HIGHLIGHTS

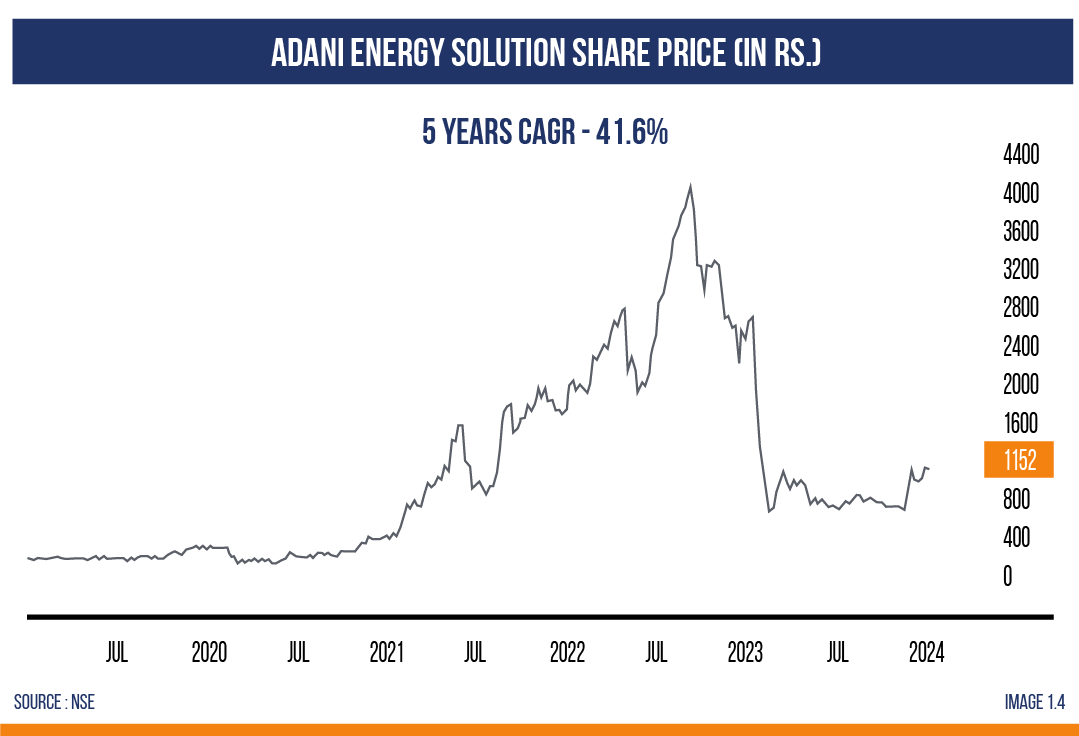

- The company has been performing remarkably, witnessing a consistent annual growth in sales for three consecutive years, with a CAGR of 80%.

