HIGHLIGHTS

-

- Avanti has reported a year-on-year (YoY) increase of 1.01% in consolidated revenue and a significant YoY increase of 27.9% in consolidated profit after tax (PAT) figures for the fiscal year 2022-2023.

-

- With 6 manufacturing units and a collective production capacity of 775,000 metric tons (MT), Avanti is India’s largest shrimp feed producer. Furthermore, the company boasts an impressive market share ranging from 48% to 50% in the domestic feed business.

-

- India accounts for 79% of its revenues, followed by the USA (18%) and the rest (3%).

- There has been a notable correction in the prices of fish meal and soybean, leading to a consistent improvement in profit margins over the past four quarters. Gross margin expanded 594 bps YoY and stood at 23.9% in Q4 of FY 22-23- The highest gross margin in the past 21 quarters.

INDUSTRY OUTLOOK

By 2050, the world population will reach 9.8 billion, leading to a significant strain on the already limited food resources. Hence, the Fisheries and Aquaculture sector plays a vital role in meeting the growing demand for protein globally. The global shrimp market is projected to reach USD 84.2 billion by 2027 from USD 62.8 billion in 2021, exhibiting a CAGR of 4.8%.

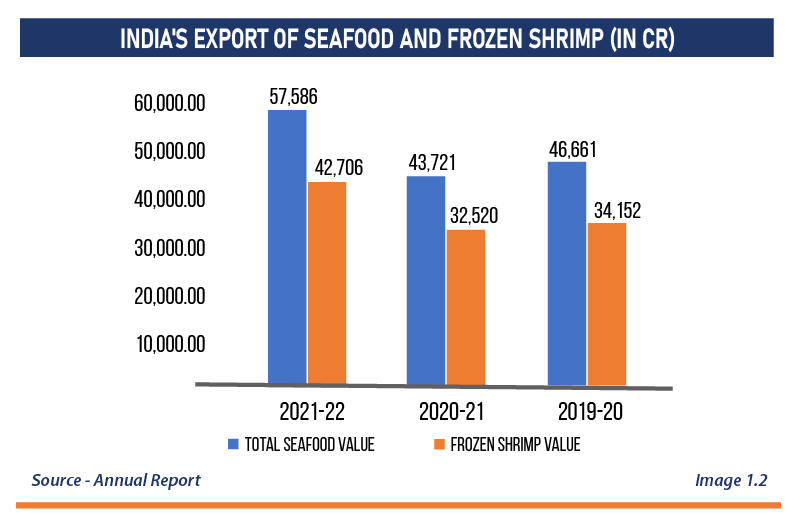

The Indian government proactively promoted aquaculture industry growth by introducing several incentive schemes to foster its development. One such initiative launched by the government is the ‘Pradhan Mantri Matsya Sampada Yojana’, with a planned investment of Rs. 20,050 crores. The Ministry of Commerce, Government of India, and MPEDA have drawn up a plan to achieve marine products export of Rs. 1 lakh crore by 2025, demonstrating the intent and seriousness to grow the sector. Frozen shrimp remains the major export item among the list of seafood, accounting for a whopping 67.72% of the USD earnings of the industry. The industry experts at the 2022 Global Seafood Alliance GOAL Conference also have shared their optimistic long-term view about growth in the aquaculture industry.

This along with the limitation of food resources, Avanti Feeds plays a crucial role in addressing this escalating global demand for shrimp by being an essential cog in the entire supply chain as it is a significant shrimp feed producer as well as a raw shrimp, cooked shrimp, and value-added shrimp producer.

Waterbase Ltd. and Coastal Corporation Ltd are Avanti’s closest listed competitors. Avanti has been showcasing immense strength and capability to withstand pressure from them and maintain its lion’s market share. Avanti has since long concentrated on constantly expanding its manufacturing capabilities and strengthening its supply chain to remain clear of any competition threat. Avanti Feeds has all the capabilities in its arsenal to extend its leadership in the sector further and reap the benefits of the good times coming in the sector.

BUSINESS DESCRIPTION

Headquartered in Hyderabad (Telangana), Avanti Feeds Ltd (Avanti) was founded in 1993 by renowned industrialist Late Sri Alluri Venkateswara Rao. Avanti Feeds Ltd. is an integrated seafood company offering end-to-end solutions in the aquaculture industry. It encompasses the entire spectrum of Shrimp culture, namely Shrimp Feed, Shrimp Hatchery, Shrimp Processing, and Power generation to shrimp farms. The company manufactures and markets prawns, shrimp, scampi, and fish feed. Avanti’s shrimp processing & export product portfolio includes raw Shrimps, cooked Shrimps, and value-added Shrimps like skewers, marinated products, and Shrimps rings. Nationally, the company markets shrimp feeds in Andhra Pradesh, Tamil Nadu, Gujarat, West Bengal, Odisha, Maharashtra, Karnataka, and Goa. Globally, Avanti has a business presence in Europe, Japan, Australia, China, the US, and the Middle East.

