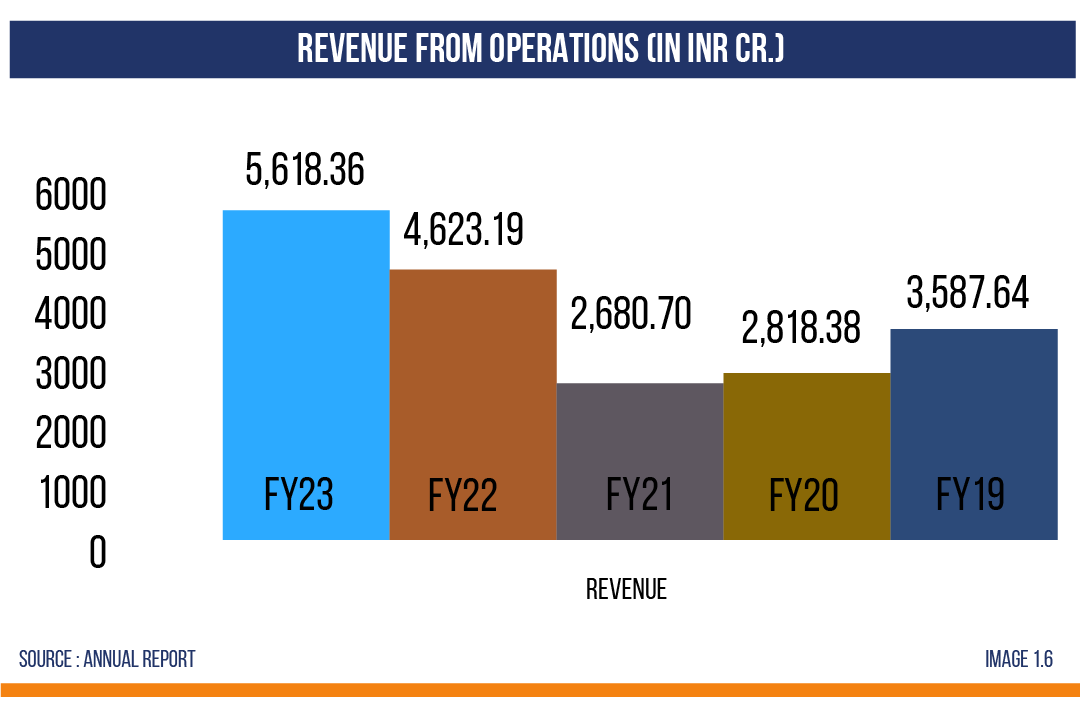

The turnover of the company has been making record highs over the past 2 financial years. The consolidated turnover for previous FY stood at Rs. 28,597 cr and is almost 48% more than its turnover 5 years ago. The company is growing its turnover at a staggering CAGR of 9.6% over the turbulent past three years which proves that the company can withstand tough times and management is expecting double-digit revenue growth from FY 2025 on the back of resumption in the growth of manufacturing numbers which has remained subdued in the previous years. In the last FY, 70% of its revenue was generated by Repair and Overhaul (ROH) and spares division. The ROH segment has registered a CAGR of an impressive 17.83% over the last 5 years and is expected to grow at a decent pace of 6-7% in the coming years.

The company is debt-free which is a positive sign for many investors. The management has a strong focus on maintaining state-of-the-art infrastructure and technologies to meet Aerospace standards and laid out Rs. 2,081 cr as capex. During the year, the company incurred a total of Rs. 2,494 cr as R&D expenses which comes out to be 9.46% of the turnover. These are the signs that give investors confidence that the company is investing heavily to be future-ready, self-sustaining and a market leader.

