HIGHLIGHTS

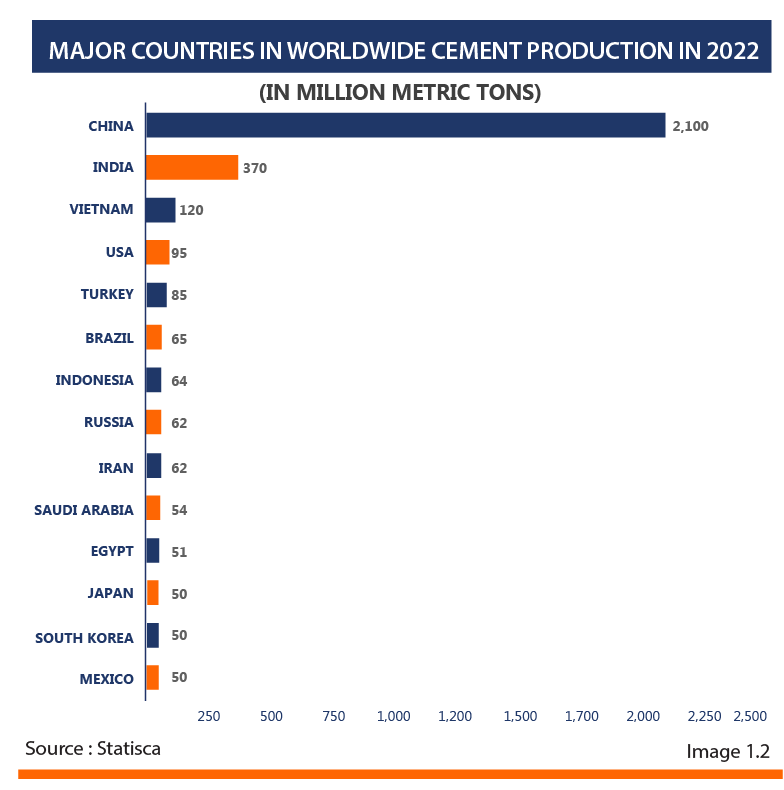

- India produced more than 7% of the world’s installed capacity for cement production, qualifying it as the second largest manufacturer on earth. The private sector carries 98% of the total capacity, while the governmental sector holds the balance of 2%.