FINANCIAL ANALYSIS

Avanti Feeds Ltd.’s financial performance over the previous years is summarized in the table.

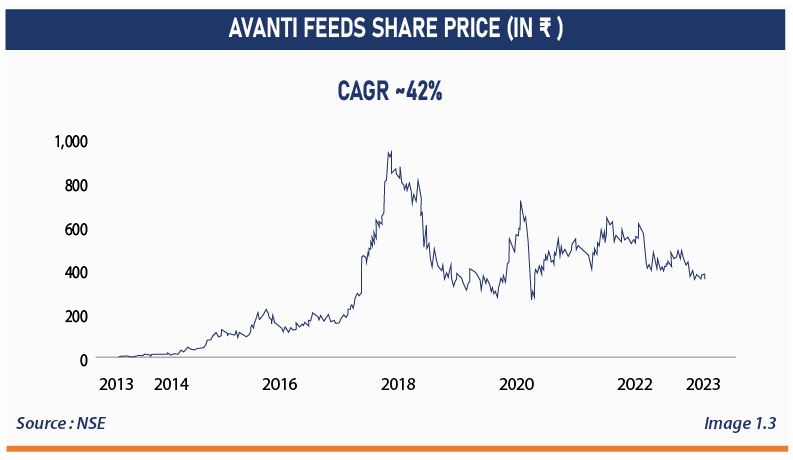

Despite facing incessant challenges such as the Covid-19 pandemic, the prolonged war between Russia and Ukraine, and high inflation rates, the company has achieved robust revenue growth at a brisk compound annual growth rate (CAGR) of 7.9% over the past five years. Moreover, the company experienced a notable 27.3% increase in profit after tax (PAT) in the last year, and the profit margins appear to be stabilizing. The expected cooling down of input costs, which account for over 85% of the total cost, is anticipated to be a significant factor in improving the company’s margins in the upcoming quarters.

Although there was an 8% decline in shrimp feed sales volumes in FY 22-23,

Avanti Feeds expanded its feed business into international markets, particularly Bangladesh, which has the potential to become a significant contributor to future feed sales. While Avanti Frozen Food, which sells high-margin value-added products, faced some challenges in the current fiscal year, the future outlook remains positive as importing countries gradually recover from the economic slump and inflation eases.

Being a net debt-free company, Avanti Feeds has the flexibility to explore new markets like fish feed and pet food; it can also expand its production capabilities without adversely impacting its bottom line. The company recently added a sixth feed manufacturing facility, which began operations in December 2022. Additionally, it plans to establish a shrimp processing segment with a capacity of 7,000 metric tons by the end of FY24, positioning itself well to capture market demand as it recovers.