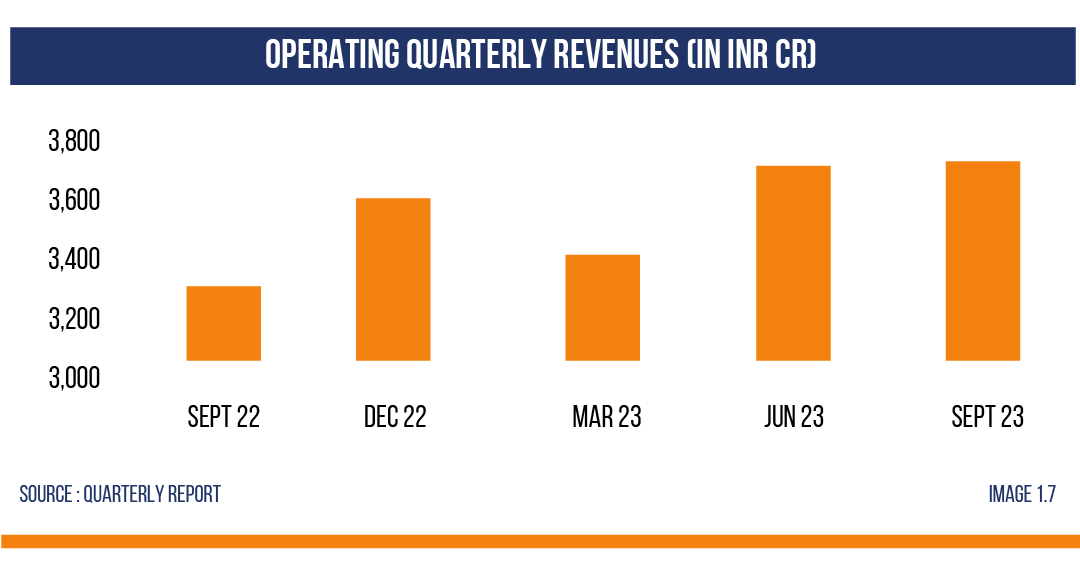

- Adani Energy Solutions Limited (AESL) reported a robust performance in Q2, recording consolidated revenue of 3,421 Cr, marking a significant 13% year-on-year increase.

- In Q2, AESL transmission business segment achieved an impressive 8% operational revenue growth which was fuelled by line commissioning and incentive Additionally, there was 9% increase in EBITDA, reaching Rs. 907 Cr.

- In Q2, the distribution segment’s revenue reached Rs. 2,480 Cr, reflecting a noteworthy 15% year-on-year This growth can be attributed to elevated units sold and increased customer acquisitions.

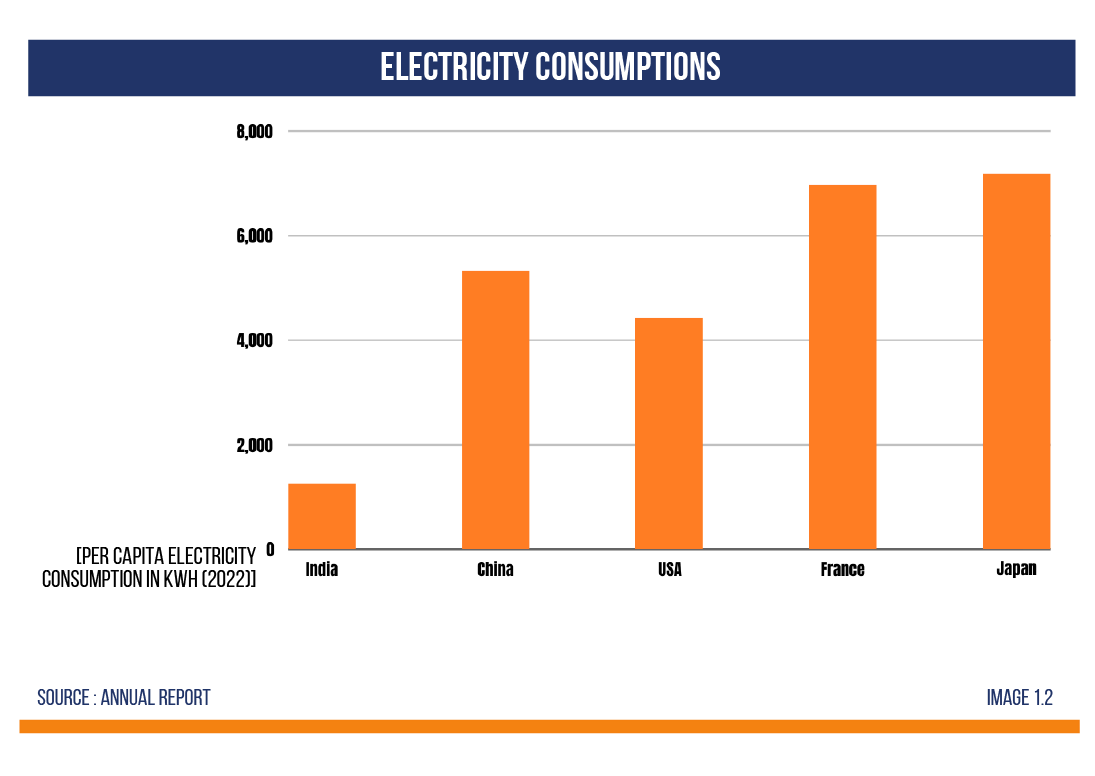

The worldwide electricity demand is projected to grow at an annual average of 3.7% from 2021 to 2030, fuelled by economic expansion and population growth, especially in emerging and developing nations. The global power generation market is expected to reach $2,462.37 billion by 2026. With a robust CAGR of 10.1%, the market size is projected to soar to $3,982.36 billion by 2031. Riding the wave of surging electricity demands in Asia, the region is expected to contribute over 50% to the world’s electricity needs by 2025. Adani Energy Solutions Ltd. aligns itself with this electrifying growth, leveraging the escalating use of renewable sources, including wind and solar energy, which have more than doubled since 2015, surpassing even the combined output of all global nuclear power plants.