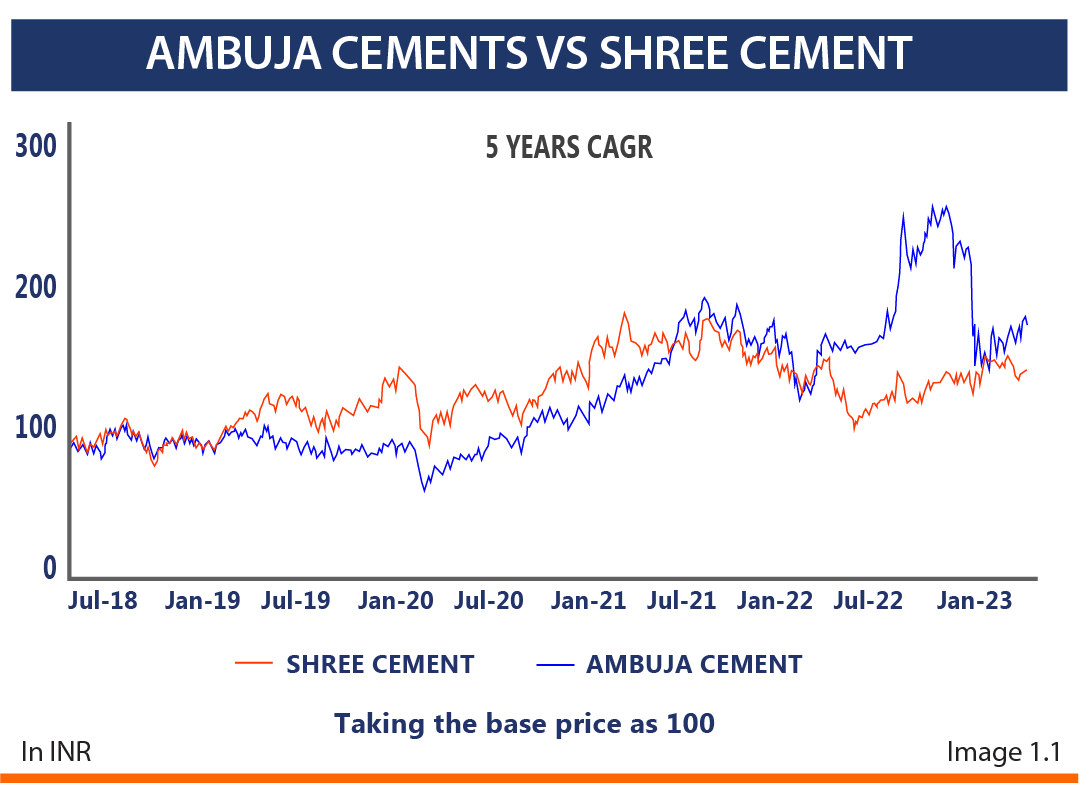

- Shree Cement was better in terms of share price returns for a stretch of few years till mid 2021 but off late, Ambuja Cement has surpassed the performance and generated high investor returns over the last couple of years.

- Q3FY23, for both the companies, Ambuja Cements’ financial performance improved sharply due to improved operational efficiencies through group synergies, while that of Shree Cement was stagnant and it even recorded higher depreciation charge. ACC-Ambuja group was form just in September of last year, hence, there must be lots of synergy left to explore.

CEMENT INDUSTRY

India produced more than 7% of the world’s installed capacity for cement

production, qualifying it as the second largest manufacturer on earth. The

private sector carries 98% of the total capacity, while the governmental sector holds the balance of 2%. Near 70% of India’s total cement production is represented by the top 20 manufacturers. India has substantial limestone mines of outstanding quality and quantity that offer the cement sector significant adaptions. By 2022 India has established an installed capacity of 553 MTPA. In the next ten years, India might leapfrog China as the world’s leading clinker and grey cement exporter to the Middle East, Africa, and other developing economies.

Cement operations close to ports, such as the ones in Gujarat and Visakhapatnam, will profit from an export advantage and be logistically well-prepared to compete with cement mills in the country’s interior. By 2025, 550 MT of cement is anticipated to be produced in India. By FY 2027, India’s cement demand is forecasted to reach 419.92 MT, driven by skyrocketing needs from several sectors, including housing, commercial development, and industrial construction.

The major players in the Indian market include companies like Ultratech,

Ambuja, ACC, Shree Cement, etc.

This report focuses on two of the key strategic players. First, the global

economy is coming out of the grip of recessionary fears. Second, investment in infrastructure is expected to increase from here onwards. This is an excellent opportunity for the cement sector. Hence, the report.

AMBUJA CEMENT

One of the foremost cement manufacturers in India, Ambuja Cements Ltd.

(ACL), commenced cement production in 1986. Initially known as Gujarat

Ambuja Cements Ltd, the company later changed its name to Ambuja

Cements Ltd. In 2006, there was a corporate collaboration with Holcim, the

second-largest cement producer in the world. Holcim controlled a 61.62%

controlling share in Ambuja Cements from 2010 till 2022. For INR 21.4 billion,

Holcim acquired a 14.8% promoters’ share in GACL. Subsequently, in 2022,

Adani Group paid US$10.5 billion to purchase Holcim’s share in Ambuja

Cements and ACC.