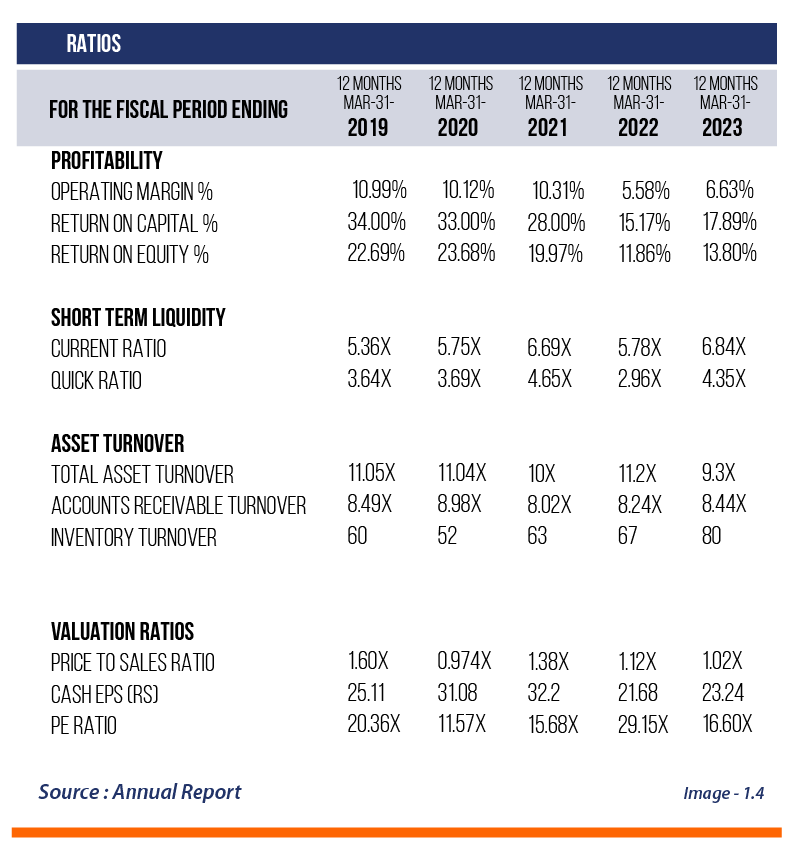

Significant improvement in cash flow from operating activities is observed, with a shift from Rs. (212) crore in FY 21-22 to Rs. 451 crore in FY 22-23. This improvement is driven by better trade receivable realization and inventory management, indicating a thriving core business and further confirming its viability. Short-term liquidity ratios indicate the company’s ability to smoothly fund the working capital requirement. Increasing the Current and Quick ratio suggest that Avanti stands strong in paying off its current liabilities.

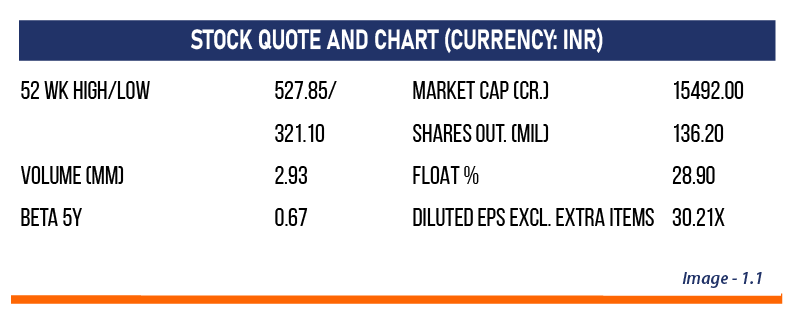

The unchanged promoter holding and zero promoter pledge provide additional assurance to investors. Furthermore, the present price-to-earnings (PE) ratio of 16.6 times is below the 5-year average of 19.9 times, offering investors a reasonable margin of safety.

CURRENT DEVELOPMENTS AND FUTURE EXPECTIONS

Business – Avanti Feeds is a prominent player in the aquaculture industry,

specializing in producing high-quality shrimp feeds, hatchery services, and

seafood processing. Their commitment to sustainability is evident as they are actively involved in the sustainable energy sector. The company offers various nutritious feeds, including popular products like Manamei, Prostar, Profeed, and Titan. Fishmeal plays a crucial role in their aquaculture feeds, providing a high-quality source of protein essential for the growth and health of farmed fish. This has led to a surge in Fishmeal exports from India over the last 8 to 10 months, driven by increased demand from countries like China, Taiwan, and Vietnam. With India’s annual Fishmeal production at around 3.75-4 lakh MT and the shrimp industry consuming 3 lakhs MT per annum (75-80%), Avanti Feeds remains a key contributor to the global seafood market

The company’s subsidiary, Avanti Frozen Foods Private Ltd, established in

2015, has been pivotal in delivering top-notch seafood products to global

markets. Notably, the USA and China are major importers of Indian seafood,

with frozen shrimp being a significant export item, constituting a remarkable

40.98% of the total exported quantity during the fiscal year. Avanti Feeds

boasts an advanced hatchery division in Andhra Pradesh with an impressive

capacity of 600 million post-larvae shrimp seeds. Their recent performance

has been commendable, with the PBT (Before Exceptional item) for the

Shrimp Processing Division (Q4FY23) increasing from Rs. 30 crores in Q3FY23

to Rs. 38 crores, mainly attributed to reduced ocean freight charges and an

increase in average USD/INR conversion rate by Rs. 1.52/$.

Beyond their business success, Avanti Feeds remains deeply committed to

promoting sustainable aquaculture practices. They actively encourage

farmers to diversify their activities beyond shrimp culture, exploring various

non-shrimp culture regions across India. With their holistic approach to aquaculture and dedication to quality, Avanti Feeds plays a vital role in the industry’s growth and development.

Financials and Future Expectations – The Company registered a decent performance despite the downturn faced by the sector in FY 22-23. EBITDA margin for the year was 9.09%, a healthy recovery of 30% from last year. The primary reason for better margin is the softening of two input materials like wheat flour and soybean meal prices. If the fishmeal prices are correct in the coming quarters, we will see margin expansion and a possible rerating of the

company. During the latest investor’s call, the management gave guidance

on better results starting from FY 24-25. With China importing more and

expanding into markets like Korea and Japan, the future looks suitable for the company as it will have an outstanding balance between domestic and

international demand.

