HIGHLIGHTS

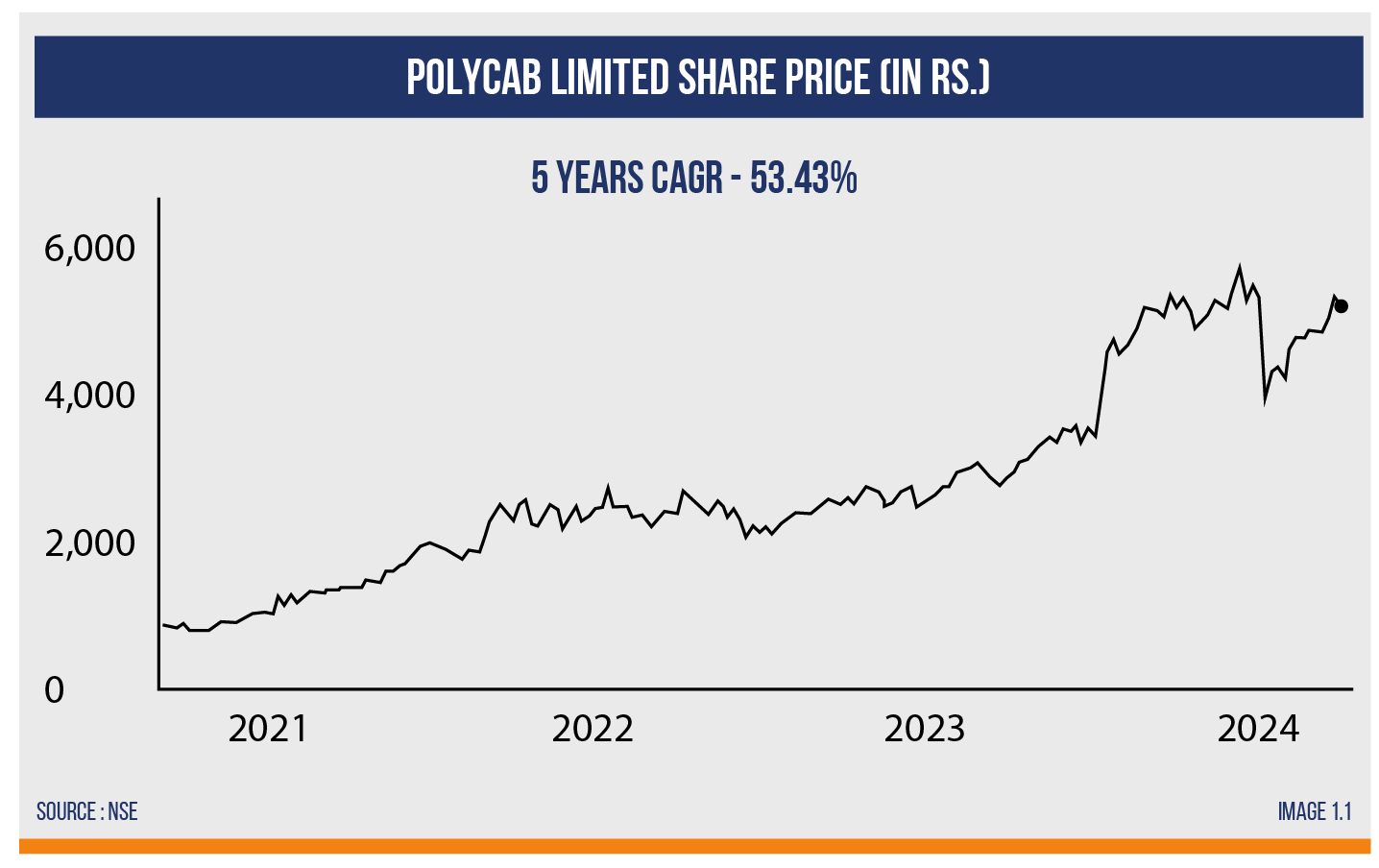

LAKEWATER SHARED REPORT ON : AUGUST 22, 2020 | CMP : ₹913.3 CMP AS ON 12TH APRIL, 2024 : ₹5,300 CAGR for this period : 53.43% In this report, we shall decode the likely reasons for Polycab’s phenomenal performance over approximately the past four years since we published our first report on Polycab. Polycab has grown 4X in 4 years, registering a CAGR of 53.43% due to its strong fundamentals and growth expansion strategies. Revenues have increased in the past two quarters, and net profits have improved over the last two years. The following points delve deeper into why Polycab returned tremendously:- Polycab India combined its Heavy Duty Cables (HDC) and Light Duty Cables (LDC) businesses, which increased sales and improved efficiency in sales, supply chain, and operations. This change allowed the company to offer a wide range of wires and cables. This has helped the company’s overall performance and strengthened its B2B business.

- In June 2023, Polycab India acquired the remaining 25% of Steel Matrix’s shares, making it a wholly-owned subsidiary. Steel Matrix produces steel drums and bobbins for cables and wires. This acquisition enhances Polycab’s supply chain control and operational efficiency and strengthens its manufacturing process through improved backward integration.