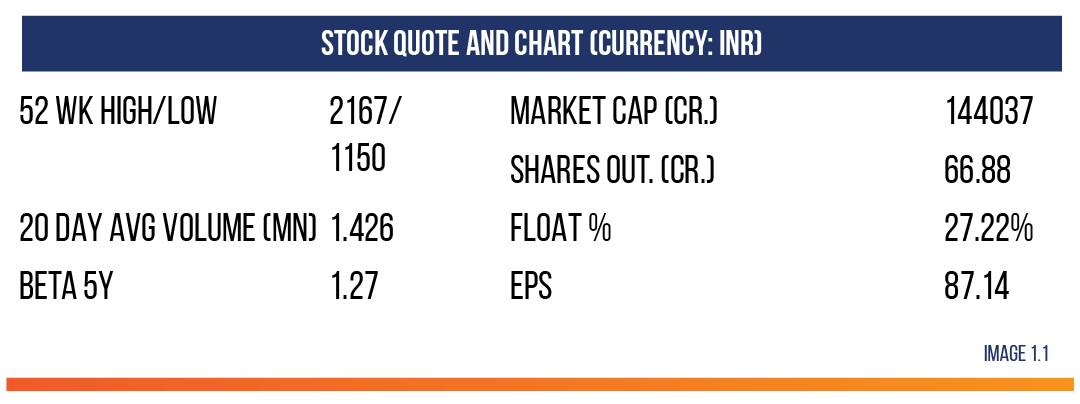

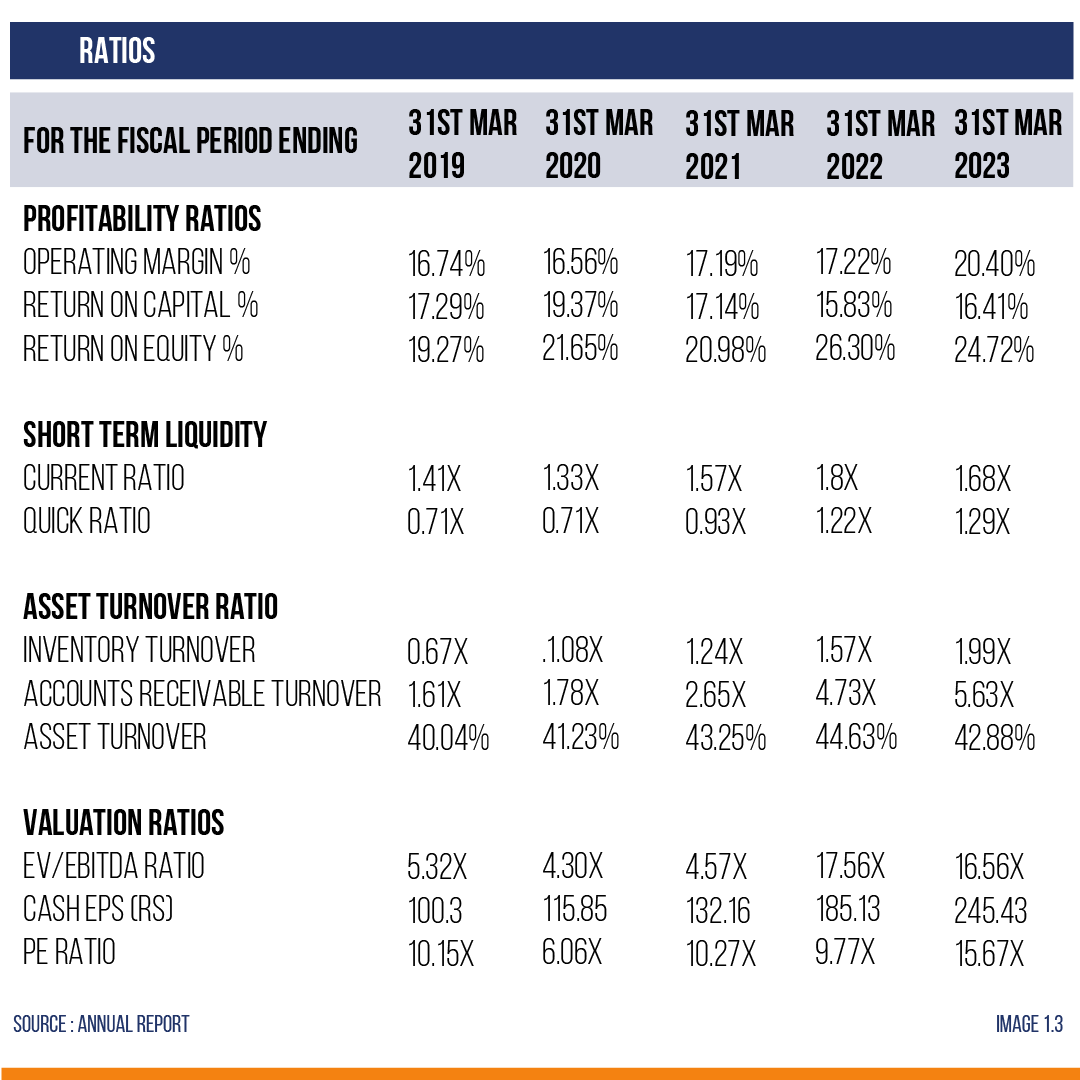

The cash and bank balance of the company stood at Rs. 20,306 cr in FY 2022-23, a significant jump from Rs. 14,344 cr in the previous year. This development led to the company earning twice the interest income from Rs. 424 cr in FY 2021 -22 to Rs. 928 cr in FY 2022-23. Interest income comprised around 16% of the PAT and will be an important metric to check for investors going forward. To achieve the mandatory threshold of 25% minimum public shareholding in the company, the promoter (Govt of India) offered 3.5% of equity shares in OFS. There is zero promoter pledge which provides additional assurance to investors. The company’s ROE ratio of 24.72% is significantly good and is above its 5-year average. Cash EPS is on an uptrend and Debtor turnover has improved massively, all of which solidify an investor’s trust in the company

