HIGHLIGHTS

- Adani Ports & SEZ Ltd. (APSEZL) is one of the most profitable port operators globally, with 70% port EBIDTA margins for FY 22-23. It is ranked 4th among 45 companies in the marine port sector globally.

- The Company’s market share has grown from 1% in FY02 to 24% in FY23.

Mundra port, operated by the Company, is the largest commercial port in India in terms of volume handled in FY 23. - The Company has given a FY 24 forecast of Rs. 24,000-25,000 crore for revenue with a capex outlay of Rs. 4,000-4,500 crore. The management aims to drive growth through better capacity utilization and increasing efficiency.

- The company faced limited near-term impact on the cost of capital due to the Hindenburg Short Selling Report.

INDUSTRY OUTLOOK

India’s logistics sector is at the cusp of a significant regime change. With the

advent of the China+1 strategy, even a nominal procurement shift from China to India will drive up India’s share of exports and global trade. One of the direct beneficiaries of the said scenario would be logistics providers. According to the Ministry of Shipping, around 95% of India’s external trading by volume and 70% by value are handled by ports in India. By implementing favorable policies, The Government of India is supporting the ports sector. De-licensing and 10-year tax holidays to enterprises engaged in developing, maintaining, and operating ports, inland waterways, and ports are excellent initiatives.

Indian external trade is on a steady growth trajectory clocking US$ 685 billion

in FY 21 to US$ 1028 billion in FY 22, and until Sept 2022, it reached $ 612.22

billion. India has negotiated Free Trade Agreement with Australia, and the

landmark CEPA with UAE, which could increase non-oil merchandise trade to

US$ 100 billion over the next 5 years. It is also in talks with the UK, which could

double the bilateral trade by 2030.

As per the studies conducted under the Sagarmala Programme, cargo traffic

is expected to be approximately 2500 MMTPA by 2025, while the existing port

capacity is 1500 MMTPA. As and when India grows into a US$ 5 trillion

economy, cargo throughput is likely to double from 2021-22 levels. Almost 30% of the nation’s export and import cargo is transshipped via foreign hubs,

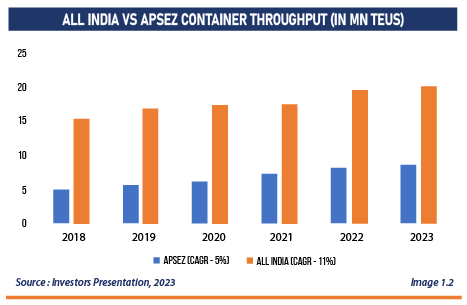

which will change in the coming times as India’s ports become more extensive & can accept larger vessels. A comparison of cargo and container throughput of APSEZL and All India level is shown in image 1.2.

Adani Ports and Gujarat Pipavav Port Ltd are the top players in this space.

However, even though the latter is the closest competitor, it is just approximately 1/20th of the Adani Port’s revenue size. The mismatch signifies the gap and strong management qualities of APSEZL.

BUSINESS DESCRIPTION

Founded in 1998, and headquartered in Ahmedabad, Gujarat, India, Adani

Ports and SEZ Limited, is a growth-driven and world-class transport and

logistics company. It has a well-diversified portfolio of 14 ports across the

coastline. It is India’s most significant integrated logistics player, with assets

comprising 87 trains, 9 multi-modal logistics parks, and 1.5 million sq. feet of

warehousing facilities. The SEZ unit has 12,000 ha of a land bank at 3 locations. The company is positioning itself to emerge as the world’s largest port company and India’s largest transport utility by 2030, with strategic assets across the globe offering customer-centric integrated logistics services.