AMBUJA CEMENT GROWTH STRATEGY

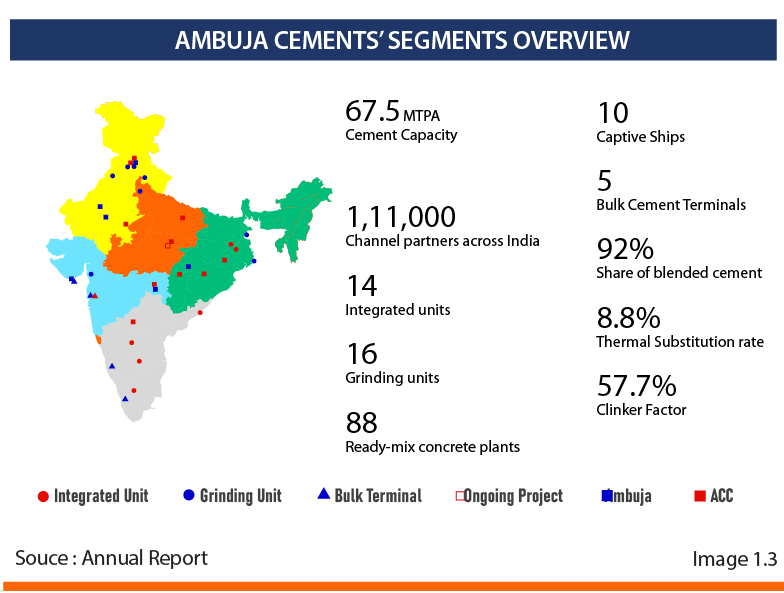

After coming into the folds of Adani Group, Ambuja Cement has taken a

conscious call to include three levers as part of its growth strategy. This

includes (a) doubling the plant capacity, (2) becoming a low cost player by

reducing the operating cost and (c) enhancing the marketing and branding

strategy

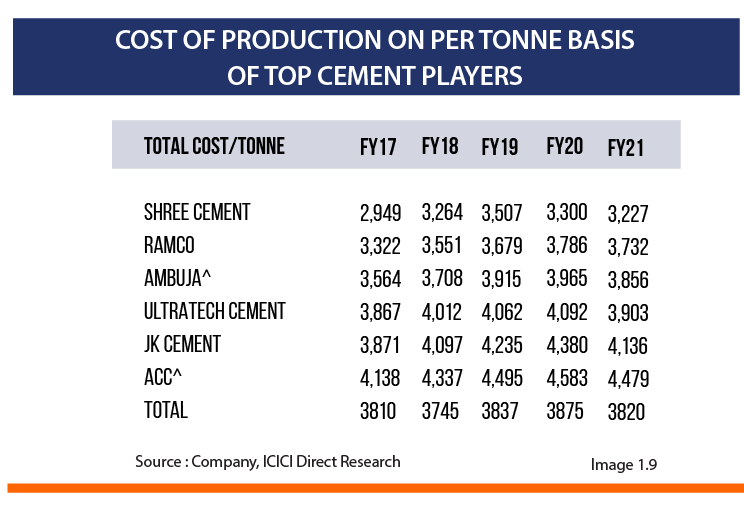

- The company is concentrating on reducing costs through operational efficiency, which includes optimizing sourcing through successful negotiations, managing the supply chain effectively, and increasing the use of alternative fuel resources. This resulted in a reduction of 5% of total cost per tonne supported by logistical efficiencies, enhancing network efficiency, concentrating on receivables management to drive cash generation, and initiatives to optimize inventory. The target reduction is to the tune of Rs.300-400 cost reduction per tonne.

- Ambuja Cement’s mid to long-term priorities include expanding production

capacity and sales, introducing a new value-added product in the blended cement category, focusing on cost optimization across production and logistics, and launching a waste heat recovery system to reduce power and fuel costs. The management unveiled the plans for a 12 million capacity spread across seven locations in its latest quarterly financial presentation.

- In terms of marketing and branding exercise, the management plans to redefine the catchment areas for better market reach. After a prolonged survey, 10 growth states have been identified where the Company will work to become the number one or number two player. By 2027, the Company plans to increase the B2B share from the existing 21% to about 25% because this segment is growing faster than the trade segment.

Since Cement has a considerable environmental impact, Ambuja Cement is taking conscious calls on the ESG front by introducing greener products in its Ready mix Portfolio, including products like ACC Aeromax, ACC Ecomax, and ACC CoolClean. All these will help the Company to enhance its EBITDA margin to about 25%, which has been constant at about 19% over the last three years.

SHREE CEMENT

In 1979, Shree Cement, an Indian cement manufacturer, was established in Beawar, Rajasthan. It is one of the largest industrial manufacturers in Northern India having its contemporary headquarters in Kolkata. With a combined capacity of 43.3 MT in India and 50.4 MT internationally, Shree Cement has increased in just over 20 years from having a 2 million tonne (MT) industrial capacity to becoming the third biggest cement manufacturing company in the nation. Shree Power (Captive Power Plant) and Shree Mega Power are several other names for the power it manufactures and sells (Independent Power Plant). Its manufacturing capacity has more than doubled since 2006 as a response to both new land expansion and increased plant capacity.

SHREE CEMENT GROWTH STRATEGIES

The Company is working with the strategy to achieve volume growth and

concentrate on improving the realizations as well as margin. Lower costs on

account of logistics and improved share in premium products is expected to

drive the EBITDA to 20% levels.

Shree Cements intends to invest Rs.4,750 crore in increasing its capacity across several products and establishing a captive solar facility. A total of Rs.4,750 crore would be spent on improving cement capacity, Rs.500 crore on establishing a cutting-edge solar power plant, and Rs.700 crore on increasing clinker production capacity. By 2030, the Company has envisioned to have 80 million tons capacity.

The integrated cement mill will be constructed in Rajasthan’s Nawalgarh. The $3,500 billion commitment will go towards increasing the capacity of cement to 3.50 million tonnes annually (MTPA). This is more expensive than its existing capital cost on average. At the moment, Shree Cements is operating at 67% of its complete 43.40 MTPA cement capacity. The facility would also have a 3.80 MTPA clinker capacity. It is estimated that the factory will be operational by the end of the fiscal year 2023–2024. Moreover, Shree Cements East Private Limited will establish a clinker grinding mill in the Purulia area of West Bengal in order to take advantage of the enormous demand-supply mismatch in East India.

