HIGHLIGHTS

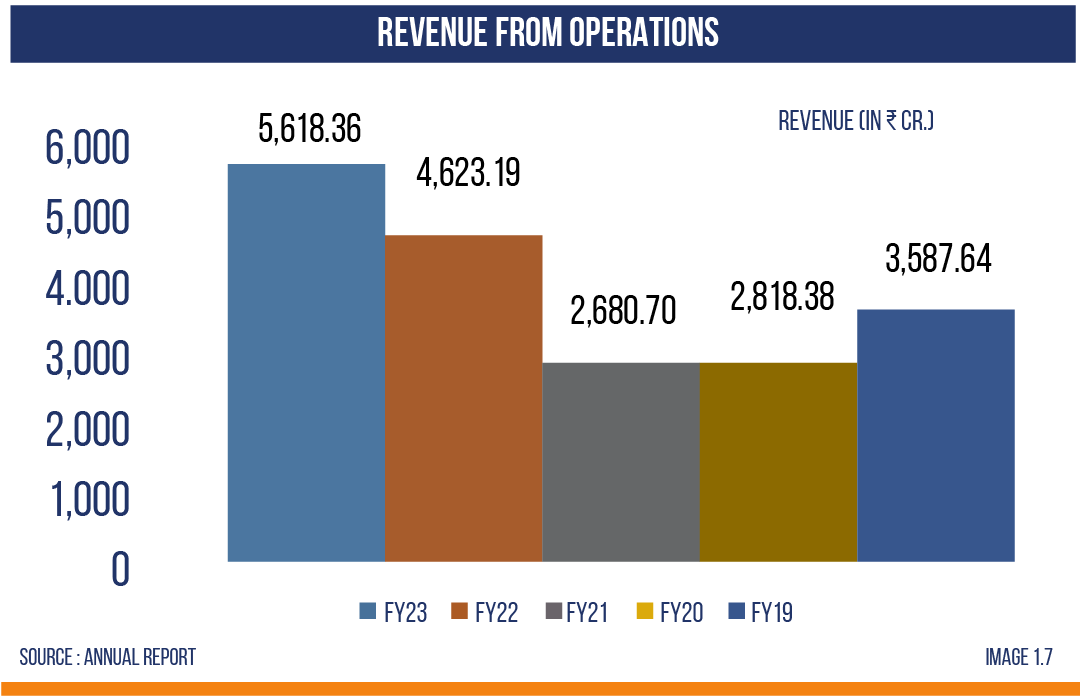

- FY 22-23 has been a phenomenal year for Mukand Ltd. as it registered its highest revenue in the year.

- Mukand Ltd. operates in two divisions namely the Steel division and Industrial Heavy Machinery. There was a 21% & 30% increase in revenue of the Steel division & Industrial Machinery divisions respectively in FY 22-23.

- The company has substantially reduced its debt in the previous year.

- The future growth prospects look good as the company is investing in cutting-edge technology and modernizing the production process to ensure product quality of the highest level and minimal wastage.

