Highlights

• Past few years have seen robust investments in the power and infrastructure sectors. This has supported the growth of wires and cables market, along with government incentives.

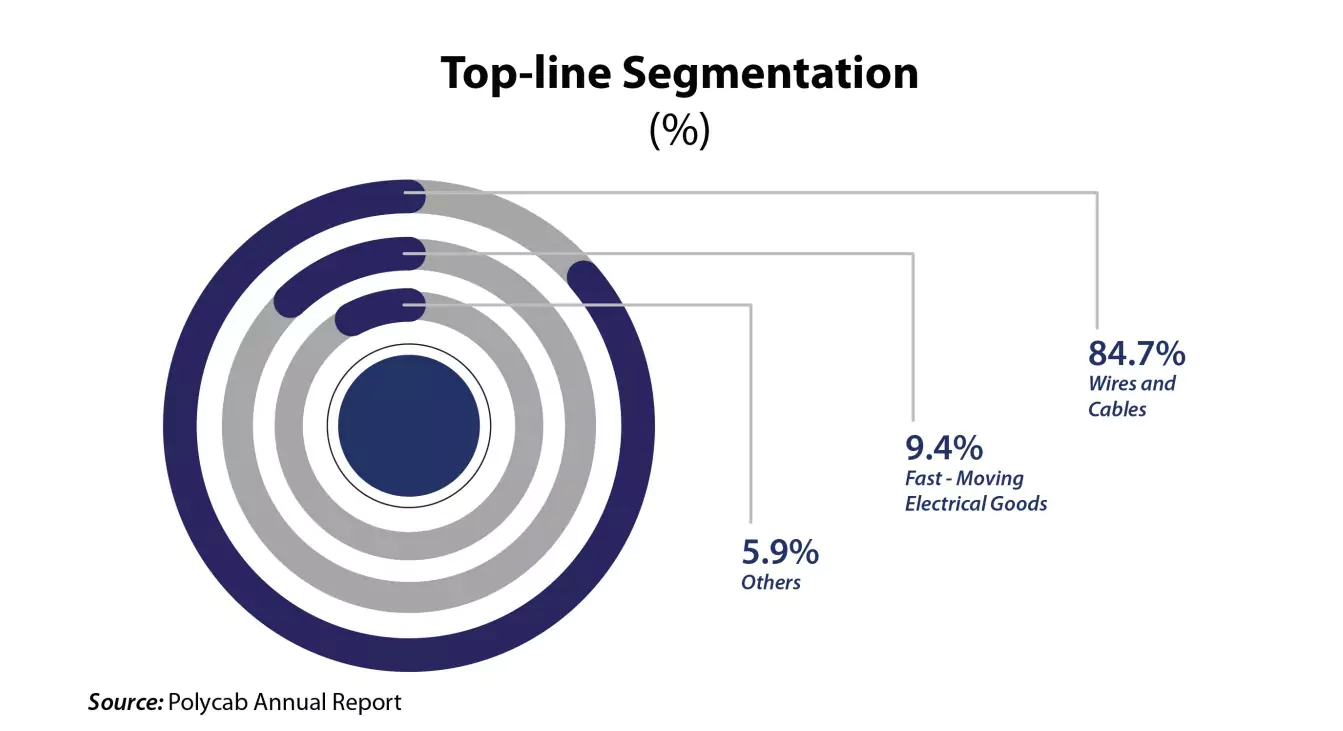

• The manufacturing base comprises 1/3rd of the unorganized sector of the wires and cables sector, the remaining 2/3rd is dominated by few major players. Polycab holds a ~18% market share of the organized sector.

• Vast distribution network has helped Polycab to establish the Fast-Moving Electrical Goods (FMEG) segment in B2C space.

