HIGHLIGHTS

- Galaxy Surfactants has a global market presence and is a supplier to more than 1400 branded organizations. The business has a good track record, adequate liquidity, and a comfortable debt matrix.

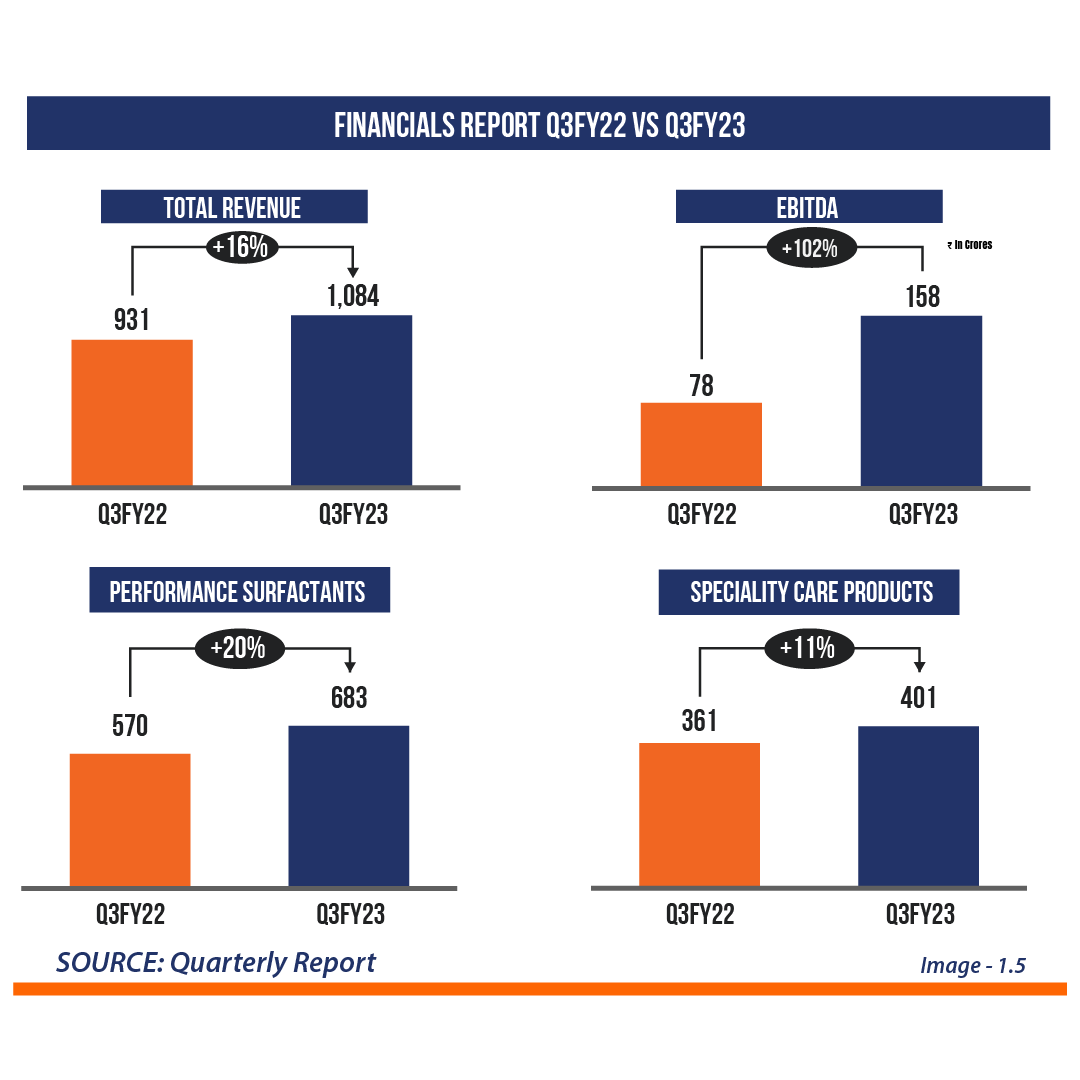

- The Company’s Q3FY23 financial results put it back on a growth track.