In line with the industry progress, Shree Cement too is doing its bit to reduce the carbon footprints. As of 2023, the percentage of green power as compared to total power consumption increased to about 50%. The Company has added about 84 MW of solar power plants in different states during the current financial year and targets to add additional 42 MW over the next few months.

AMBUJA CEMENTS VS SHREE CEMENT

of growth and profitability. Recently, the stocks of both Companies witnessed

a bull run even though the overall market was wobbly.

Shree Cement was better in terms of share price returns for a stretch of few

If we talk about the Q3FY23, for both the companies, Ambuja Cements’ financial performance improved sharply due to improved operational efficiencies through group synergies, while that of Shree Cement was stagnant and it even recorded higher depreciation charge. ACC Ambuja group was form just in September of last year, hence, there must be lots of synergy left to explore. And if we talk about the March Quarter, 2023, Ambuja recorded a marginal rise in net profit at Rs. 502 crore compared to Rs 494 in a year ago period; while Shree Cement reported a 15% dip YoY in net profit at Rs 546 crore as compared to March quarter of last year with Rs. 645 crore. Further, Ambuja’s has strong resence in Pan-India, and that of Shree Cement is in north & east.

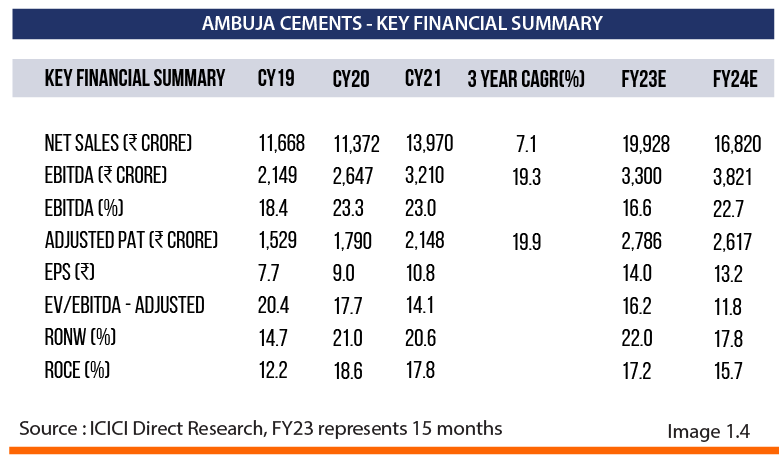

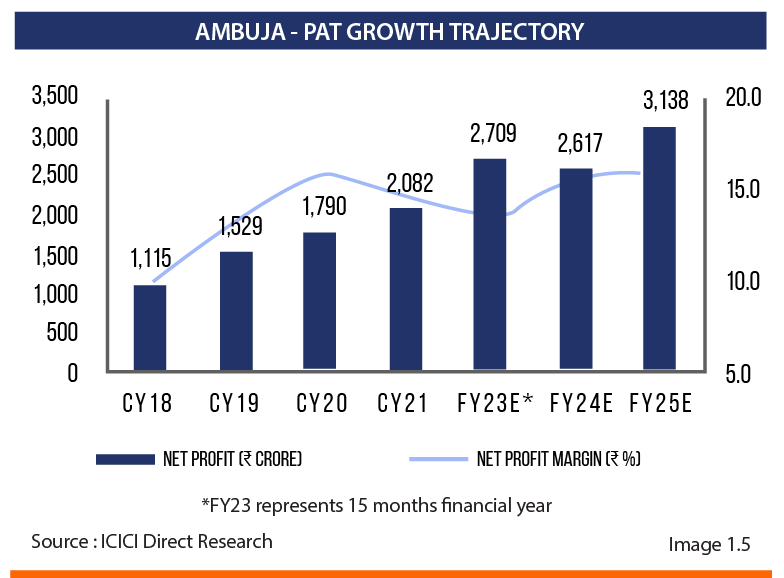

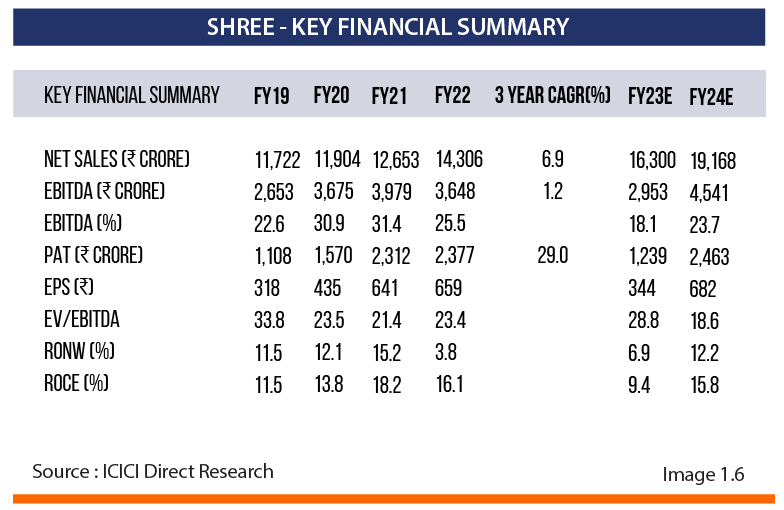

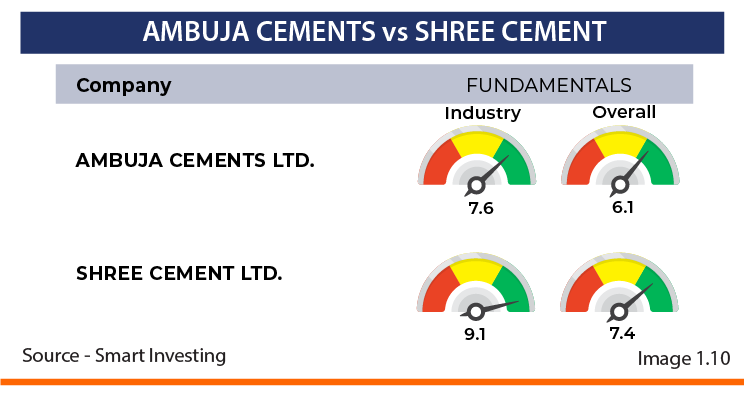

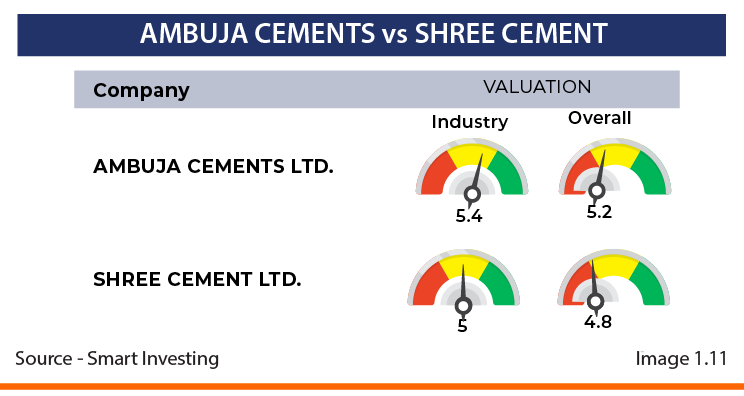