Industry Scenario

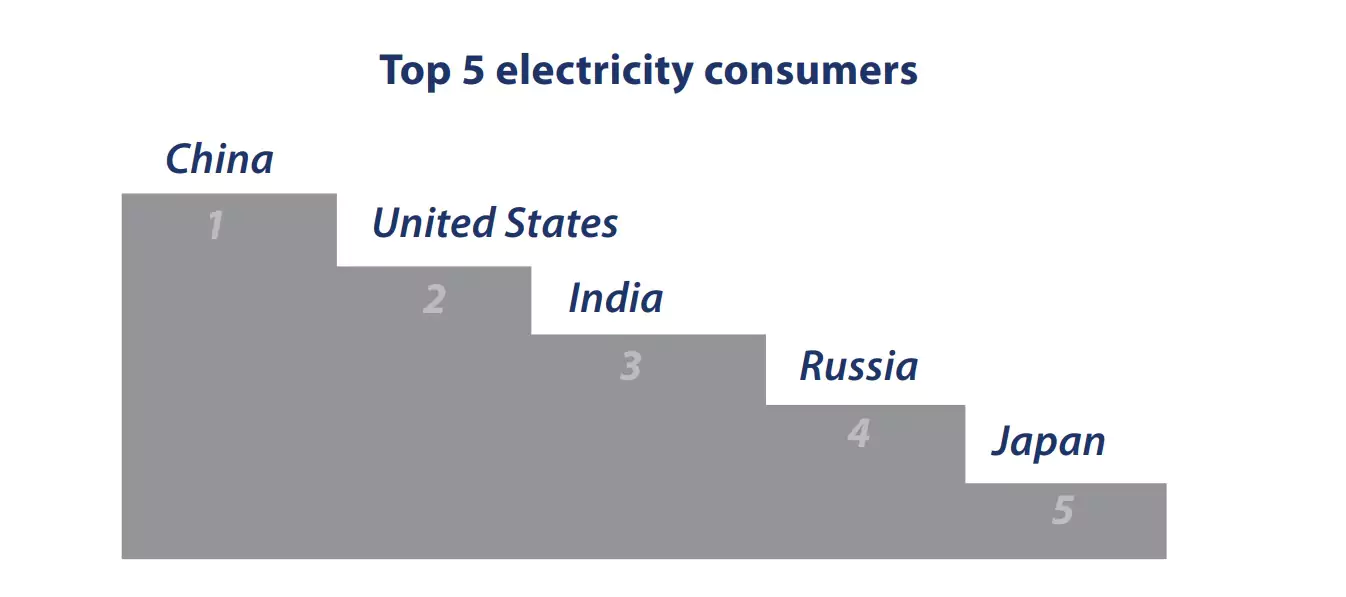

The government is constantly coming up with numerous supportive measures and trying a lot to make India self-reliant. Its prime focus is rural, infrastructure, and industrial growth. For this, a long-term strategy is planned, which includes boosting electricity generation and increasing per capita consumption. With government incentives that promote local manufacturing, it is going to rejuvenate growth. In fact, globally, the market for cables is expected to be USD 145 bln, in which ~40% is contributed by the Asia-Pacific region. India is the world’s third largest producer (China and United States, being the first and second respectively) and at the same time, a great consumer of electricity; and thus wires and cables make ~40-45% of the electrical industry. It is estimated that the domestic wires and cables industry is worth over INR 500 bln. But, the outbreak of Covid-19 has led to sluggish macroeconomic conditions and weaker consumer sentiments. Having said this, wires and cables are likely to pick demand, as it plays a vital role in all the prime sectors.

Background

Polycab India (PIL) is the leading manufacturer of wires and cables in India. It is also involved in fast moving electrical goods (FMEG). It has an extensive portfolio that caters to both the industrial and retail industries. It has a Pan India presence with 25 manufacturing facilities, which includes two joint ventures with Techno and Trafigura. 4 out of 25 manufacturers are related to FMEG products. The established supply chain is developed all over India. As on 31st March 2018 it had 3,464 authorized dealers and distributors and 29 warehouses. Additionally, it exports to over 40 countries.

Though the company was incorporated in 1996, the promoters have had more than 15 years of experience before incorporation.

Ever since 1996, it is growing and maintains a stable market share. Currently, it has a ~18% market share of the organized sector and ~12-13% of the total market for the last 5 years. Quality products, backward integration, and distribution networks will be maintained and increase its share in the coming years.