- The future growth narrative will be aided by an aggressive expansion strategy that includes new suppliers and cost-cutting plans, supported by a comfortable gearing level and a varied product range.

Industry Outlook

According to the KPMG survey, the Indian Speciality chemical industry is anticipated to grow by a compound annual growth rate of 12.4% between 2020 and 2025. Both national and international firms see the sector’s prospects as attractive. A considerable percentage of India’s chemical sector comprises specialty chemicals. New products contribute significantly to more than 50% of chemical exports from an economic approach. The competition level, margin profiles, responsiveness to movements in raw material prices, and future growth differ per product category within highly specialized chemicals. A vast assortment of opportunities for importing and exporting specialty chemicals has also been created by India’s impressive technique in process engineering, low-cost production, and inexpensive labor. While India intends to establish itself as a global manufacturing powerhouse, there will be some obstacles in the short term. In order to reach its goal, the nation should concentrate on factors including R&D, capital investment, acquisitions, economies of scale, and, most crucially, growing domestic demand.

While home care, hair care, oral care, skincare, cosmetics, and toiletries that include numerous speciality chemicals are marketed in both online and offline markets, the present trend indicates that the offline sector is seeing more traction.

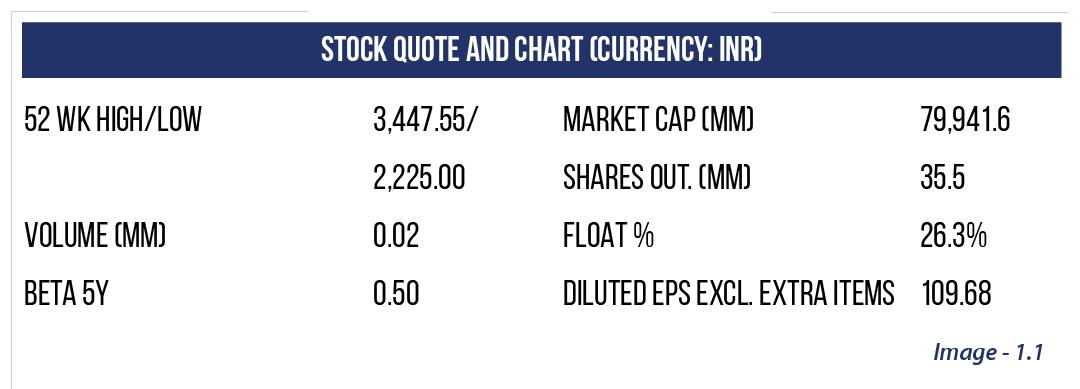

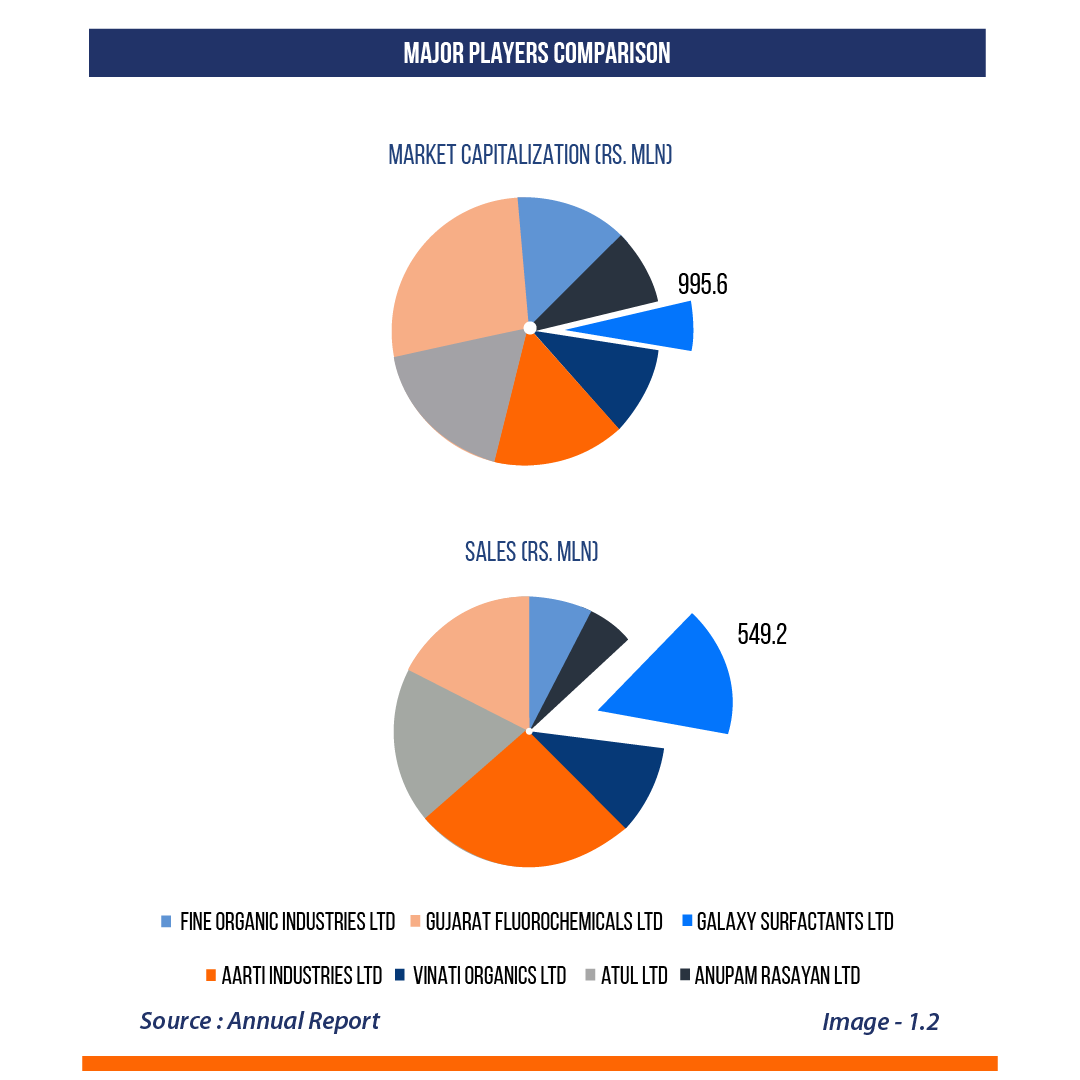

Some of the major players in this sector is shown in the image 1.2.

Business Description

Founded in 1980 and headquartered in Mumbai, Maharashtra, India, Galaxy Surfactants (Galaxy) produces speciality chemicals with a wide variety of SKUs of 200 different types in personal and home care items exported to more than 100 nations. Galaxy has partnered with about 1400 brands, including L’Oréal, Unilever, Colgate-Palmolive, Dabur, Himalaya, and others. The Company endeavors to cater to a broad category of consumers and the product profile is presented with the infographic’s help as shown in the image 1.3.

Galaxy Surfactants has offices all around the world, including India. Close to 36% of its turnover is from India, while 64% is from the rest of the world. The Company currently has 1 European patent, 21 Indian Patents, 10 US Patents, and more than 33 patents pending. The manufacturing facilities of the Company are ISO 14001 and ISO 45001 certified.