INDUSTRY OUTLOOK

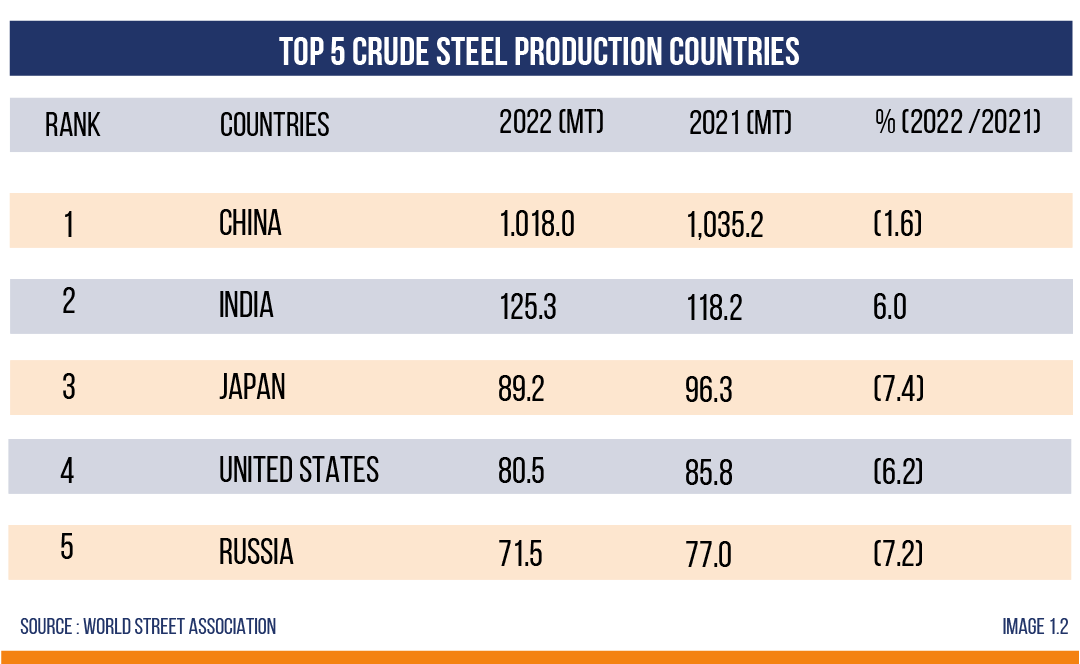

India’s steel sector showcased remarkable progress in the financial year 2022-23. With a record-high steel production of 121.06 million tonnes, up 10.4% from the previous year. India has benefited from domestic infrastructure development and surging demand from the automobile and construction sectors. However, challenges loomed in the export domain for the industry. Despite all the hurdles in the past years, India stood out as the sole nation among the top 10 steel-producing countries, with a positive growth in crude steel output in 2022. Over the past nine years, the nation’s steady growth trajectory has instilled hope for India’s role as a potential epicenter of global steel growth.

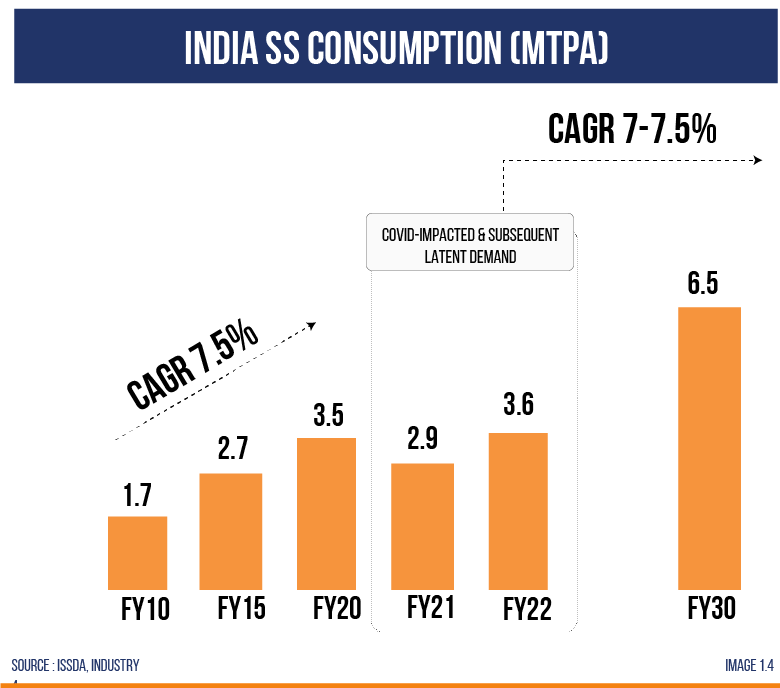

Mukand Ltd. is involved in stainless and alloy steel production primarily. Stainless Steel has been the fastest-growing metal in the world compared to other significant metals like carbon steel, zinc, and aluminium, with a CAGR of 5.8% over the last 9 years. In the medium term, Crisil expects stainless steel demand to register a CAGR of 6.5%-7.5% over fiscals 2022-2025. Consequently, it expects the per capita consumption of stainless steel to reach 8-9 kgs from the current

