The IPO craze in India isn’t following the typical set of rules. The new breed of listed firms has created new norms. Even loss-making companies are raising money through IPO. In fact, even promoters are gradually disappearing. This wasn’t the scenario until 2016. Given such situations, will the gains, be sustainable?

The New Wave

On 6 August, SEBI approved a shift from the concept of the “promoter” to “person in control” or “controlling shareholders”. Now, even VCs and PE firms own a stake in a new breed of firms that are mainly board-controlled and professionally managed.

Zomato\’s public shareholding was almost 100% by the time it was ready to list on the stock exchanges. Its promoter stake was virtually non-existent after many rounds of financing and dilution. Similar is the story about gaming firm Nazara Technologies and auto classifieds platform CarTrade, which also have low promoter shareholding. With companies like Paytm poised to go public in the coming months, this trend is only anticipated to accelerate. About 68% of Paytm is owned by Alibaba\’s Ant Group, SoftBank\’s Vision Fund, and SAIF Partners, while the founder of Paytm only owns 14.67%.

Oversubscription Of IPOs

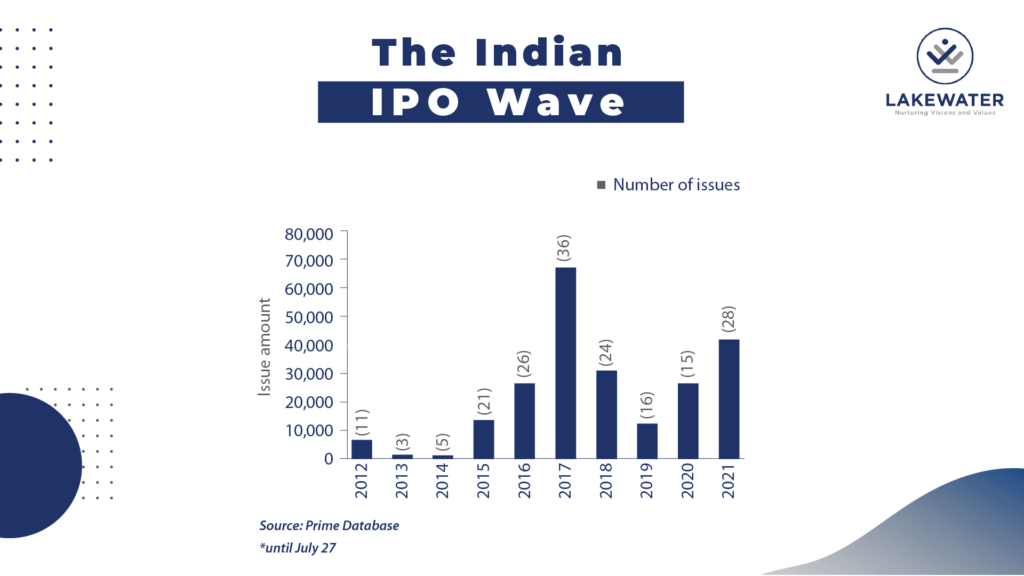

Over the last year, there have been over 50 IPOs. Most of the IPOs were heavily oversubscribed across all investor groups. The astronomical profits made on a listing day because of euphoria are fuelling a vicious cycle. According to Prime Database, oversubscription among HNI\’s has been close to 200X in the last year. Despite a quarter of the year remaining, 2021 has already proved to be the most productive year in Indian market history – both in terms of several listings and money raised. To top it all, we are in the middle of a pandemic.

India\’s IPO market is a new world. Losses do not deter firms from going public, nor do they prevent enthusiastic investors interested in a piece of the action. 6 of the 37 firms that have been listed in 2021 have been losing money. Zomato, Macrotech Developers (the Lodha Group), restaurant chain Barbeque Nation, and Devyani International, which owns Pizza Hut, KFC, and Costa Coffee in India, are prominent brands here. Six more loss-making firms, including insurance aggregator PolicyBazaar, Paytm, and budget airline GoAir, will go public in 2021.

The New Era

Oversubscriptions and profits on the first day of the listing are great; however, they do not ensure that the firm will outperform the market in the short to medium term. Recent IPOs such as Glenmark Life Sciences, Krsnaa Diagnostics, & Windlas Biotech have witnessed sluggish growth or losses on listing day. The lesson: weigh what you buy and hold carefully. Fads are temporary; fundamentals are permanent.