Financial Analysis

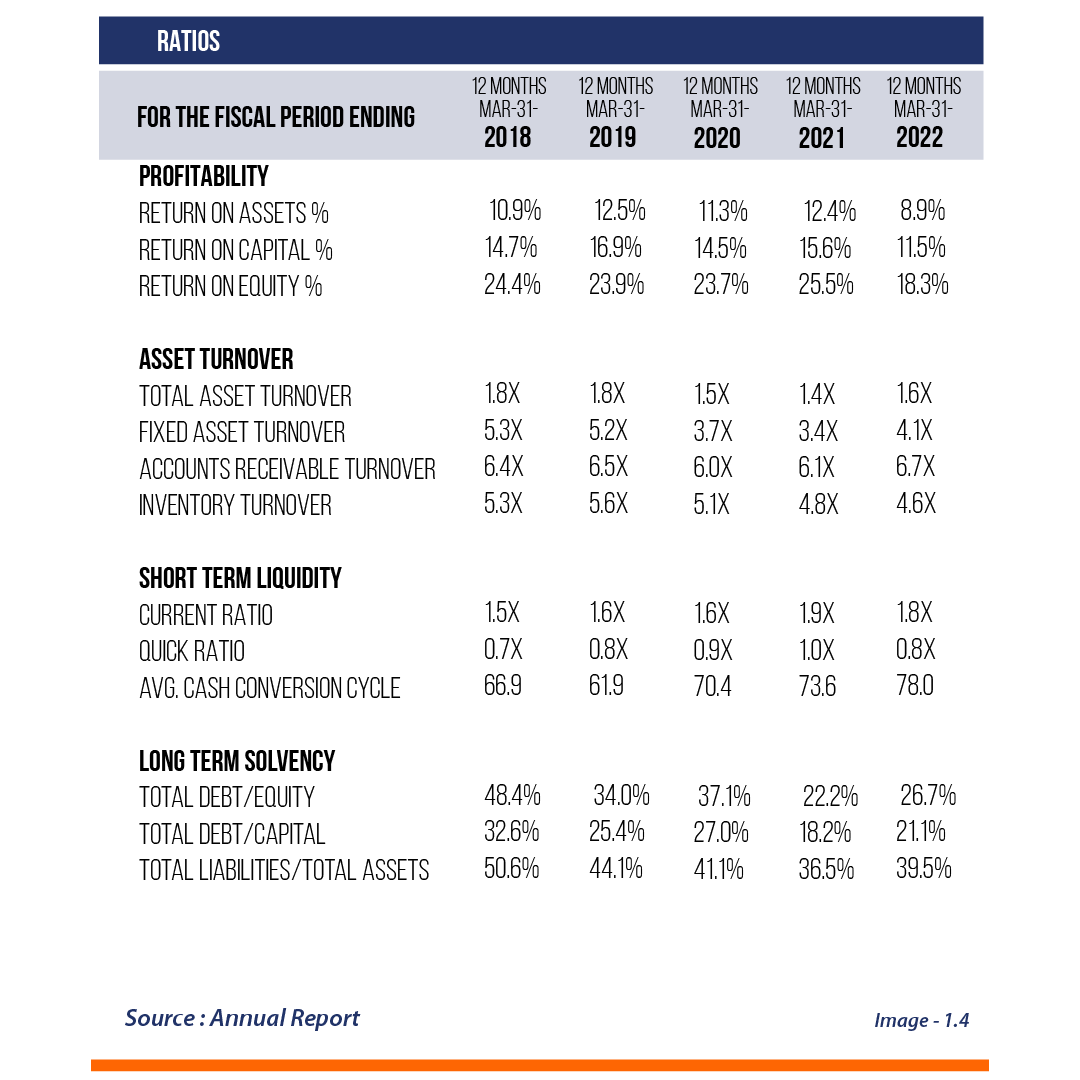

A brief overview of Galaxy Surfactant’s financial performance during the previous five years is shown in the image 1.4.

Market segments for Galaxy surfactants include those for skincare, hair care, dental care, infant care, and home care. Performance Surfactants and Specialty Care Products are two business segments, which encompasses people of any age. Till 2021, the profitability trend was in a phase of expansion. Although there is a considerable demand for the products, but due to the high production costs, supply-driven instability, rising input costs, and port congestion, their profitability didn’t scale at the same level.

