HIGHLIGHTS

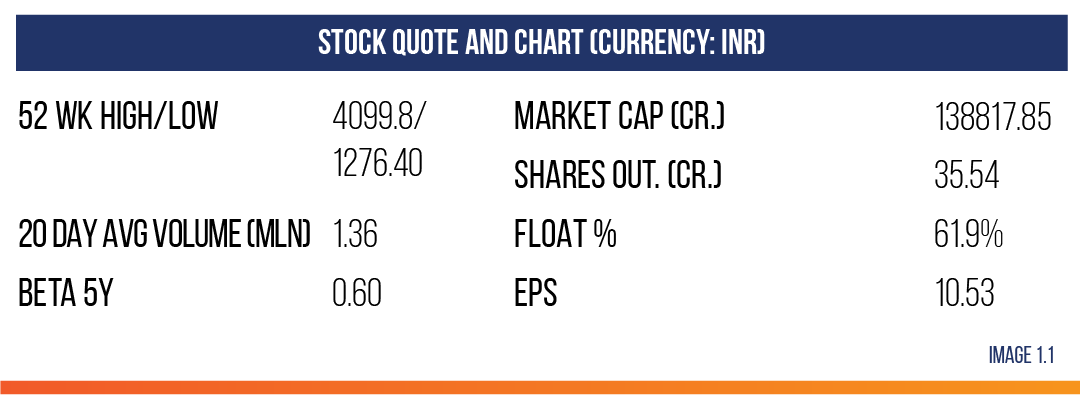

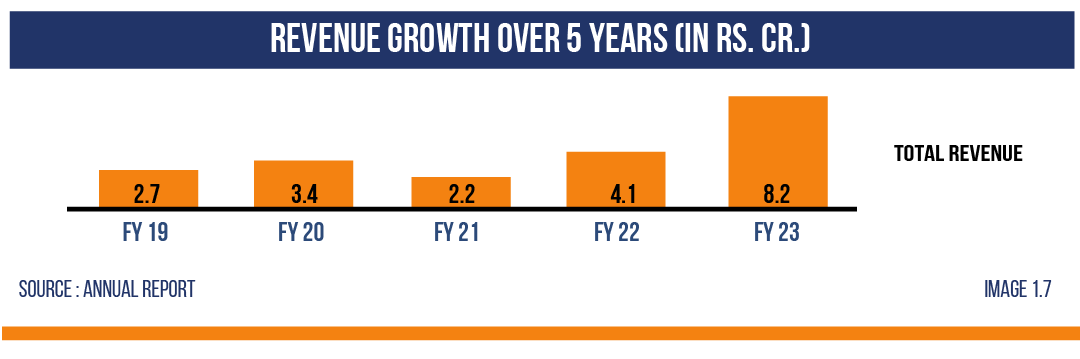

- Trent Ltd.’s annual revenue surged by an impressive 81.95% in the last year from ₹4,673.2 Cr. to ₹8,502.94 Cr, significantly outperforming its sector average revenue growth of 15.03% for the same fiscal year.