As seen in the Image 1.10 & 1.11, while the fundamentals for both companies are strong on an overall basis but in terms of valuation, Ambuja is currently available at a more attractive valuation. In terms of PE ratio, the ratio of Ambuja Cement is 34.22 and the PE ratio of Shree Cement is 65.94, which indicates that Ambuja cement is available at an attractive valuation to its EPS. Further, in terms of EV/EBITDA as well, the EV/EBITDA ratio of Ambuja cement is 14.06 and Shree cement is 21.93, indicating Ambuja to be better priced for going long. The leverage as represented by Debt to Equity ratio is also favourable for Ambuja. While both companies have low leverage levels but as of year ended 2022, Shree Cement had Debt to Equity ratio of 12.2% as against 1.3% for Ambuja. Other critical ratios like interest coverage, inventory turnover and cash conversion cycle are also in favour of Ambuja as of Dec 2022.

Both Ambuja as well as Shree Cement are good bet for long term investment. However, the subsequent analysis shows that if the investors prefer to limit the exposure to cement sector and wants to choose one, the report has an inclination towards Ambuja Cement, especially post Adani takeover.

RECOMMENDATIONS

Ambuja Cement currently has an Earnings Rating of 8 which is significantly

more bullish than the construction material industry average of 5.6 (Smart

Investing). This is against the Earnings Rating of 2 for Shree Cement. The

Company has displayed strong fundamentals like high profit margins,

growing dividends and lower debt levels. The EPS too have closed considerable improvement lately.

The price to sales ratio of Ambuja is also hovering near 5 year average which

indicates a good buying opportunity. As against this, Shree Cement currently

have multiples which are significantly above the market as well as stock’s

historical norms.