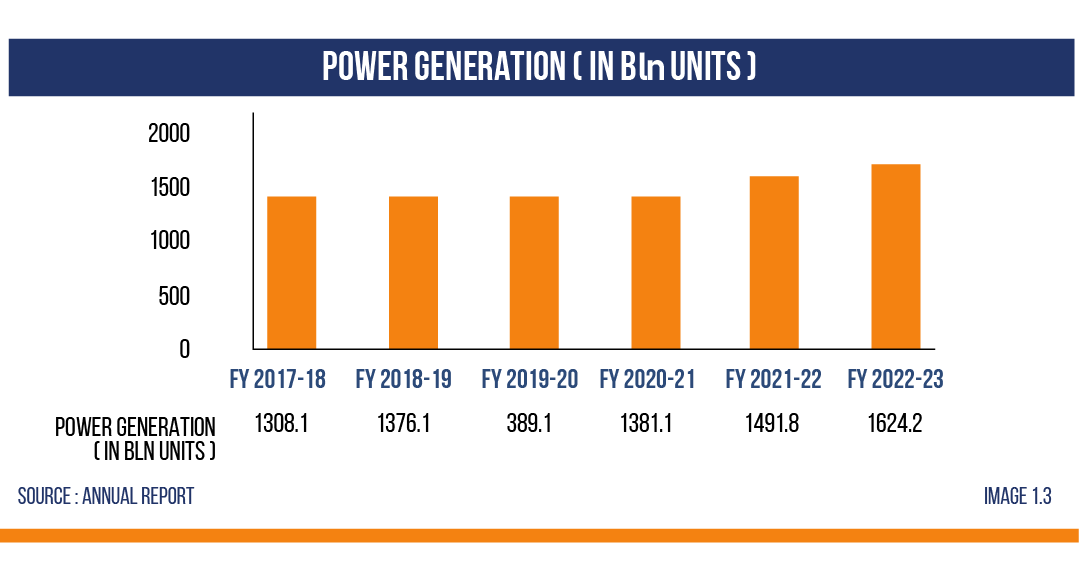

India’s power sector is a significant player in the global energy landscape. As of July 31, 2023, India is the third-largest producer and consumer of electricity worldwide, with an installed power capacity of 423.35 GW. In FY 2022-23, India experienced a significant 9.5% y-o-y surge in power consumption, totalling 1,503.65 billion units. In contrast, the power consumption in the preceding fiscal year, 2021-22, was 1,374.02 billion units. The Indian power sector is evolving positively, shaping a promising future. Ongoing economic growth fuels the electricity demand. In recent decades, India has transformed its power sector—ensuring widespread access to grid electricity, reducing power shortages, and witnessing a remarkable surge in renewable energy capacity, now constituting 25% of the nation’s total capacity.

The Indian power transmission sector has a long way to go to keep up with its power generation capabilities, and this is where companies like AESL can become the difference makers. India added 14,625 circuit kilometers and 75,902 MVA of new transformation capacity in the previous FY. There are several government initiatives to help aid companies in this sector, some of the significant ones being the Revamped Distribution Sector Scheme, UDAY, DDUGJY, etc. AESL is India’s largest private transmission company and is also involved in the power distribution business. Some major players in this industry are PSUs like Power Grid and Karnataka Power Transmission Corporation and private players like JSW Energy and CESC.