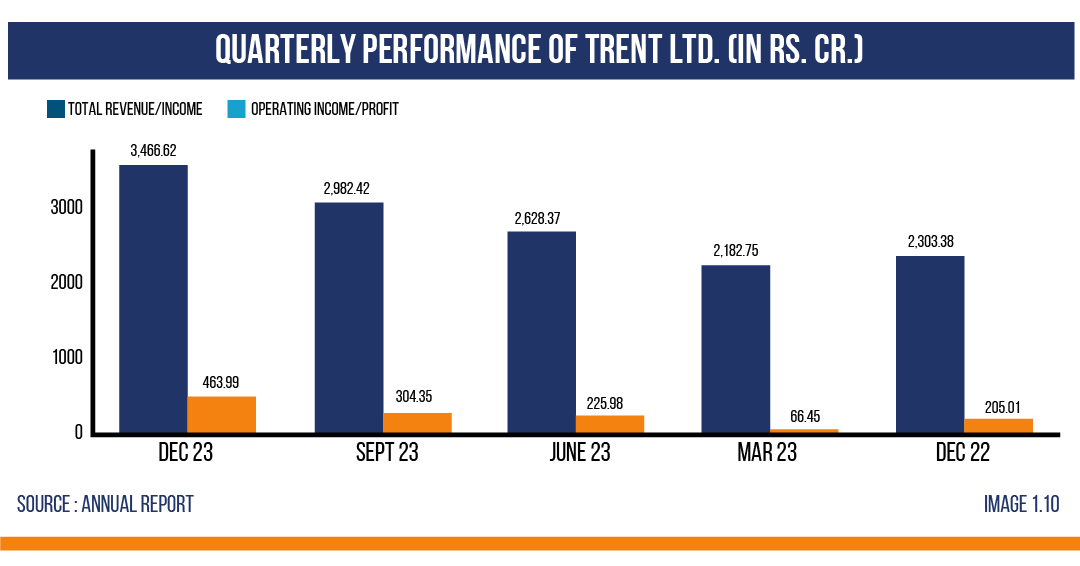

- Its quarterly revenue soared by an impressive 50% year-over-year from ₹2,365.2 Cr. to ₹3,546.95 Cr, surpassing its sector average revenue growth of 17.11% for the same quarter.

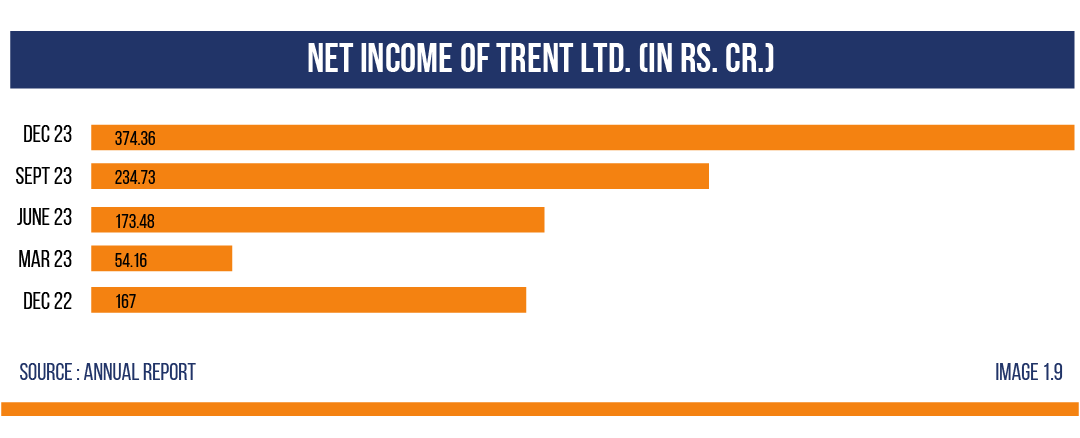

- Quarterly net profit at Trent Ltd. surged by an impressive 124.17% year-over-year ₹390.7 Cr to ₹374.36 Cr, showcasing robust financial performance compared to its sector average net profit growth of 30.68% for the same quarter.

- Trent Ltd. has shown a strong return on equity (ROE) of 31.22% during the past twelve months.

INDUSTRY OUTLOOK

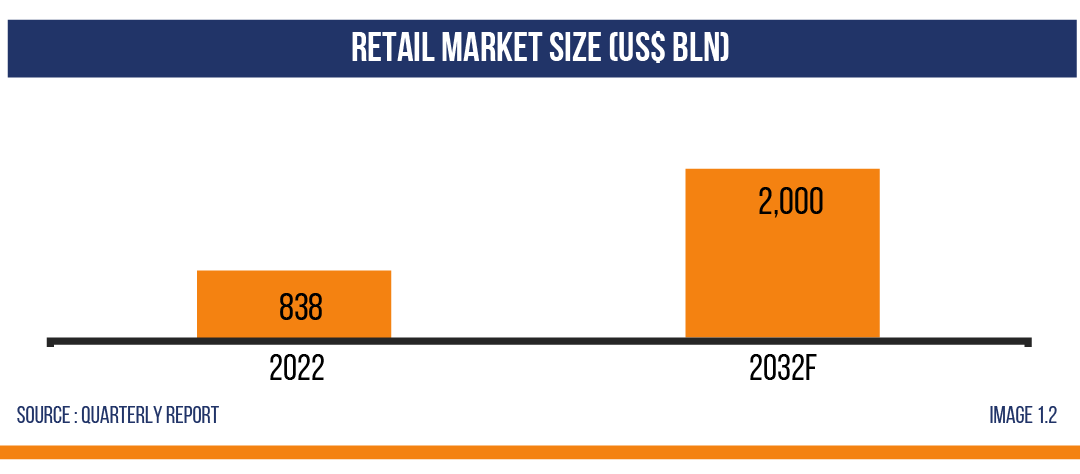

The retail market size in India is expected to amount to US$ 2 trillion by 2032, up from US$ 836 billion in 2022. While an overall increase was noted till 2019, 2020 marked a decrease due to the coronavirus pandemic. Nevertheless, the Indian market recovered and posted a remarkable comeback in terms of growth. The Indian retail industry has evolved significantly from traditional retail forms like Kirana stores and street markets to larger retail spaces like malls and supermarkets and the development of online commerce. The rise of D2C brands and regulatory changes like GST have also been significant shifts in the Indian retail landscape. The market is projected to grow at a CAGR of 9% from 2019 to 2030.