From the third quarter of FY23, the growth trajectory has improved again. Regarding asset performance, the receivables turnover has shown improvement over the last three years, which indicates that the Company can realize its receivables faster. Due to the nature of business, the Company needs to keep a lot of inventory at different levels in the value chain, which leads to lower inventory turnover. Accordingly, the cash conversion cycle has marginally increased over the last few years. For the same factor, the Company’s quick ratio is relatively low even if its current ratio is higher than the benchmark value of 1.33. This demonstrates once more how a significant portion of the working capital cycle for the firm is made up of inventories.

Debt has been on the lower side for the company currently, but before the Covid-19 pandemic, debt/equity, debt/capital, and total liabilities/total assets were all on the higher side, which leads to higher interest costs and impact on profitability. However, the company had taken a conscious call to reduce the debt to the lower side and as of 2022, the debt matrix is comfortable with a gearing of 26.7%.

Current Developments and Future Expectations

Financials – The Company released its Q3FY23 results in January, registering a stellar performance and showing strong revenue growth. The total revenue grew +16% Y-o-Y, EBITDA +102% Y-o-Y, and PAT +133% Y-o-Y. The performance surfactants grew by 20% Y-o-Y and speciality care products by +11%.

The Q3 performance was higher than market consensus on account of softening of raw material cost, lower than expected other expenses, and lower tax outgo, which was offset by a higher than anticipated depreciation charge. Export incentives in Egypt to the tune of Rs 200 mln, a better product mix, and improved efficiency in sourcing have also contributed to this performance. Against the historical EBITDA/Kg of Rs. 17-19, the Company could achieve EBITDA/Kg of Rs. 26.4 during the quarter and Rs. 25 in 9MFY23.

Business – The Company focuses on five pillars of growth innovation, sustainability, safety, digitalization and technology, and people. The central perspective of Growth pillars is to boost financial performance by increasing sales through optimizing, improving operations, and improving functionality.