2.8 kgs by 2040. As per the Stainless Steel Vision Document 2047, ISSDA and Crisil expect India to remain the fastest-growing stainless steel market in the world and second largest globally for the next several years. Growing sectors such as infrastructure, renewable energy, agricultural industry, smart cities, defense, and aerospace in our country will lead to the demand for stainless steel in the future. India loses nearly 4% of its GDP to corrosion every year, and to tackle this significant problem, stainless steel is one of the solutions.

Other players in this segment of steel include Jindal Stainless Ltd, Mishra Dhatu Nigam Ltd., and SAIL Ltd. Mukand Ltd. with an annual production capacity of little over 6 lakh metric tonnes, is still at a growing stage when compared with Jindal Stainless Ltd., having abilities over 11 lakh metric tonnes and is further expanding to more than 20 lakh metric tonnes. Mukand has the potential to thrive and grow in the sector owing to its focus on innovation and efficiency. Mukand Ltd. is a proven low-cost stainless-steel producer and is in the list of Top 25 Stainless Steel Long Product global players as per SMR Austria.

BUSINESS DESCRIPTION

Mukand Ltd., with its 80-year heritage, is a multi-division, multi-product conglomerate and a division of the Bajaj group of companies. Mukand Ltd.’s steel division produces alloy and stainless steel. Alloy steel, made by combining carbon steel with alloying elements, forms the core of numerous products like engine components, steering innards, bearings, etc. The company’s alloy steel exceeds international quality standards and is among India’s select few to deliver superior-grade alloy steel to the world. The company is also committed to producing Stainless steel of quality, surpassing the expectations of its customers. The company’s manufacturing facilities in Thane, Maharashtra (for stainless steel), and Hospet, Karnataka (for alloy steel) boast a combined annual production capacity of 6 lakh tonnes.

A leading figure in the custom heavy machinery and equipment manufacturing segment, the company embodies precision, durability, and innovation. The company is involved in making its first EOT crane to collaborate with ISRO for unique solutions in the Space Program and has been in the thick of it for the past six decades. The Industrial Machinery Division’s product portfolio is critical for many of India’s top manufacturers and ports processes. Thriving on nationwide infrastructure growth, the division explores new sectors, delivering inventive solutions and entering untapped markets.

FINANCIAL PERFORMANCE

Mukand Ltd.’s financial performance over the previous years is summarized in the table alongside.

The top line of the company has almost doubled and grown at a staggering CAGR of 23.02% over the turbulent past three years from Rs. 2,922 crores in FY 19-20 to Rs. 5,568 crores in FY 22-23, which proves that the management upholds the company’s value of customer centricity. Mukand Ltd. registered its highest dispatch in FY 23, and its steel division’s revenue increased by 21% y-o-y. The infrastructure and steel companies faced the brunt of the global slowdown and supply chain issues caused by the war last year. Despite all the challenges, Mukand Ltd. recorded a handsome 102% increase in Standalone Profit after Tax (PAT) in the previous FY. The company’s PAT has grown at a CAGR of 207% over the last three years.

Mukand Ltd.’s production numbers have been in a healthy uptrend- over the past few years. The world’s appetite for alloy steel and stainless steel will continue to grow, which will aid the company’s growth in the future. Having perfected approximately 450 grades of alloy steel products, the company has an inventory mix matched only by a few companies in the sector, thereby negating the threat of competition to some extent.