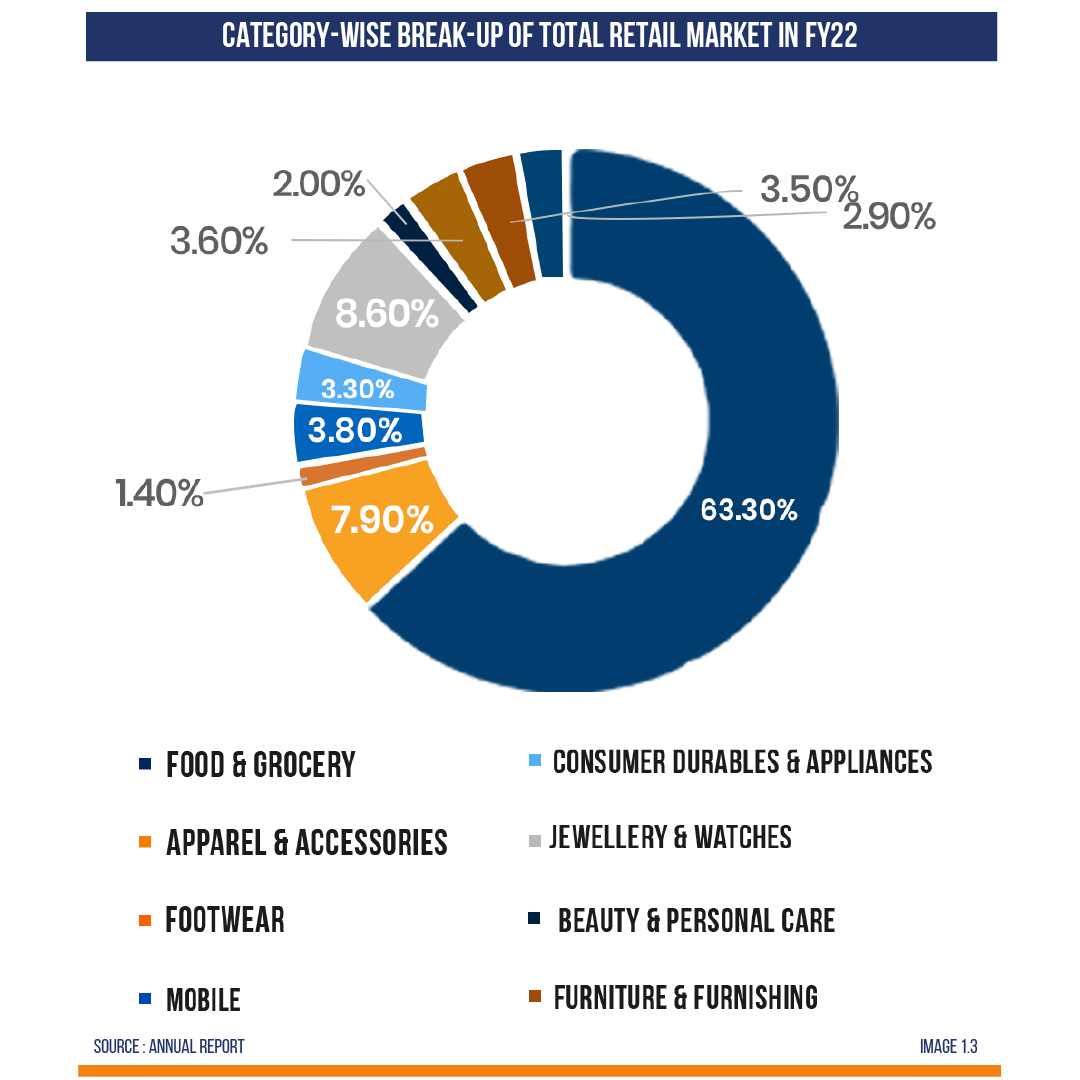

The Indian textile and apparel industry is a significant contributor to the country’s economy, with a market size of US$172.3 billion in 2022 and an expected growth to US$387.3 billion by 2028. This growth is driven by increasing demand for premium quality clothing and footwear items, government initiatives to empower weavers, and a shift towards sustainable and ethically sourced materials. As India is undergoing rapid economic growth, urbanization, and an increase in per capita income, fashion apparel is anticipated to grow in the coming years and maintain its position as one of the most significant segments. In terms of revenue, the Indian apparel market is projected to reach US$105.50 billion in 2024. The state-wise analysis reveals Maharashtra as India’s most significant textiles and apparel market, driven by skilled weavers, a thriving e-commerce industry, and abundant raw material availability.