Current Scenario

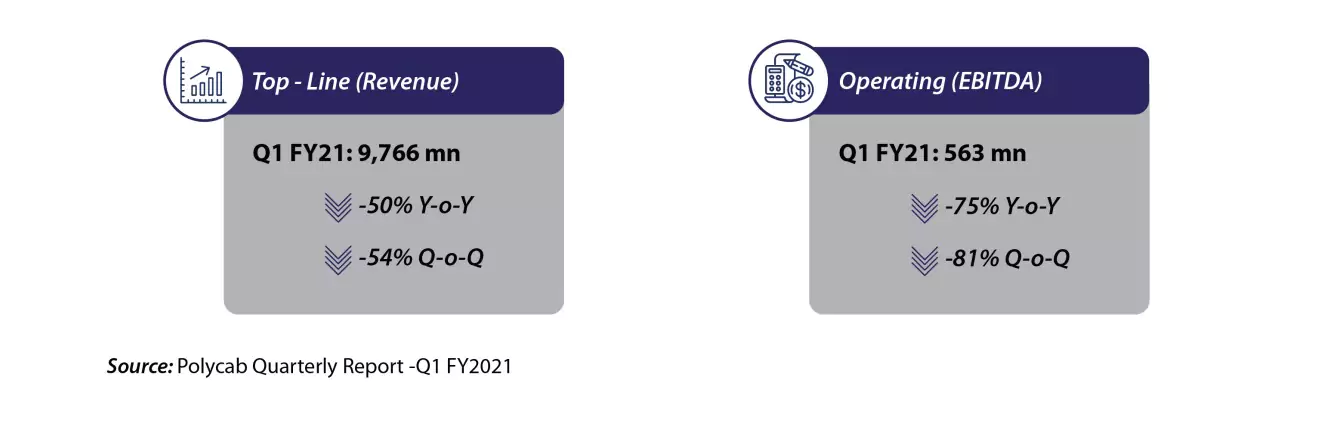

The earning of Q1 FY 21 has been released. The revenue has severely been impacted by Covid-19 outbreak and has reported a decline of 50% YoY, since ~45 business days were lost in lockdown this year.

Q1FY2020 has been overall tough for all. But, Polycab was able to combat with positive growth in June 2020. Higher revenues were recorded as B2C sales were trending. The export orders witnessed a growth of 116%. Also, tight cost control drove better EBITDA than expected. The shrink in expenses was due to judicious cost management, by a massive cut in advertisement costs and low variable pay to employees. The company managed to maintain its liquidity by deferring noncritical spends and drawing credit lines. It is expected that some of the overhead cuts will be sustainable.

The unpredictable local lockdowns are affecting closures of stores. The Q2FY2020 is expected to show better results, as the demands are pumping up. However, the newly established subsidiaries in the US and Australia are embarking as strong spots of growth.

Strengths

• Independent of China

Polycab isn’t dependent on China apart from premium fans (which has alternatives as well). Most of the cables and wire metals is sourced from Japan. The rest of the non-metals are obtained majorly from India itself or from all over the globe. One of the notable points is that for FMEG businesses, everything is manufactured in the country itself.

• Economic Growth

India is witnessing robust economic growth, fast pace urbanization, and an increase in per capita consumption. These dynamics shoot up the demand for electricity and acts as a catalyst to strengthen and expand the current generation and transmission. Transmission and Distribution segment is assured to experience steep growth as the demand for energy rises.