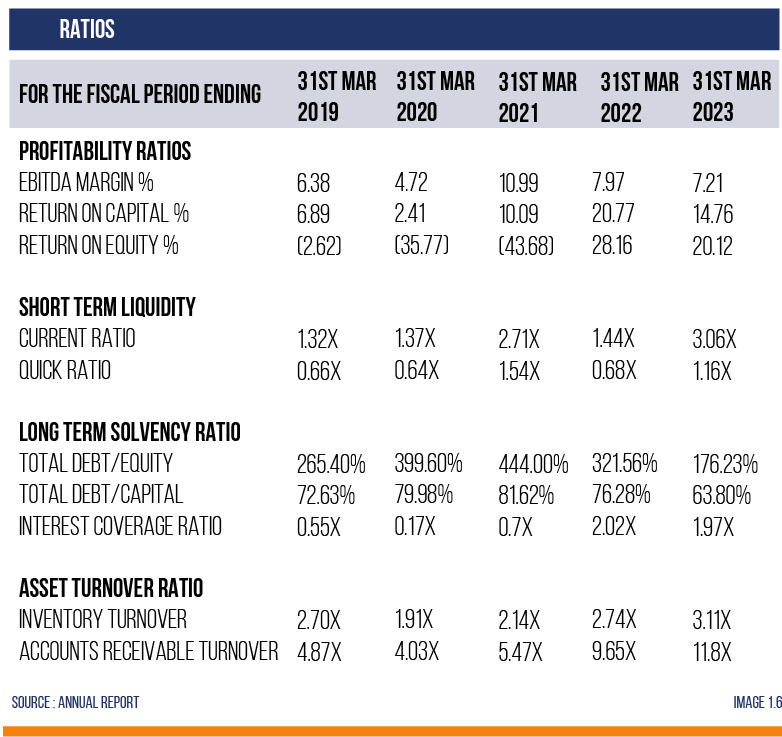

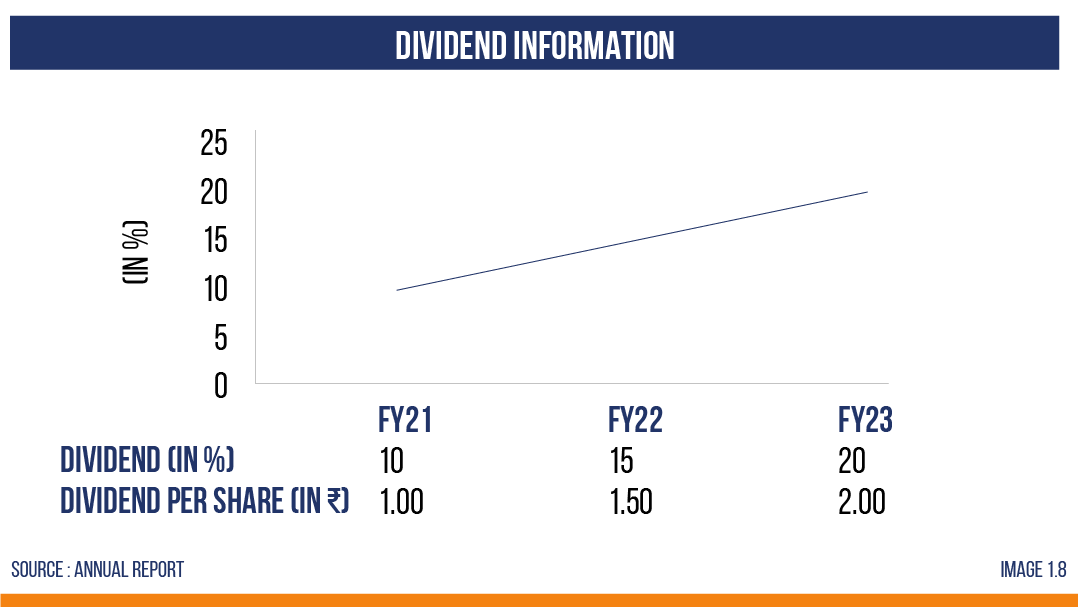

The company has reduced its debt significantly over the last 2 years due to better business performance and some surplus asset sales. The Debt-to-Equity ratio has decreased from a mammoth 444% to 176%, and the Interest Coverage ratio has also improved massively from 0.7X to 1.97X levels. This shall give investors confidence in the future and the management freedom to make capital expenditures as required and further catapult the company’s growth story. Another confidence boosting activity for the investors, as done by the company, is the regular dividend distribution over the last 3 years.