BUSINESS DESCRIPTION

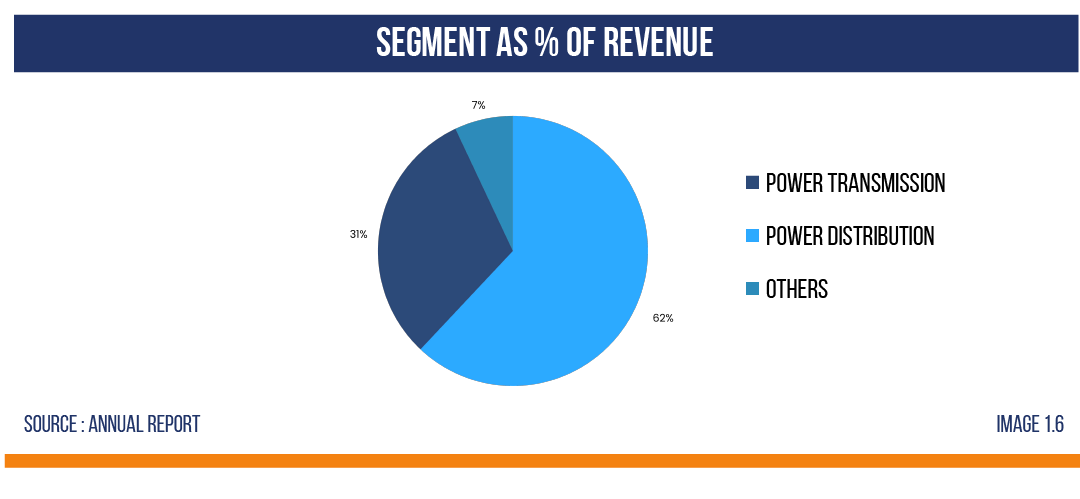

Established in 2006, Adani Energy Solutions Limited, initially focused on evacuating power from its Mundra thermal power plant, is now the largest private-sector power transmission and distribution company. Headquartered in Ahmedabad, Gujarat, Adani Energy Solutions Limited (AESL), operates across 14 states comprising a cumulative transmission network of 19,779 circuit kilometres (ckm) and 46,001 MVA of power transformation capacity. AESL is actively involved in the ownership and operation of high-voltage AC transmission lines and substations at various voltage levels and high-voltage DC transmission lines. With a diverse portfolio, AESL boasts a significant capacity for power transformation and an extensive network of transmission lines.

The distribution segment of AESL holds the position of India’s largest private-sector power distribution utility. It has operated in Mumbai for over nine decades and manages nearly 2,000 MW of power demand with an efficient distribution network. Recently, the company also entered into the smart metering business.