- Polycab India has entered the Extra-High-Voltage (EHV) cables market, with a potential market size of INR 4,000-5,000 crore rupees by 2025. This move is driven by the growing demand for high-voltage and extra-high-voltage cables, particularly in Tier 1 and 2 cities and smart cities.

- The Indian government’s ‘Housing for All’ scheme aims to build 12 million and 28.5 million houses in urban and rural areas, respectively. It has introduced policies like RoDTEP, AAS, and EPCG for international trade and DDUGJY for electrification. As of 2023, 290 million households had been electrified.

- Revenue from operations surged from approximately ₹8,000 crores in March 2020 to ₹16,000 crores as of March 29, 2024. That is a 200% increase!

- The economy has not only recovered from the ill effects of COVID-19 but has also registered spectacular growth, with great GPD numbers providing optimism worldwide. The stock markets also saw a V-shaped recovery, which led to Polycab touching its high within a year.

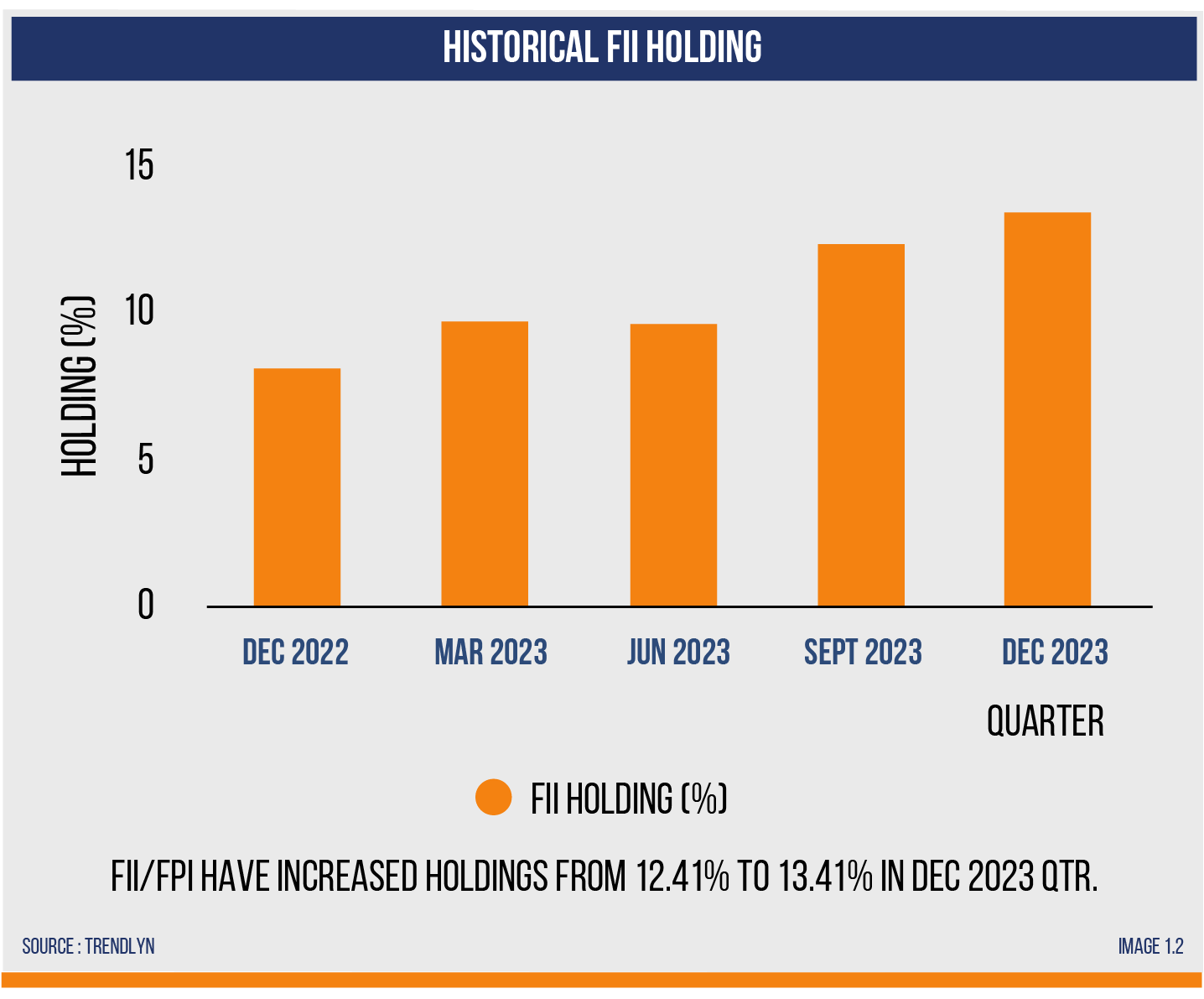

- An increase in buying from FIIs/FPIs have been witnessed showcasing the company’s strength as shown in Image 1.2.

- According to a research report, India’s wires and cables market is projected to grow at 14.2% (CAGR) from 2024 to 2030. With an organized market share of 22%- 24%, Polycab is a market leader in the wire and cable business. As the market grows, the company might become even more profitable.