Significant cash flow improvement from the company’s operating activities can be observed, with a shift from Rs. (328.46) crore in FY 20-21 to Rs. 105.91 crore in FY 22-23. This improvement is driven by better- trade receivable realization and inventory management, indicating that the administration has turned around the core business metrics, and one can expect the business to thrive in the future.

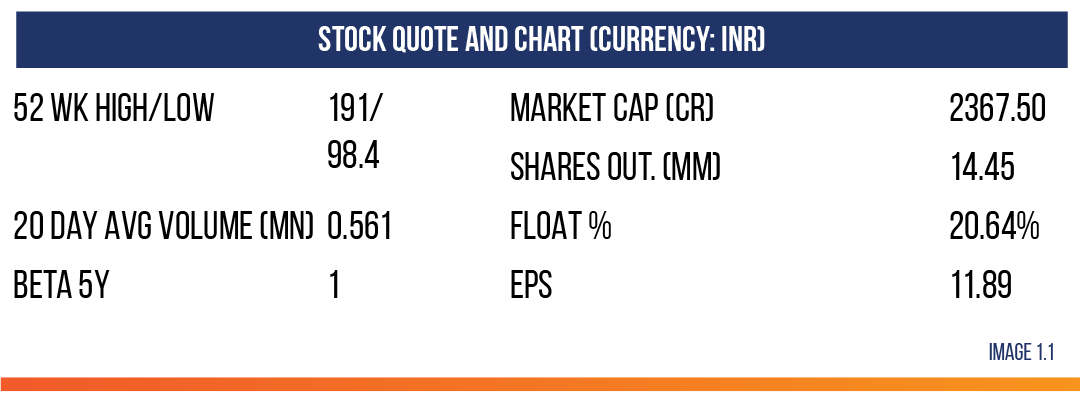

The fact that promoters have increased their holding in the latest quarter and there are zero promoter pledges provides additional assur- ance to investors. Furthermore, the company’s price-to-earnings (PE) ratio of 13.3 times is below the sector’s PE of 32 times, offering investors a reasonable margin of safety.

CURRENT DEVELOPMENTS AND FUTURE EXPECTATIONS

Financials – The Company released its Q1FY24 results in August, registering 3% operating revenue growth q-o-q in a challenging time for many companies in this sector. Q-o-Q, the specialty steel segment revenue increased by 4.75%, and the Industrial machinery and Engineering contract segment’s revenue increased by 25%. Compared to Q1FY23-, the Company’s PAT increased by 19.7%. The increase in profit can be attributed to reduced finance costs, better cost management, and a slight reduction in the price of materials consumed.

Business and Future Expectations – Mukand Ltd.’s commitment to excellence is underscored by its impressive financial performance. Notably, the company has achieved significant improvements in its financial metrics. The debtor days have reduced from 46.1 to a more efficient 30.4 days, reflecting enhanced cash flow management. Furthermore, the company has successfully streamlined its operations, reducing working capital requirements from 143 days to 101 days. These achievements highlight Mukand Ltd.’s dedication to operational efficiency and its ability to adapt and thrive in a competitive market.

One of the critical factors responsible for the consistent performance of the steel division is investment in cutting-edge technology & revamping of production processes. This has led to reduced operating costs & better prices offered to customers. Efficient Supply Chain Manage- ment ensures the timely delivery of products and hence contributes to meeting demand for steel in the market. The cost of inputs like iron ore and nickel has started to cool down compared to last year, leading to better margins for the company. The 300% increase in imports from China in 2022-23 has adversely affected the domestic stainless steel industry. The Government had earlier revoked CVD on certain products, but now, on the recommendation of the Steel Ministry, it may have to implement duties on such imports again. This can be another boost for the performance of Mukand Ltd.