FINANCIAL PERFORMANCE

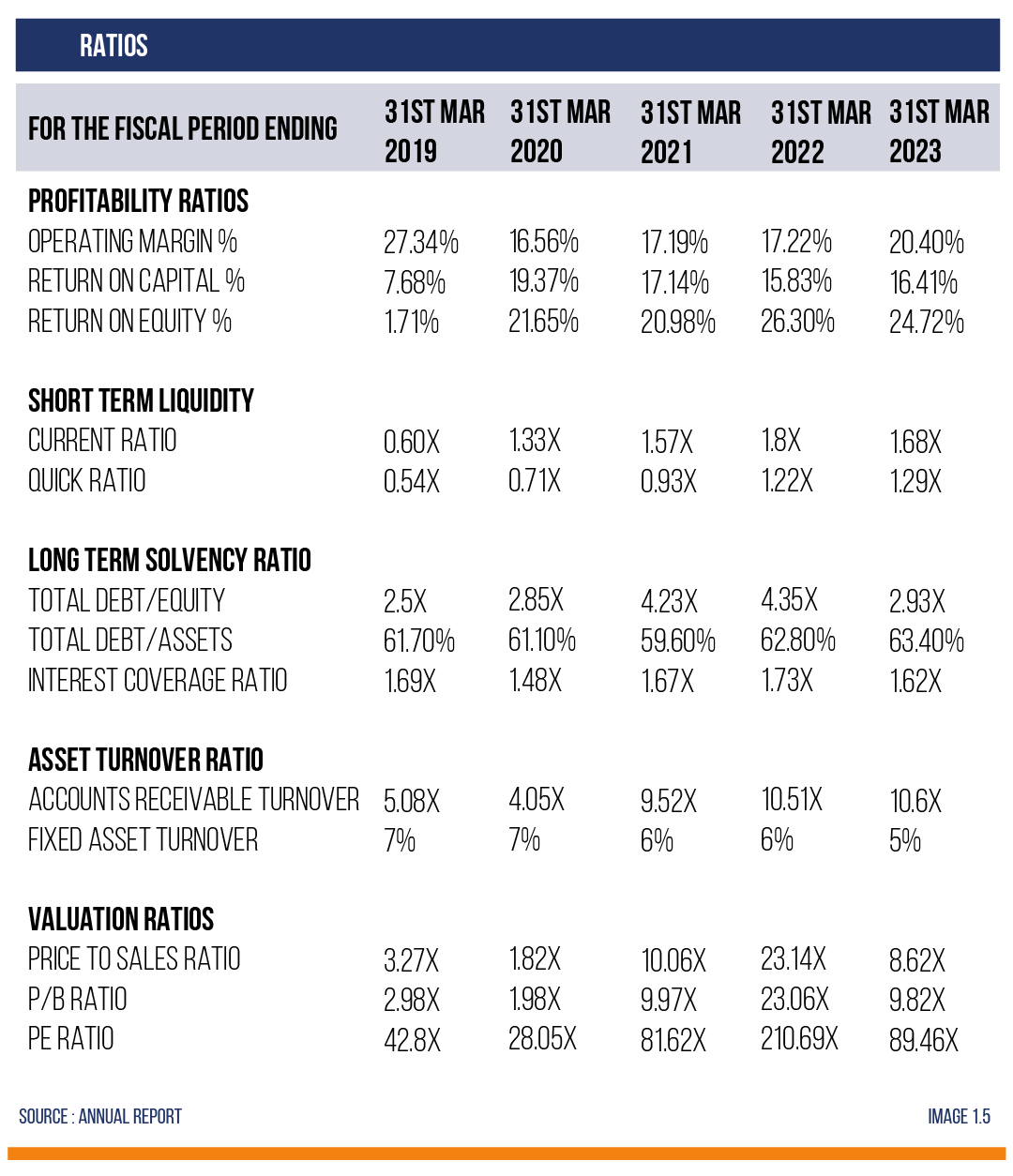

A brief overview of Adani Energy Solutions Limited’s financial performance during the previous five years is shown in image 1.5.

FY23, like all previous years, has been a stellar year for AESL in the operational and financial arena. It has crossed its highest-ever revenue and EBITDA figure. Its consolidated operating revenue grew by 16.67% YOY to Rs. 13,840 Cr, and consolidated EBITDA increased by 7.2% on revenue growth. The company maintained supply reliability of more than 99.9% and demonstrated a significant decline in distribution loss from 6.55% to 5.93%, aiding profitability.

The company’s Asset base increased by 13.62 % to Rs. 53,932 Cr, whereas the current and non-current liabilities increased by 13.7% to Rs. 41,172 Cr. Between 2016 and 2023, the transmission network industry grew by 5%, whereas AESL grew by a staggering 16%, which is 3.42x, demonstrating the company’s outperformance. The company is undertaking many projects in the current FY, which will require a significant capex, including the HVDC Mumbai project. The company’s gearing ratio, i.e., debt to net worth ratio, has improved slightly in the previous FY from 2.71x to 2.68x levels. The return on asset metric at 2.37% has also improved compared to the last 4 years average. Similarly, the return on capital at 9.59% is better than the 4-year average of 9.15%.

The current and quick ratio demonstrates that the company’s short-term liquidity metrics have improved compared to last year. Net debt to EBITDA ratio of 5.6x is within the range of previous years’ figures. Debt to equity ratio has moderated quite a bit from 4.35x to 2.93x levels, giving equity investors more confidence in the future.

CURRENT DEVELOPMENTS AND FUTURE EXPECTATIONS

Financials – In Q1 FY24, AESL witnessed a substantial 19% YoY surge in revenue. The noteworthy aspect is the significant shift, particularly marked by a remarkable 70% YoY growth in Profit before Tax (PBT), reaching Rs 343 Cr. The positive trajectory is further underscored by an 8% YoY increase in Profit after Tax (PAT) during the same quarter. Distribution segment’s revenue increased due to higher unit sales and the recovery of a past-period regulatory gap. In Q1, Transmission segment’s PAT declined due to a higher tax outgo, while Distribution PAT improved to Rs 20 Cr from a previous loss of Rs 66 Cr attributed to foreign currency loan movements.