In 2022, the Indian aquaculture market demonstrated substantial growth,

reaching a size of 12.4 million tonnes. Market analysts project a steady and

robust average compound annual growth rate (CAGR) of over 8% from 2023

to 2028, which is expected to propel the market to a size of 20 million tonnes

by 2028. The Pradhan Mantri Matsya Sampada Yojana (PMMSY), a flagship

program with a substantial investment of Rs. 20.05k crores (equivalent to USD 2.46 billion), aims to foster the growth and expansion of the fisheries sector in India. As the company is exploring the fish feed industry as its next venture, we expect the company to have good growth prospects and expand its market. As per the management, the fish feed sales volume is way higher than shrimp feed, but the sector still needs to be more organized.

Recent Events – In the fiscal year 2022-23, Avanti achieved a significant milestone by successfully entering the Bangladesh market. Before this, the

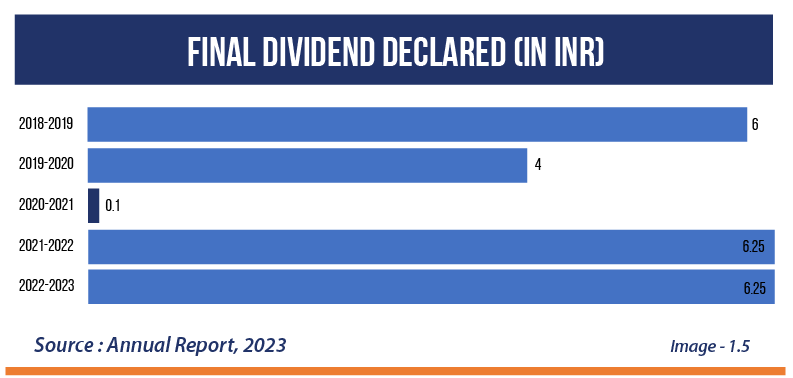

company had already established a strong presence in Europe, Asia, USA, and Canada. The Company declared a dividend of Rs.6.25 per share for FY 2022-23, resulting in a cash outflow of Rs. 8515.35 lakhs. This dividend payout represents 42.74% of the standalone profits of the company.

Avanti is also expanding its Shrimp Processing plants to consolidate its pole

position further–

1. The pre-processing facility in Gopalapuram commenced its operations on

31st March 2023 with a capacity of 6000MT p.a.

2. A new processing plant and cold storage unit in East Godavari District with

7000MT p.a. capacity is expected to begin operations by March 2024.

The company had to recall some of its consignments of cooked shrimp

products from the USA market because of contamination, but it has settled

approximately 91% of those claims. Since Oct 2022, USFDA has removed the

cooked shrimps produced and exported by Avanti Frozen from the import

alert list. This will likely increase the confidence of importers in the USA,

leading to higher sales

Furthermore, Avanti has received an incentive of Rs. 6.85 crores under the PLI

scheme from the Govt. of India. The company also received approval for

Grant-in-Aid for the proposed investment in the New Shrimp Processing

Plant from the GOI.

Strengths –

-

- Avanti is the pioneer in the Indian Shrimp industry and has been in the business for more than 3 decades. It gives it enough experience to manoeuvre its way through tricky times.

-

- Avanti has a fruitful and long-term collaboration with the Thai Union, a stalwart in the Global Seafood Industry, which helps it bring global best practices and technological advancements into India. This has resulted in a solid customer base of loyal farmers.

-

- Improving ROCE signals better utilization of capital in the last 2 years

-

- The company’s management is aware of the benefits of diversification and is indulged extensively in exploring the fish feed and pet food industries. Both these industries can potentially be the company’s future growth engine

-

- Two of the green flags for the company include being net debt-free and having zero promoter pledges.

CONCLUSION

The Shrimp feed and processing industry is going through a consolidation

phase currently, With the expectations of India’s economy growing at the

fastest stage and the world’s major economies recovering from all the recent developments, the industry will also increase. Avanti is excellently positioned to take benefit of the same as it has more than 50% share in the Indian market and great relations in foreign markets. It has a proven track record and is the safest bet in the industry. The management’s decision to be a net debt-free company with cash and other investments sitting on its balance sheet of approximately Rs. 1000 crores is an additional confidence booster for all the stakeholders. The management is currently focused on market growth, expansion, and diversification. Health experts are now promoting seafood as a healthier alternative to red meat, With the rising purchasing power of the middle class in India, the shrimp market’s potential is expected to increase. Hence, Avanti is an exciting player to follow in an unconventional industry.