Mukand Ltd. also continues to lead the way in the industrial and engineering sectors. As there is a manufacturing growth story in play due to initiatives like “Make in India” and “Atmanirbhar Bharat,” the demand for machinery design and engineering machines is expected to increase. The company secured a contract to design and manufacture a crane for DGNP, Vizag (Indian Navy) in FY22-23. The crane is said to be India’s heaviest by weight and largest by span. Securing a contract like this can be instrumental for this division’s growth going forward and helping the company to ensure many lucrative offers.

Recent Events –

- Recommended preference dividend @ 8% on Cumulative Redeemable Preference Shares of Rs.10/- each issued in FY 2019-20.

- The Directors also recommend a dividend @ Rs. 2 per equity share for the year, 3rd year in a row. Never in the last 2 decades has the company paid regular dividends for 3 consecutive years. This shows management’s confidence in the future viability of the business.

- On January 05, 2023, the Company completed the transfer of 45.94 acres of the surplus land at Kalwe / Dighe.

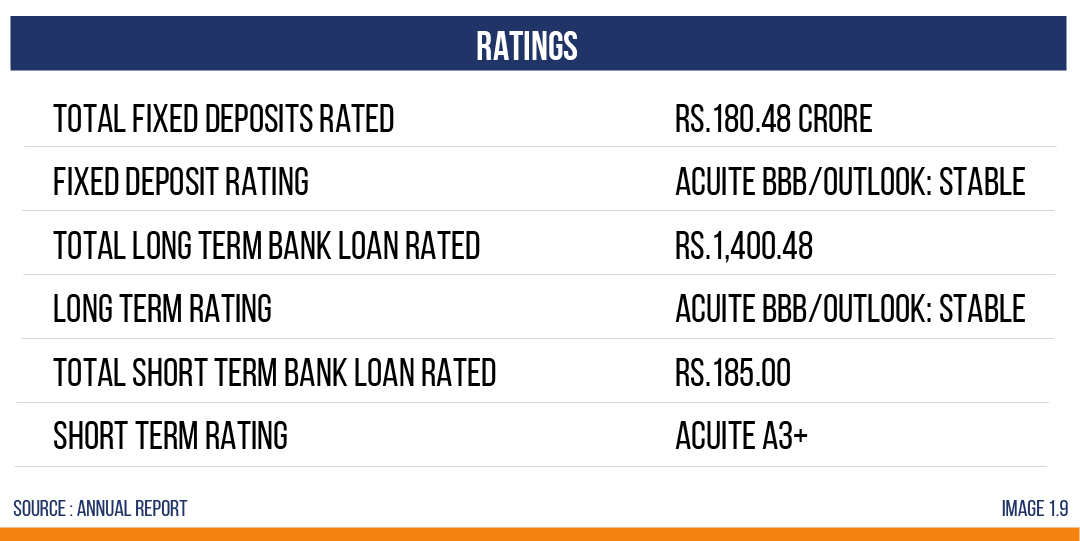

- The rating agency Acuite Ratings & Research Limited (“ACUITE”), vide its letter dated January 03, 2023, has reaffirmed the ratings of various credit facilities /exposures of the company.

- During FY22, the company developed new products such as micro-alloyed steel with high vanadium, boron micro-alloyed steel with specific end quenched hardenability, ASTM A 350 LF 2 and LF 6 alloy steel grades, etc. These developments have opened up new markets for the steel division.

- The company sold its remaining 5.51% stake in its erstwhile subsidiary- Mukand Sumi Special Steel Ltd., to the promoter group for a consideration of Rs. 147.58 crores.