India’s retail trading sector attracted US$ 4.56 billion in FDIs between April 2000 and September 2023, showcasing promising aspects ahead. The retail industry in India accounts for over 10% of the country’s GDP and around 8% of the workforce (35+ million). With the current pace, it is expected to create 25 million new jobs by 2030. Trent, Avenue Supermarts Ltd., Aditya Birla Fashion, Shoppers Shop Ltd., etc., are leaders in the industry who have witnessed decent growth and are performing well overall.

BUSINESS DESCRIPTION

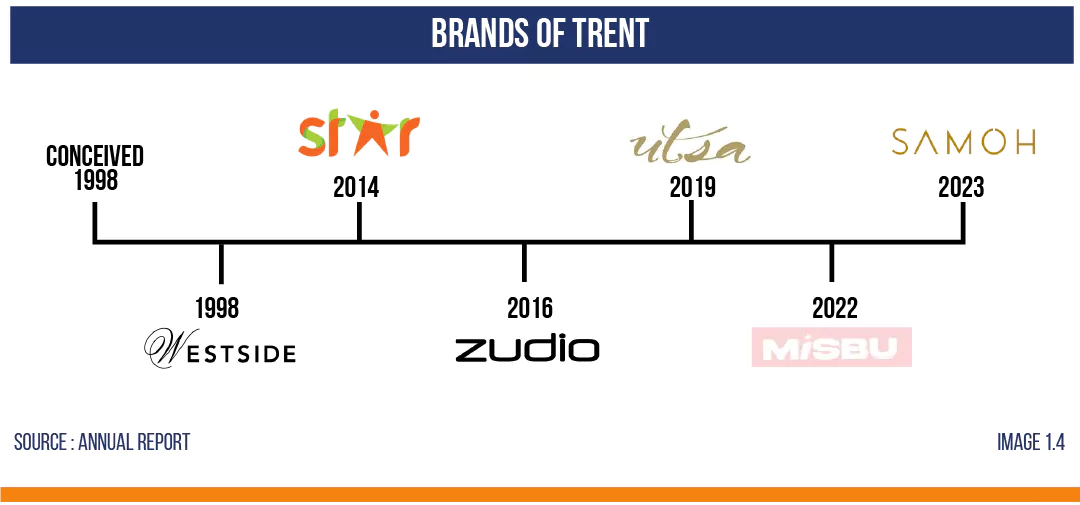

Trent Limited, under the Tata Group, based in Mumbai, was established in 1998. It operates various retail formats such as Westside, Zudio, and Star Bazaar all over India. Westside, the largest chain, offers apparel, footwear, cosmetics, and home furnishings in well-designed stores with prime locations. Trent focuses on robust and sustainable business models and has a JV/association with Zara that contributes to its growth.

Trent also operates the Star Bazaar hypermarket chain, which provides customers with a basket of products like staple foods, beverages, health and beauty products, consumer electronics, and household items at reasonable prices. Star Bazaar also has a variety of fashionable in-house garments for men, women, and children. Since 2008, Trent has had a franchise and a wholesale supply arrangement with Tesco and its wholly-owned subsidiary in India for Star Bazaar.

Trent holds 76% interest in Landmark Ltd, a family entertainment format store focusing on toys, adult and young adult books, sports-related merchandise, tech accessories, gaming, and stationery. Presently, the company operates 600+ stores under various retail concepts: Westside (227 stores), Zudio (460 stores), Star Bazaar (67 stores), Zara & Massima Dutti, and others.

FINANCIAL PERFORMANCE

Trent Ltd.’s financial performance over the rent Ltd.’s financial performance over the previous years is summarized in the table.