FINANCIAL ANALYSIS

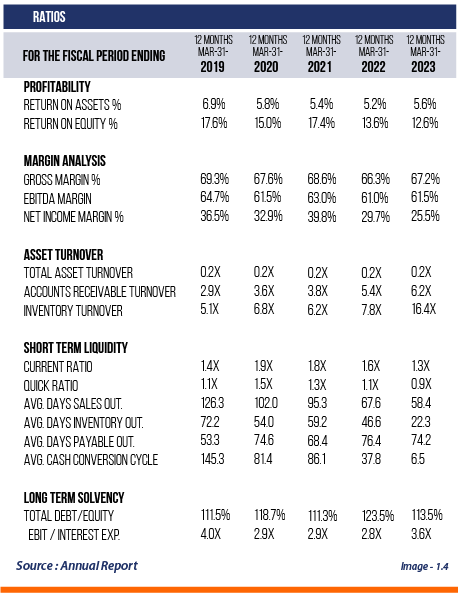

A brief overview of Adani Ports & Special Economic Zone’s financial performance during the previous five years is shown in image 1.4.

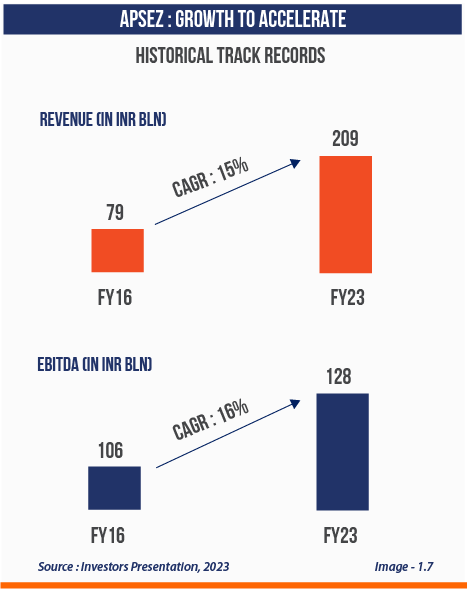

The absolute profit level, and the company’s turnover has been increasing

gradually over the last five years. The revenue and EBITDA have grown at a

CAGR of close to 16 to 18% in the last five years. The financial year 2023 was

good in terms of operational and financial performance for the company.

Consolidation of Haifa port numbers & higher volume growth of 11%, contributed to a better top line. APSEZL has not only crossed its highest-ever revenue but also the EBITDA guidance provided at the beginning of the year. Geographical diversification, business model transition, and cargo mix diversification are stated to be the key reasons behind the growing top line of the company.

In 2023 the company is planning to invest about Rs 27,000 cr, including six major acquisitions and organic capex of another Rs 9,000 crore. The strength of these acquisitions or investments is that most of them have been done through the company’s internal equals, resulting from the gross debt-to-fixed asset ratio declining from a high of 80% in 2019 to about 60% in the current financial year. The company targets to achieve a Cargo volume of 500 MMT by 2025 & transform the business into a transport utility business.

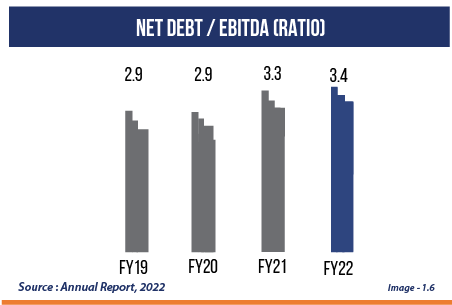

Net debt to EBITDA ratio of 3.1x is within the range of management’s guidance

of 3-3.5x, which is further expected to come down to a more comfortable 2.5x

in the next FY. During the 2nd quarter of the current FY, the company reassessed its risk management approach towards foreign currency exposure. Also, it used natural hedging, i.e., enough of future dollar-linked revenue to meet the maturity dates cash flows on debt in a FY.

Another key positive is the reduction of pledge shares which has reduced from 17.31% in December 2022 to 4.66% in March 2023; this is accompanied by the prepayment of fund-based loans undertaken by the company to a great

extent. Lower interest expenses will help boost the bottom line subsequently.

CURRENT DEVELOPMENTS AND FUTURE EXPECTATIONS

- Financials – The Company registered a stellar performance and showed strong revenue growth. APSEZL’s revenue and EBITDA have grown at a CAGR of 16-18% in the last 5-year period. The growth in cargo volume was led by coal (+19%), containers (+7%), and liquids, excluding crude (+7%). The automobile segment saw an 11% jump in volumes. The non-Mundra port volumes grew at 12% Y-o-Y while the Mundra growth rate was 3%. The share of non-Mundra

ports increased to 54% in the cargo basket from 52% in FY22.