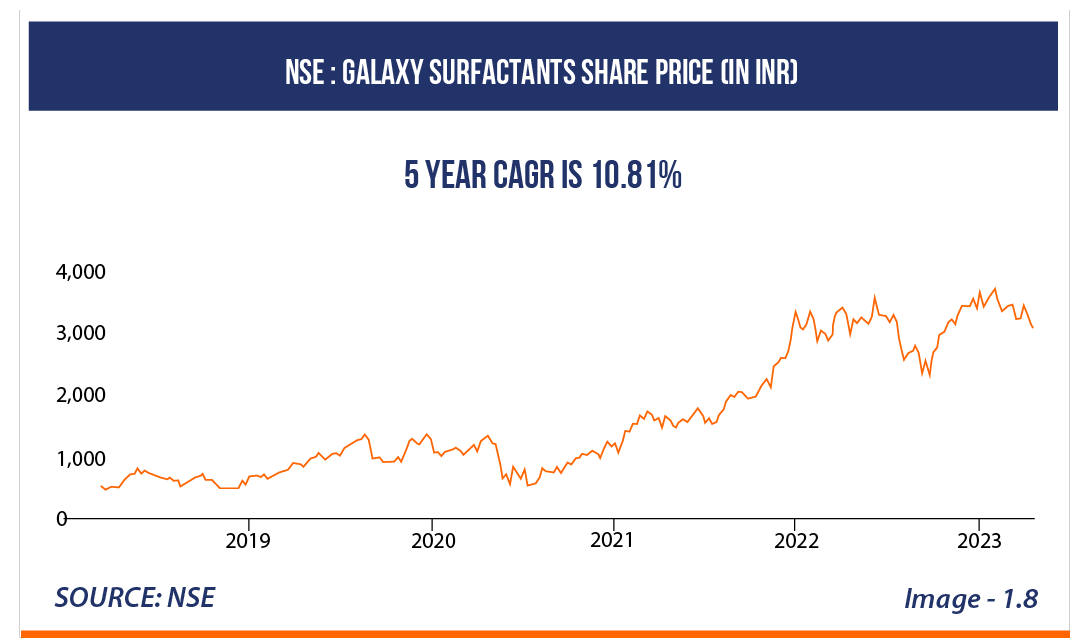

The stock has been under pressure over the last year. Still, the management has gradually shifted to more efficient sourcing of raw materials and improvement in product mix and has cashed in on the built strength of its business model to provide a stellar performance last quarter. The business continues to focus on solid R&D with an annual budget of Rs. 40-50 crs.

Recent Events – On the 20th of FEB 2023, the Company declared its Q3FY23 financials (discussed above) which announced Rs. 18/share dividend.

Organic expansion is high on the cards for the Company. The Company has applied for environmental clearance for 50 acres of land adjacent to its existing unit in Taloja and Jhagadia to take care of its expansion over the next eight-odd years. The annual capex outlay projected by the Company stands at Rs. 150-200 crores, financed by internal accruals.

Future Expectations – Given the new cutting-edge AI-based automation for production, new client base, worldwide reach, trained people, cost-reduction approaches, and new supply chain initiative, the company’s predicted growth is on the positive side, making it a solid choice to buy its share. An optimistic look is influenced by the firm’s growing earnings and expanding sales. In the short run, there is a demand cutback from Europe and AMET regions, but the management has confirmed staying its market share in any of the geographies. In contrast, the demand cutback is only temporary.

Strength and Recommendations –

- Throughout the previous three years, the company has maintained a respectable ROCE of 20.35%.

- As more than 50% of the revenue mix comes from Multinational Corporations, so there is the stickiness of the business volume which augurs in favour of the Company’s sustainability.

- EBITDA margins are relatively stable as the Company can pass on the increased raw material prices to the consumers.

- The corporation manages its cash flow well; its CFO/PAT ratio is 1.01.

- The Company’s Price to Sales is significantly below the 5-year average and is trading at a 13% discount to its peers in the chemical industry.