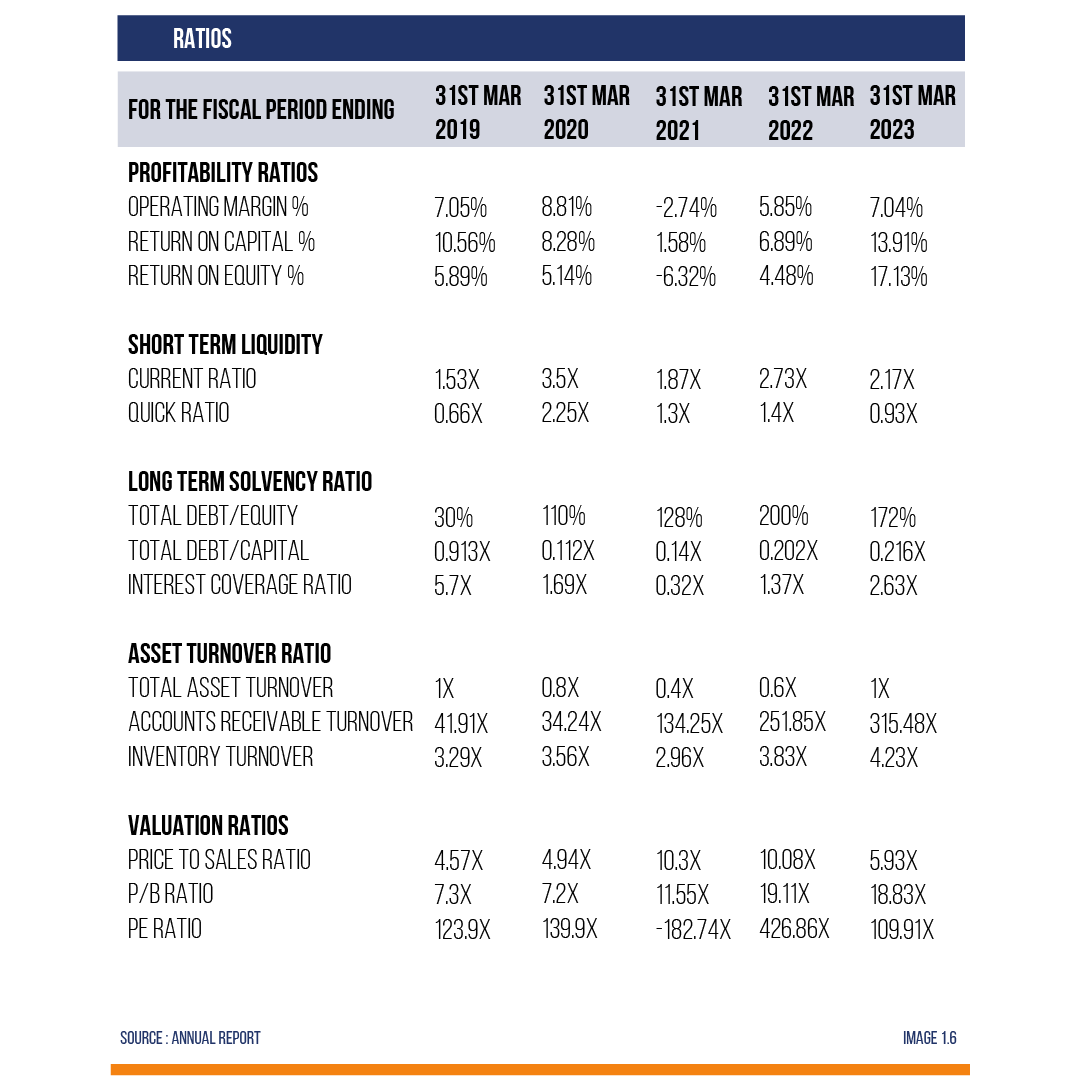

Despite facing some unprecedented challenges in the form of COVID-19, intense competition in the space, and ever-changing consumer demand, the company has clocked a stellar 33% CAGR in revenue numbers over the past 5 years. Similarly, the company achieved 38.98% CAGR over a 5-year horizon in the PAT numbers, showing the strength of the business model and management. The table shows that the operating margins have returned to pre-pandemic levels and are increasing steadily. Westside recorded its highest-ever EBITDA and EBIT margins in FY 23.

The sales per square foot is a key metric while analyzing retail companies, and the same ratio for Westside in FY 23 increased by 67% compared to FY21. The bill size of its membership customers and others has increased for the past five years, showing the company’s ability to retain and attract new customers. For retailers, shrinkage to sales is another key metric to understand operating efficiency, and the company had 0.18% shrinkage to sales. The inventory ratio of 4.2X is quite good compared to its peers and has been consistently improving over the past 3 years.