CURRENT DEVELOPMENTS AND FUTURE EXPECTATIONS

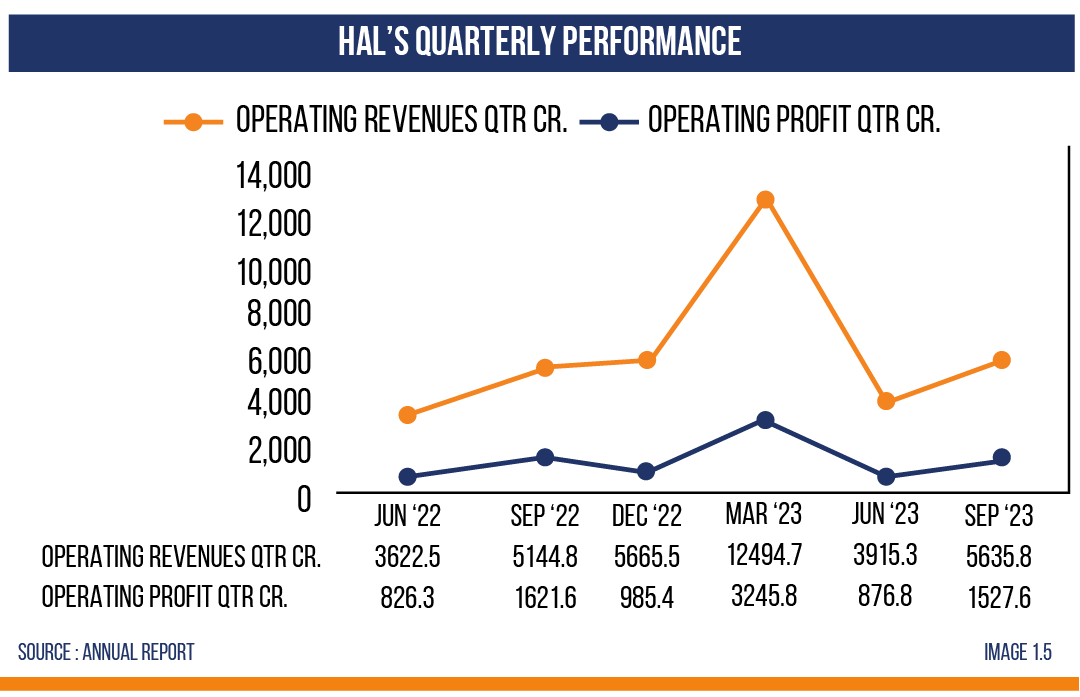

Financials – In Sept 2023, HAL reported operating revenues of Rs. 5,635.8 cr, representing a substantial increase of approximately 44% from the Q1 figure of Rs. 3,915.30 cr. This is a significant increase from last quarter’s numbers. However, some of this can be attributed to the cyclical nature of HAL’s business and the variation in contract timings. Sept 2023 Quarterly Revenue stood at Rs 6,106 cr (including other income) which is up by 12.9% YoY. This demonstrates HAL’s ability to maintain a strong position in the aerospace and defense industry and continue to outperform many metrics.