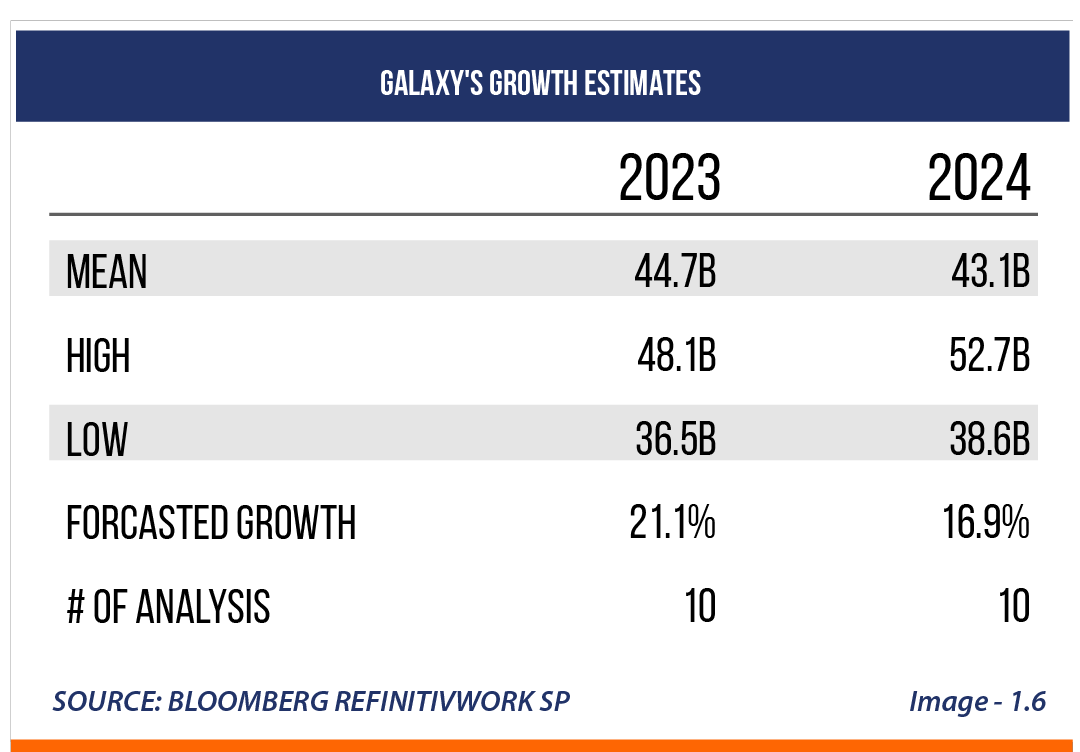

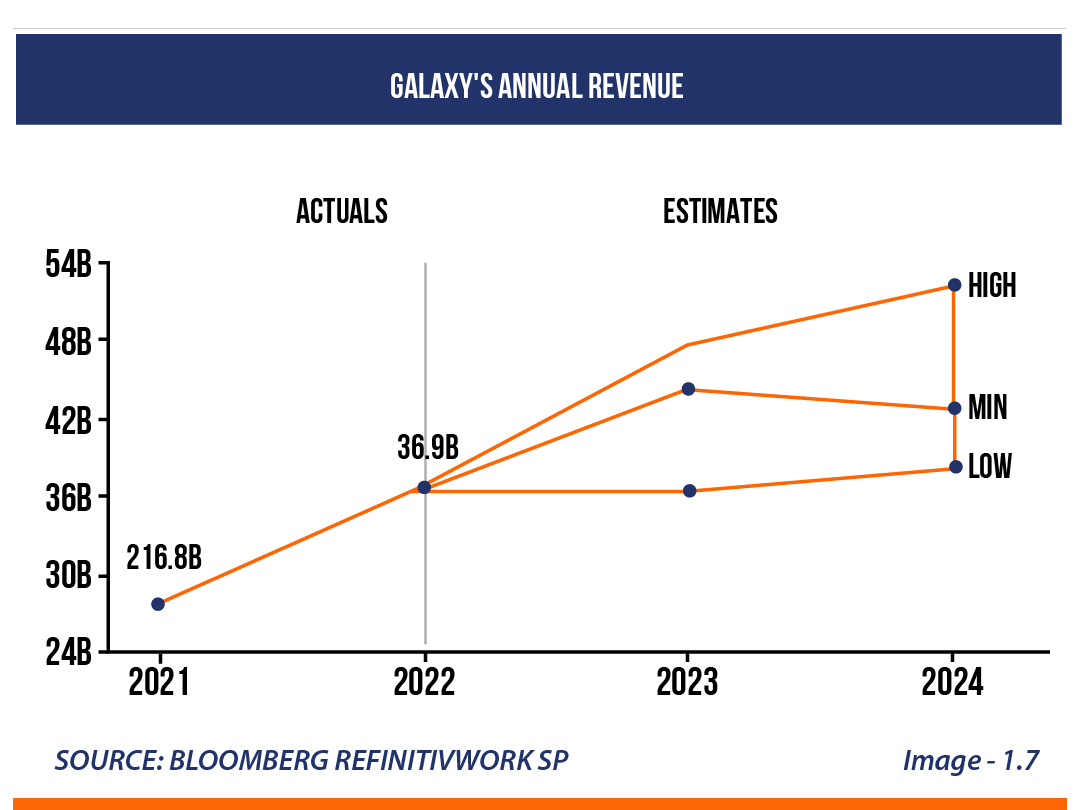

- The revenue forecast for the Company is also strong as evident from the market projections given in image 1.7.