In FY 23, the company added 20 Westside stores, which require Rs. 6.7 crores in capex per store, and 125 Zudio stores, which require Rs. 2-3 crores each. The company has very low debt obligations. All its expansionary undertakings are from internally generated funds. The company’s gross fixed assets have grown from Rs. 870 crores in FY19 to Rs. 1,391 crores in FY23.

The company has been generating decent cash flows from its operating activity and has grown by a handsome 51% CAGR over the past five years. In FY 23, Free Cash flow rose by 145%, providing the management impetus to expand organically with confidence.

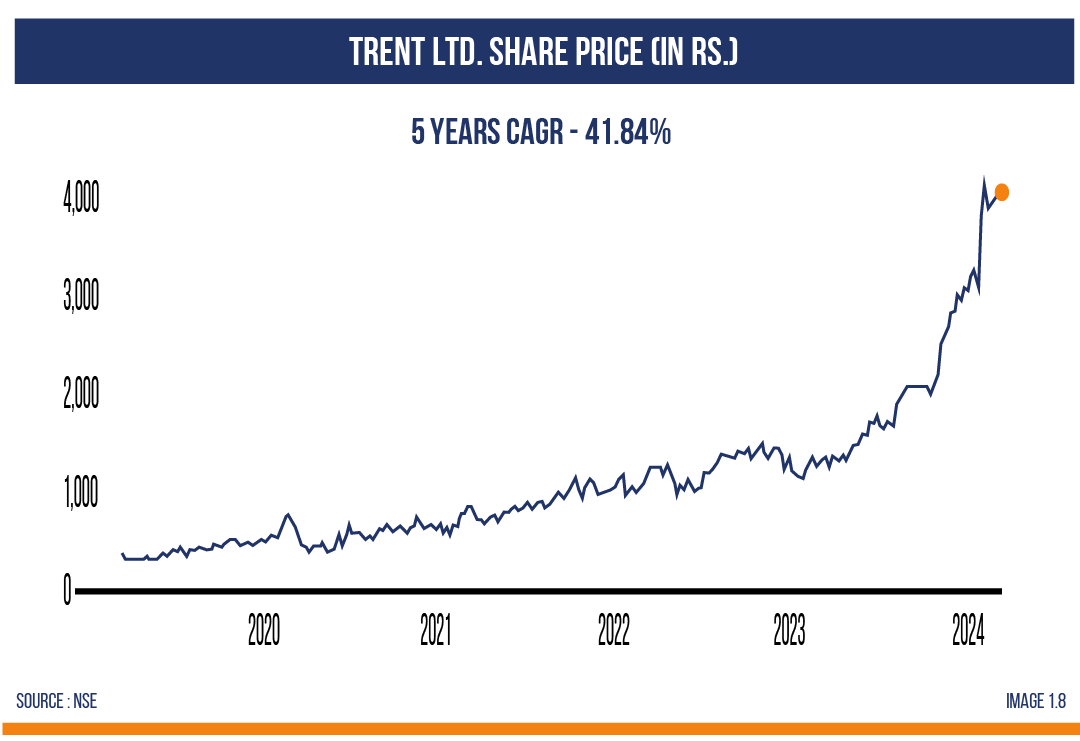

The company has negligible debt and can quickly service its existing obligations. Both the short-term liquidity and long-term solvency ratios are good. The current PE ratio is lower than its 5-year high of 426X. The price-to-sales ratio is also at a decent level. The unchanged Promoter holding and zero promoter pledge provide an additional security margin to the investors.

CURRENT DEVELOPMENTS AND FUTURE EXPECTATIONS

Financials –Trent Limited, an Indian retail company under the Tata Group, has shown impressive financial performance in the first 9 months of FY 24. Quarterly revenue of Trent rose 50% year-over-year (YoY) to ₹3,546.95 crore, and quarterly net profit rose 124.17% YoY to ₹374.36 crore. Annually, the net profit rose 320.19% in the last year to ₹444.69 crore whereas the sector’s average net profit growth being -160.63%. This undoubtedly proves that Trent has maintained a strong presence in the Indian retail market, with a pre-tax return on capital employed (ROCE) of 21% and a return on equity (ROE) of 6% over the last five years.