• Government Incentive

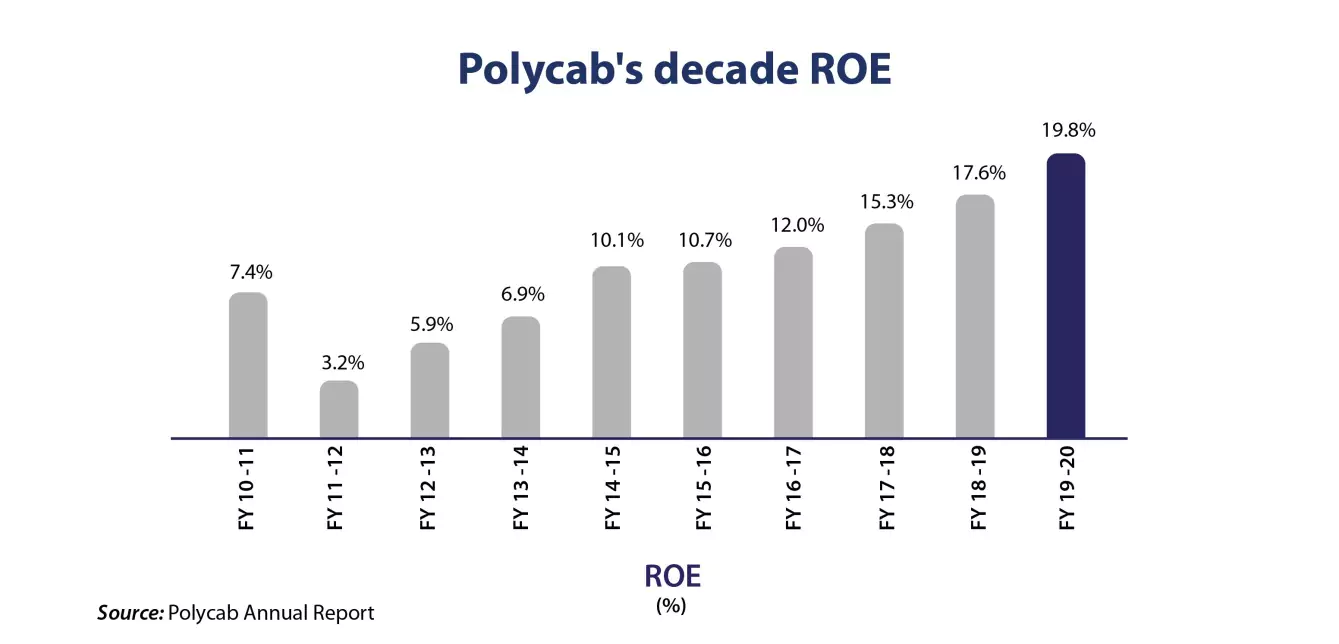

Due to Covid-19, many countries are turning towards India. India can grab this chance and be “Made for World”, only if it’s well connected. Prime Minister, Narendra Modi, realizes its opportunity and in 2020 in his Independence Day speech has announced to connect 6 lakh villages with optical fibre in 1000 days. This will increase the demand for optical wires. Also, government incentives like the Integrated Power Development Scheme (IPDS) and Pradhan Mantri Sahaj Bijli Ghar Yojna have created a positive impact on this industry. This has given a solid backing for the rising ROE.