Examining the quarterly numbers, it can be made out that with Rs. 1,527.6 crore as operating profit HAL’s performance was exemplary compared to previous quarter but compared to last year’s operating profit it came a little bit lower. The decrease in operating profit can be attributed to various factors, including project completion and associated costs. On a positive note, operating margins have improved Q-o-Q from 22.39% to 27.11%. Net profit has increased Y-o-Y as well as Q-o-Q. These financial figures underline HAL’s ability to navigate the dynamic aerospace and defense industry successfully. Despite short-term fluctuations, the company remains resilient and continues to make substantial contributions to the sector. HAL’s long-term growth trajectory and its capacity to adapt to industry dynamics make it a significant player in the field.

Business and Future Expectations – In FY 2023-24, India’s military and commercial aerospace sectors show promising growth. With a sectoral allocation of Rs. 5,54,875 cr, about 93% of the Defense budget, the Army was allocated 57%, the Air Force 19%, and the Navy 17%. This highlights opportunities for HAL and sector expansion.

In the fiscal year 2023-24, Aerospace & Defence companies, including Hindustan Aeronautics Limited (HAL), are poised for stability or growth.

This optimism stems from critical factors:

1. Global Defence Spending: Amid rising geopolitical tensions, major world powers are boosting their military capabilities, leading to increased defense spending. HAL is well positioned to benefit from this trend.

2. India’s Civil Aviation Development: India’s focus on expanding civil aviation, especially in tier-2 cities through the UDAN Scheme, offers HAL opportunities. HAL’s Hindustan-228 aircraft, India’s first home-grown civil aircraft for commercial use, aligns perfectly with this initiative. Looking ahead, HAL has exciting prospects in:

- Government’s Emphasis on Domestic Products: HAL stands to gain from the government’s push for self-reliance, presenting opportunities for new orders and growth.

- Diversification into the Military Sector: In times of crisis, the stability of the military sector attracts commercial players seeking risk-averse strategies. HAL can tap into this trend by forming strategic alliances with commercial entities looking to enter the military sector.

Recent Events –

- The company declared 2 interim dividends and 1 final dividend in FY23 & a final dividend of Rs.15 per share in August 2023.

- HAL opened Integrated Cryogenic Engine Manufacturing Facility (ICMF) in Bengaluru in Sept 2022 which will be dedicated to Rocket manufacturing and assembly for the expanding ISRO. It also delivered its 150th satellite bus structure to ISRO.

- The entity commissioned new helicopter manufacturing facility at Tumakuru.

- Under the UDAN initiative, the company delivered Hindustan-228 aircraft, the first Made in India civil aircraft used for commercial flight. The company has also created a dedicated Indigenization fund and will transfer 3% of operating profits after tax every year starting from FY 2022-23.

- The company has split the face value of its shares from Rs 10 to Rs 5 (Record date – 29 Sep 2023)

Strength –

- HAL’s strength lies in its impeccable financial stability, characterized by zero promoter pledges and a debt free status.

- As a trusted partner of the Indian Defence Forces, HAL plays a vital role in extending support to aging fleets, some of which have served for over six decades.

- The basic EPS stood at Rs. 85.9 in March 2020 which after giving effects to the Split of shares stands at Rs. 84.17 in Sept 2023.

- The company has been maintaining a healthy dividend payout of 29.6%.

- The company’s impressive reduction in working capital requirements, from 98.4 days to 38.2 days, reflects enhanced efficiency in managing short-term financial obligations and signals improved liquidity, which can bolster its financial flexibility and strategic opportunities.

- The FII/FPI Holding has surged in the Sept 2023 quarter, from 11.9% to 12.63%. Mutual Funds have also increased their holding from 6.6% to 7.2%.

- HAL’s price is near its all-time high of Rs. 2,145.

CONCLUSION

Hindustan Aeronautics Ltd. (HAL) stands as a robust and promising contender in the aerospace and defense industry. With a track record of consistent financial growth, a debt-free status, and strong government support in India’s evolving defense landscape, HAL emerges as an interesting investment opportunity. Its expanding order book, strategic diversification into sectors like space, and commitment to self-reliance underscore its potential for sustainable growth. Furthermore, the company’s ability to adapt to changing industry dynamics and its increasing investor appeal make it a sound choice for those seeking a stake in the future of Indian aerospace and defense.