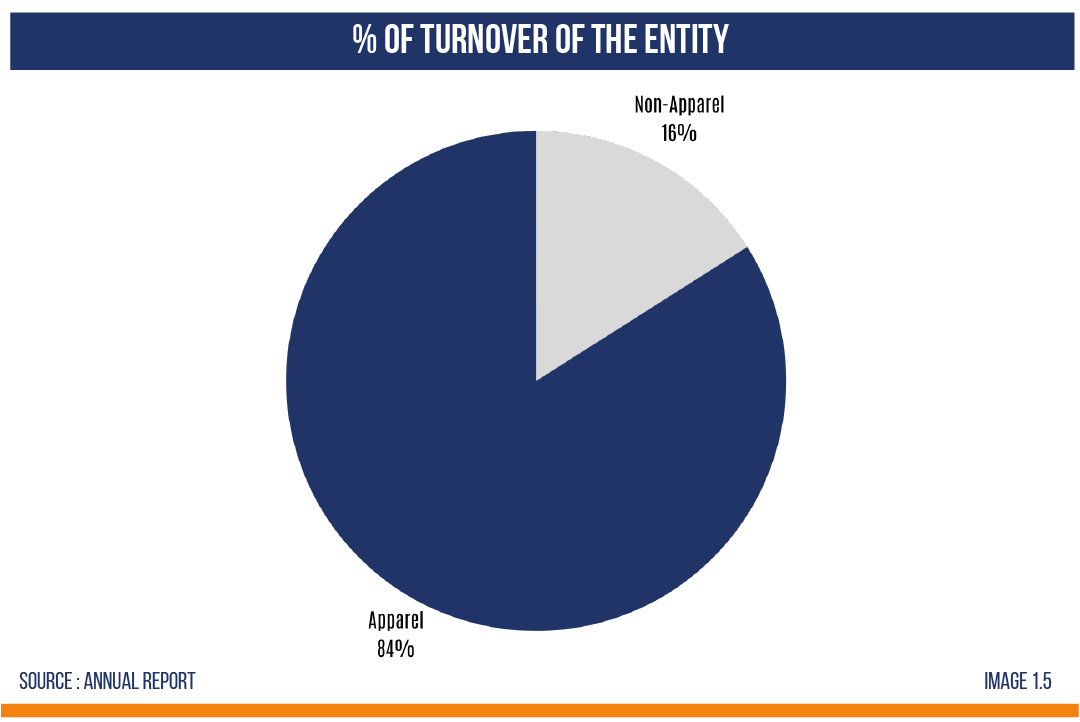

Talking about the gross margin profiles of its key brands: Westside and Zudio, they have remained consistent with historical trends. Notably, the operating EBIT margin for Q3FY24 stood at 13.0%, a significant improvement from 8.5% in Q3FY23. The main business of the Group entities is retailing/ trading of merchandise and well-thought efforts and strategies in these will push Trent to a better positioning in the retail market.

The business of Star Bazaar registered operating revenue growth of 26% in Q3FY24 vis-à-vis the corresponding previous period. Almost, the entirety of this growth was from like-for like stores and the volume growth was also strong and comparable. Trent attributes its success to operating discipline, speed of execution, and strategic alignment of revenue profiles with its objectives and plans.

Business and Future Expectations –During the 3rd quarter, Trent added 5 Westside and 50 Zudio stores across 36 cities including 13 new cities. In Q3FY24, the fashion concepts registered encouraging LFL (Like for like) growth of over 10% vis-à-vis Q3FY23. Across all the brands, the focus has been on delivering consistent value to the customers through a differentiated product portfolio. The in-house stores continue to provide an elevated brand experience even as we pursue our expansion program. Some emerging categories, including beauty and personal care, innerwear, and footwear, contribute to over 19% of the standalone revenues and can become a key contributor to the future revenue.

Trent plans to set themselves apart, by providing exceptional value to customers, ensuring competitive product quality, and enhancing the overall shopping experience through factors like convenience, store layout, and proximity. The company is leveraging technology and has been growing its presence online which will be an important going forward. Online sales constituted 6% of Westside’s revenue and this online channel registered a staggering 24% growth in FY23 and is only going to get better.

Recent Events –

- The company declared and paid dividend of Rs. 2.20 per share this financial year.

- Trent Ltd. continues its efforts to CSR initiatives.

- The company also collaborate with leading fashion bloggers, vloggers, and influencers and organise popular fashion & youth events to reinforce the brand messages to a wider audience. This has led to generation of over 2,50,000 views and engagements a week.

- Star has continued to pursue a clustered approach with stores in Maharashtra, Karnataka, Telangana and Gujarat with an aim of creating local scale and being closer to customers. This allows them to achieve (a) better understanding of local needs and preferences, (b) cost efficiency due to economies of scale, and (c) increased brand visibility.