• FMEG Segment

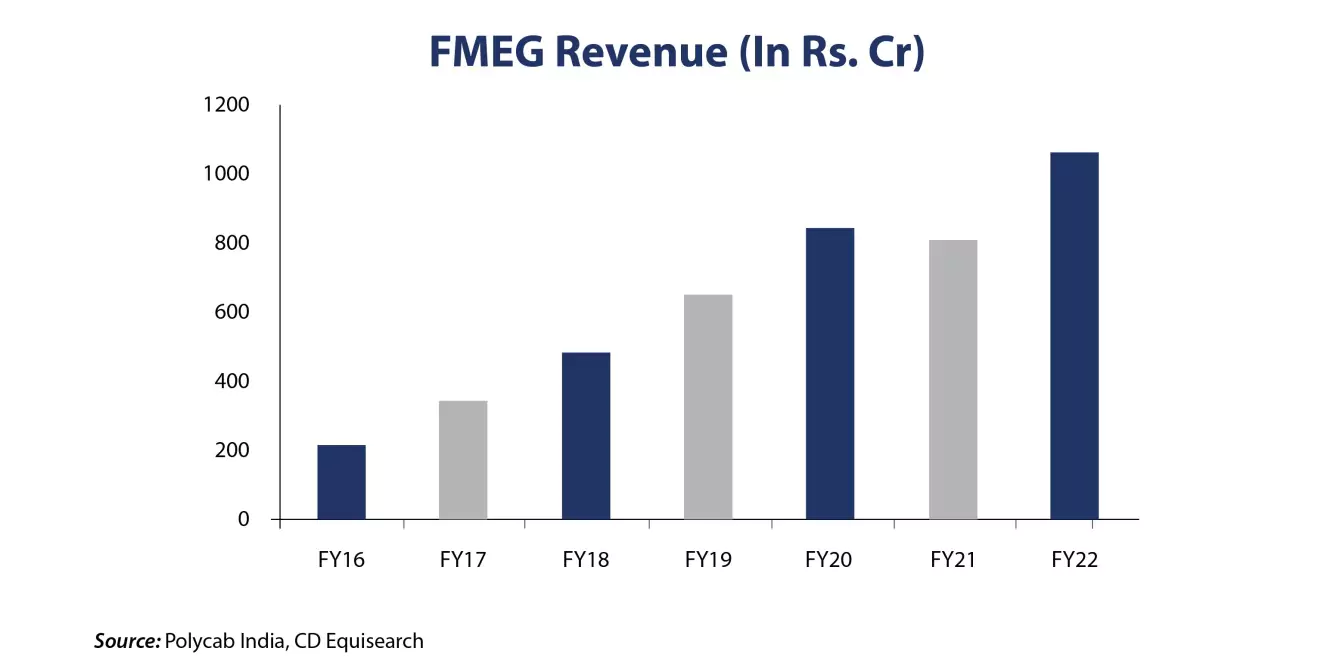

Polycab is a leader in wires and cables business. With just 6 years in the industry, the FMEG segment’s share in revenue is increased to ~9%. 5 year top-line CAGR of FMEG business is 47%. Though the EBIT margins are low, strong brand positioning is establishing Polycab as a dominant B2C player.

The stable 18% share in the organized sector is being expanded with the support of the FMEG sector.

• Export Business

The export orders had witnessed a growth of ~116% YoY, in spite of Dangote Project linked sales were nil in Q1. The earnings are expected to vigorously grow with the execution of the Dangote Project. Furthermore, the company is also exploring opportunities in the USA, Australia via its subsidiaries. Exports business is expected to reach a target of 10% of overall revenues in 3 to 5 years.

• Backward Integration

Innovation, quality, and availability are Polycab’s competitive edge, which makes backward integration its prime focus. Production of raw materials has reduced its reliance on external factors and ensures stable supply. Its production capabilities have made high barriers for other companies to emulate. Once the Ryker plant (entire stake purchase in May 2020) is fully operational, it shall be able to fulfill the demand for copper wire rods too.

Issues

• Covid-19 phase

Although the distribution channel is active, the large retailers in Tier 1 are affected, resulting in underutilization of capacity. Another barrier is the shortage of laborers. This is resulting delays in construction and infrastructure-related projects.

• Commodity Risk

Polycab manufactures raw materials, but the cost of primary raw materials is fluctuating. For instance, copper and aluminum are linked to prices depicted on the London Metal Exchange and that of PVC compounds depends on crude oil’s price. Usually, the cost is passed on to consumers, but this isn’t possible in case of rapid fluctuation. This consequently affects the operating results. Currently, mitigation is managed with the help of hedging.

• Key-end user

Polycab is dependent on its key end-users. A downturn in any of them due to geopolitical tensions, general economic slowdown, or government policy can impact Polycab negatively. The company is ought to diversify and penetrate deeper to avoid impact on any user.

Consumer sentiment is weak at the moment. July has seen growth already and this is just a phase effect, which shall be recovered soon.

FY2021 Outlook

Polycab is trying to keep the balance sheet healthy. The focus is to maintain an optimized inventory level. Channel financing, cost and supply chain optimization, digitization of processes, are multiple strategies that Polycab is undertaking to drive growth. There is a significant expectation from the export business, provided there isn’t any strict lockdown in any geography. Apart from the internal stratagems, the external factor that shall play a crucial role here is the anti-China sentiment. This shall help the company attain a better grip on the market.

Overall, 2QFY21 is expected to be better than the first quarter.