- Business – APSEZL has a robust aggressive profile and established market position in the port sector due to the location of its assets, favorable operating characteristics, and long-term customer tie-ups. Over the years, the company has expanded its presence across the West and East Coast through port development/strategic acquisitions.

During the investor’s call, the management gave broad guidance for FY 2024 wherein the Company expects cargo volume to be 370-390 million tonnes, yielding a revenue of nearly Rs. 25,000 crores. The EBITDA is expected to be in the range of Rs.14000-15000 crores. A considerable capex has already been done and the current year’s capex is expected to moderate at about Rs. 4000 cr.

- Recent Events – The Company declared Rs. 5/share dividend for the year ending March 23, totaling a payout of Rs.1080 crore.Some key stake purchases during the year include –

· Haifa Port Company- Operator of Israel’s largest port

· Ocean Sparkle- India’s leading third-party marine service provider

· Gangavaram Port- India’s third largest non-major port· Indian Oiltanking Limited- One of India’s large third-party liquid tank storage players· ICD Tumb- One of India’s largest ICD

· Karaikal Port- A deep-sea all-weather port

During the year, the Company won 5 bids- 2 in the port business, including mechanisation of 4MMT berth at Haldia dock complex and Greenfield construction of Tajpur Port at West Bengal, and 3 in the logistics business. The investments in these 5 bids will enable the Company to achieve its ambitious, targeted cargo volume of 500 million metric tons in 2025.

The shares pledged have decreased from 17% to 4% in FY 23, and the promoters plan to move towards zero pledges in a year or so.

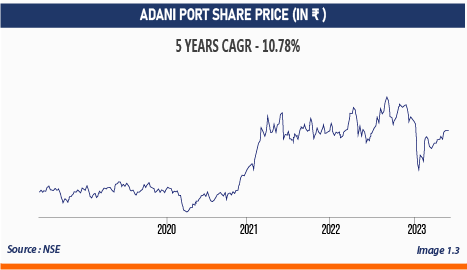

The Company came under a bit of pressure after the Hindenburg report, but it has regained the prices prevalent before the report showcasing its innate strength and investor confidence.

- Strength –

· The company is planning to become carbon-neutral by 2025.

· Sticky cargo constitutes ~54% of total cargo with a higher base. 71%

of Mundra Port’s cargo continues to remain sticky in nature which

ensures resilience.

· APSEZL volumes have grown at a CAGR of 25% which is 4 times thegrowth of Industry volumes at 6% and the trend is expected to continue.

· Its market capitalization has outperformed the growth of the BSE

Sensitive Index since 2010 by ~2x.· ROCE of matured ports like Mundra, Dahej, etc. is continuously

improving and operational ramp-up in the recently acquired ports

will consequently drive the respective port’s ROCE to 20% levels.· ROCE of logistics business at 6% has doubled in FY 23 compared to

FY 22 which illustrates the growth potential in that segment.

CONCLUSION

APSEZL aims to increase the utilization of non-Mundra ports within its operations, seeking to diversify its logistics activities. The Company has strategically engaged in long-term customer contracts to optimize cargo monitoring and management. These agreements enable APSEZL to provide door-to-door delivery or collection services, enhancing cargo visibility and streamlining logistics. This proactive approach ensures efficient operations and prioritizes customer satisfaction by offering seamless and reliable services. The entry into foreign markets will open different markets new customer base and lay down the roadmap for the Company to become a significant worldwide port player and logistic service provider. APSEZL handled close to 24% of India’s total cargo volumes. The significant market share, industry-leading metrics, and competitive advantage make it a solid choice to buy its share. The management’s near-term goal is to deleverage, providing stability and confidence to debt and equity holders. There will be a lot of opportunities in FY 27-28 when a lot of terminals are coming for expiry.