Strength –

- The company’s clientele includes India’s marquee automobile giants, having long-term associations with companies like Maruti, Tata Motors, and Hero MotoCorp. This, in turn, enhances the sustainability of the company.

- The company is associated with two immensely reputed groups- Bajaj Group and Sumitomo Corporation. Its association with Sumitomo Corporation can be used as leverage to lure global companies for good business opportunities.

- The ROCE of the company in the last year was 34% more than its 5-year average.

- The impressive product portfolio of the company caters to growing sectors like automobile, engineering, manufacturing, and construction. This augers well for the growth of the company too.

- Exports accounted for 7% of revenues in FY22.

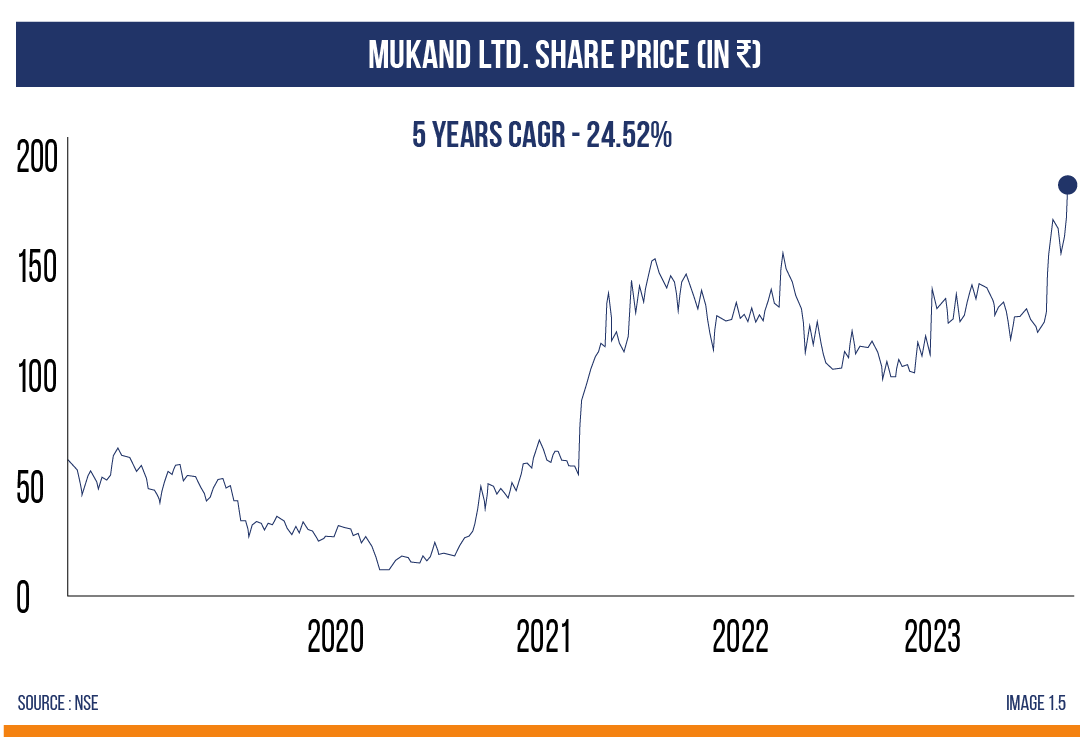

- The company has outperformed its sectoral index- Nifty Metal over the last 3 years by a whopping 356%.

CONCLUSION

Strong and rising demand from sectors like infrastructure, consumer durables, and automobile, amongst others, makes the specialty and stainless steel industry an exciting space to look into Mukand Ltd. is showing improved business metrics after paying a substantial portion of its debt and is well-positioned to reap the benefits of revenue expansion. Healthy operating cashflows, multi-decadal experience, envy-worthy product portfolio, strong promoter group, and blue-chip corporate clientele are some factors auguring well for the company. Over the past quarters, steel companies have come under a bit of pressure, and this being a cyclical industry, caution must be exercised.