In the latest quarter, the company experienced a robust 12.99% year-over-year growth in revenue, reaching Rs 3,766.46 Cr. This outperformed the sector’s average revenue growth of 4.99% for the same period. While the annual net profit for the company showed a steady 4.29% increase to Rs 1,256.33 Cr, aligning closely with the sector’s average net profit growth of 4.35%, the quarterly performance presents a notable improvement. With a remarkable 33.81% year-over-year surge to Rs 275.88 Cr, the company has outshone its sector’s average quarterly net profit growth of 67.59%. This highlights a promising upward trend in the short-term performance compared to the annual figures.

Business and Future Expectations –

- AESL realized a notable 9% growth in EBITDA, culminating in an absolute figure of Rs.907 Cr. Notably, the Q2 Profit after Tax (PAT) for transmission business saw a significant uptick, reaching Rs.259 Cr, marking an impressive 8.5% increase. Distribution segment’s PAT reached Rs. 25 Cr, reflecting a 155% YoY increase due to one-time bookings made in the same quarter last year.

- Bhadla-Fatehgarh HVDC project – The company is gearing up to bid for the largest HVDC line and expresses confidence in its efficiency and reliability to successfully complete the project within the stipulated timeframe, drawing parallels to its prior successful endeavours like the KVTL or WKTL.

- HVDC Mumbai project – The project is on track with a planned commissioning between 2025-26. The committed capital expenditure is Rs. 6,600 to Rs. 7.000 Cr, with current spending at Rs. 1100 to Rs. 1200 Cr.

- Smart metering projects – AESL secured smart metering projects in South Mumbai (West region) and Assam, and have initiated the ordering process for the complete meter requirements for both locations.

- The company is participating in a number of biddings and reverse auctions, out of which two heavyweight evacuations in Rajasthan corridor and Khavda are the ones to look out for.

Recent Events –

- Adani Transmission Limited (ATL) has rebranded as Adani Energy Solutions Limited (AESL) since July 27, 2023. This strategic change positions the company to explore opportunities in smart metering, district cooling solutions, and other energy solutions while retaining its leadership in transmission and distribution sectors.

- AEML, Mumbai’s leading power utility, has achieved the distinction of being India’s top power utility, according to the Ministry of Power’s 11th Annual Integrated Rating and Ranking for Power Distribution.

- AESL is in the Top 50 of India’s Most Sustainable Companies in the annual ranking of BW Business World.

- AESL is not just about profit but also for people and the planet! Single-use Plastic Free, Zero Waste to Landfill (ZWL), Net Water Positive certification has been received by the company from independent agencies.

Strength –

- HAL’s strength lies in its impeccable financial stability, characterized by zero promoter pledges and a debt free status.

- As a trusted partner of the Indian Defence Forces, HAL plays a vital role in extending support to aging fleets, some of which have served for over six decades.

- The basic EPS stood at Rs. 85.9 in March 2020 which after giving effects to the Split of shares stands at Rs. 84.17 in Sept 2023.

- The company has been maintaining a healthy dividend payout of 29.6%.

- The company’s impressive reduction in working capital requirements, from 98.4 days to 38.2 days, reflects enhanced efficiency in managing short-term financial obligations and signals improved liquidity, which can bolster its financial flexibility and strategic opportunities.

- The FII/FPI Holding has surged in the Sept 2023 quarter, from 11.9% to 12.63%. Mutual Funds have also increased their holding from 6.6% to 7.2%.

- HAL’s price is near its all-time high of Rs. 2,145.

CONCLUSION

Adani Energy Solutions Ltd. positions itself as a strategic player in India’s transmission sector and stands as an attractive investment opportunity. The company has outlined a visionary roadmap, setting a formidable target of possessing 30,000 circuit kilometers (ckm) in transmission assets and achieving distribution meeting 4.5 Mega Volt-Ampere (MVA) per customer by 2026. In tandem with this ambitious vision, the company’s financial performance is equally compelling, evidenced by its impressive quarterly revenue of Rs 3,766 Cr for September 2023, reflecting a substantial YoY growth of 11.5%. This commendable revenue growth not only underscores Adani Energy Solutions Ltd.’s operational excellence but also enhances its appeal to investors seeking both strategic market presence and promising financial returns in the dynamic landscape of India’s energy sector.