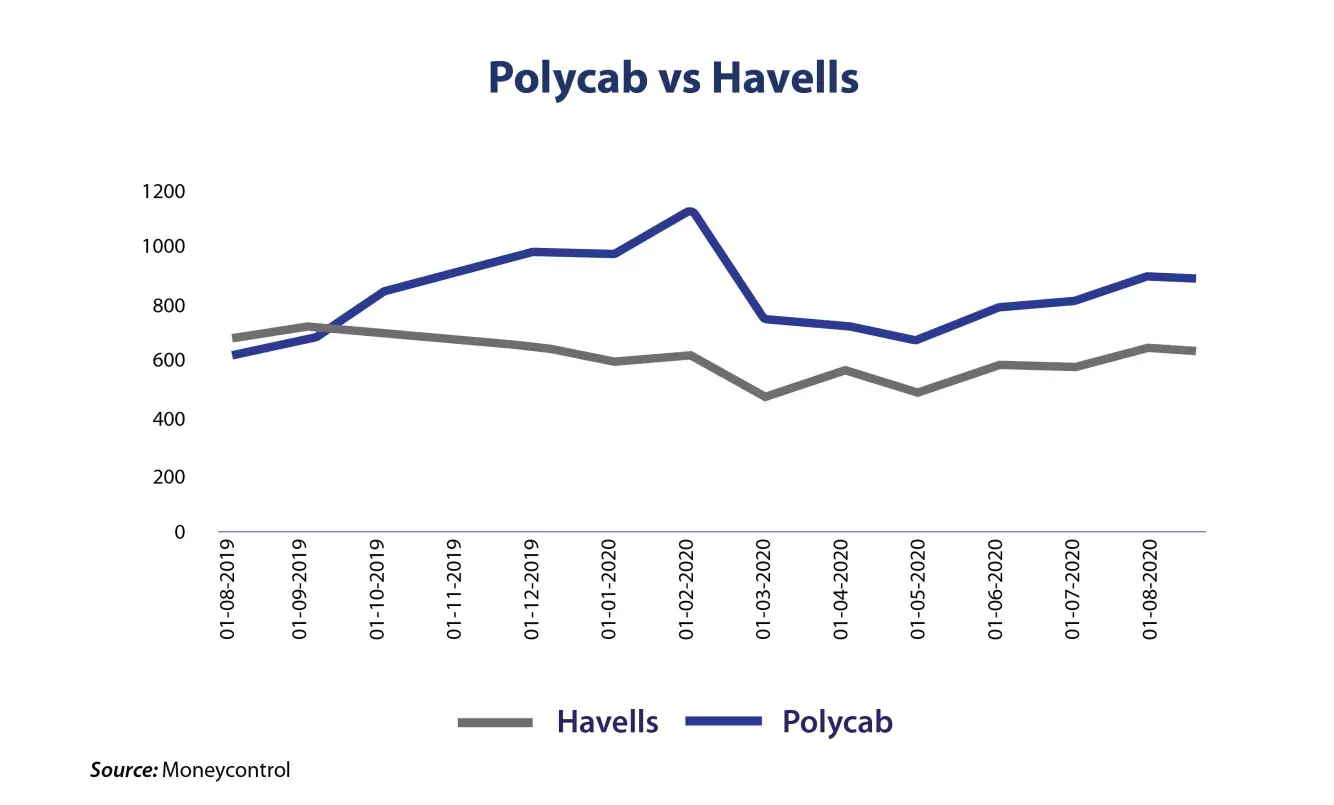

Polycab or Havells

Though Polycab and Havells belong to similar territories– electrical equipment manufacturing, the results have been divergent. While Havell’s performance was dismal, that of Polycab bet estimates. The prime difference is the market to which they cater. Polycab is both in B2B and B2C market, but largely B2B and Havells is mainly in retail.

If we took into account the compound annual growth rate performance for the last 5 years, Havells has grown at a pace of 11% while Polycab has grown around 12%. Polycab’s margin expansion and ROCE are both higher than Havells.

Here is a synopsis of some of the important financial elements of the two stocks of FY20:

Polycab is expanding its consumer durable business, while Havells is having a blip. Maybe, in future, the tables might turn around. But as of now, the odds are in favour of Polycab.

Conclusion

Industry Revolution 4.0 has made digital a new normal and is transforming conventional business. This needs smart and advanced digital infrastructure. Further, the wire and cable industry in India will see steady growth in the upcoming years due to the commercialization of renewable power generation. These will lead to the robust growth of Polycab.

Polycab expects healthy progress because of an increase in consumer electrical demand, and government incentives. The growth is further backed by its wide range of products, strong manufacturing experience, strategic backward integration, and branding position. Keeping a note of all these positive factors, Lakewater Advisors concludes to be bullish regarding Polycab.

References

https://trendlyne.com/research-reports/post/POLYCAB/139599/polycab-india-ltd/

https://polycab.com/wp-content/uploads/2020/06/Polycab-India-Ltd-AR-2019-20.pdf