Strength –

- Stock price surged a massive 204.26% and outperformed its sector by 136.84% in the past year.

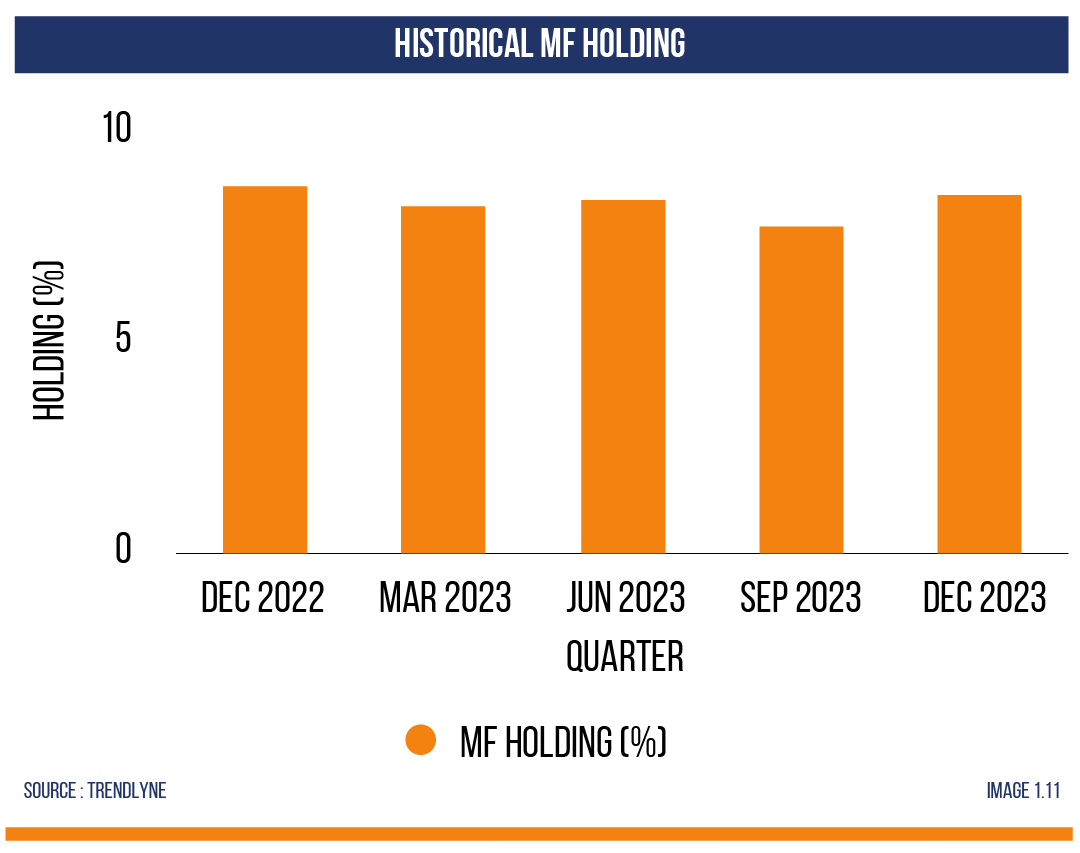

- Mutual Fund Holding increased 9.14% from the last quarter to 9.21%.

- The 3rd quarter net profit rose 124.17% YoY to ₹374.36 Cr. Corresponding sector’s average net profit growth YoY for the quarter was 30.68%.

- Trent Ltd. has been maintaining a healthy dividend pay-out of 20.0%.

- Company has delivered good profit growth of 25.6% CAGR over last 5 years.

- Its business model allows active ownership across the value chain giving it freedom and resilience as well as helping them in quick conversion of concept to products in store. This enables them to provide latest fashion trends.

- The company avoids active marketing spends and emphasises more on its own brands, thus it is able to provide relative price stability to customers.

CONCLUSION

Trent Ltd. is positioned nicely in a sector which will have a long runway, considering the fact that India’s growth story has just begun and the consumption theme will persist. The population shift from rural to urban India has just begun and this will impact the retail sector profoundly. The management’s expansionary approach and catering to all types of customers will have a great impact in the coming years as this will further establish their brand. With debt at low levels, good cashflow generation, increased online presence, strong promoter group and great control over its supply chain the company can be expected to continue its growth trajectory. Trent Ltd. becomes a good investment for all of these reasons