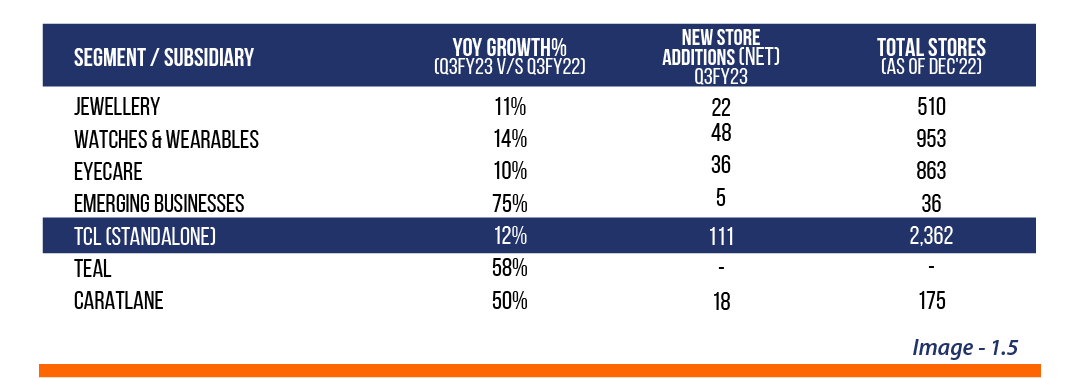

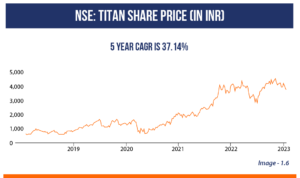

CMP: INR 2,371.30

JAN 20, 2023

HIGHLIGHTS

- With strong parentage from Tatas and a lineage of its own (established in 1984), the Company has a solid financial record and a loyal customer base.

- The external rating of the Company has been reaffirmed at a substantial level of AAA.

- The financial performance of Q3FY23 places the Company back on the growth trajectory.

- An aggressive growth plan for new stores backed with a comfortable gearing level and diversified product portfolio will assist in the future growth story.

Industry Outlook

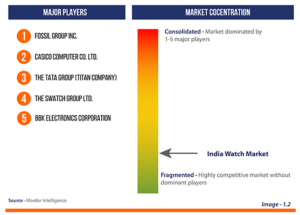

As our country moves towards USD 5000 per capita GDP, the desire for lifestyle products will explode. The Indian watch market itself, is expected to grow at a CAGR of 20.32% between 2022 to 2027. The affordability and disposability of this segment make them a preferable fashion statement for customers. There is an increased preference for ‘value for money’ products in the low and mid-priced segments, giving the increase in demand from rural India. Further, over time, the watch models have been modernized to include health monitoring applications. Increased awareness of these applications leads to higher demand for smartwatches and wearables. Many international brands are also entering the Indian market as the need for such health-monitoring smart watches is increasing. Players like Apple, Fossil, Xiaomi, Fitbit, etc., are all eying for a share of this pie. Some of the competitors in this segment are shown in image 1.2 .

While the products are being sold online and offline on an omni channel basis, the current trend shows that the demand in the offline market is higher. Furthermore, demand is concentrated on specialty and watch-dedicated stores, even in the offline market.

The wearable watch market is overtaking the plain vanilla wristwatch segment with considerable growth. Essential watches account for 95.1% of the overall watch exports, and now they have to fight against with aggressive competition by other wearables like smartwatches, wristbands, etc. Yet, the outlook for 2023 remains strong as the wearables now attract Tier 2 and Tier 3 cities in India. The Production Linked Incentive scheme has also been made applicable by the Government for the wearables market, leading to the development of the ecosystem foraying in domestic production and multiple launches of ‘Made in India’ products in the category.

Business Description

Founded in 1984 and headquartered in Bengaluru, Titan Company Ltd (Titan) manufactures and markets watches, eyewear, jewellery, and apparel via its subsidiaries and licensed international brands. It has come a long way, since it started as one product category in 1984. Some in-house company brands include Titan Edge, Raga, Nebula, Fastrack, Sonata, Xylys, World of Titan, etc. Jewellery runs under the brand Mia, Caratlane, Zoya, etc. Overall, Titan ecosystem has 16 brands. A brief of the critical domestic and international brands (under license) is shown on the image 1.3.

As of 31st Dec 2022, the Company operated via 2,537 stores, spread across ~ 2.8 million square feet of retail space. Apart from the segments mentioned above, the Company is also diversifying its presence in automated and precision machines for the defence sector and aerospace segment. The manufacturing facilities of the Company are ISO 14001 and ISO 45001 certified.

Financial Analysis

In the image 1.4 given is a quick sneak peek into the financial performance of Titan over the last 5 years.

The Company’s top line is driven by four key segments, jewellery, eyewear, watches & wearables. Among these, jewellery & watches contributes the highest share in sales and profit. Revenue has increased by 32% in FY 21-22 from last year to INR 27,456 crore from INR 20,783 crore, with ROE of 25.8% (12.2% in FY 20-21).

The profitability trend was in the growth phase till 2020. However, with the Covid-19 pandemic, the demand for goods due to elastic demand went down, leading to slower growth in sales and a more than proportionate increase in production cost. Since 2022, the profit has started to improve again and is gradually inching to pre covid levels.

For this asset turnover side, the company operations on the retail model, and hence the receivables are higher, leading to good receivables turnover. However, this benefit is offset by the high inventory days as the Company has to maintain a wide variety of inventory at all the retail outlets. This leads to an increasing cash conversion cycle for the Company. For the same reason, the Company’s quick ratio is relatively weak even though the current ratio is above 1.33 benchmark level. This once again proves that inventory constitutes a significant chunk of the working capital cycle for the Company.

Debt has historically been on the lower side for the Company but post covid pandemic, the debt as a percentage of total equity has been increasing. This has also contributed to the slippage in the interest coverage ratio (depicted by EBITDA/Interest Exp in the table above). While the gearing and interest

coverage ratio is still comfortable, the trend needs to reverse to ensure that the leverage continues within the comfort level of the shareholders.

Current Developments and Future Expectations

Financials –

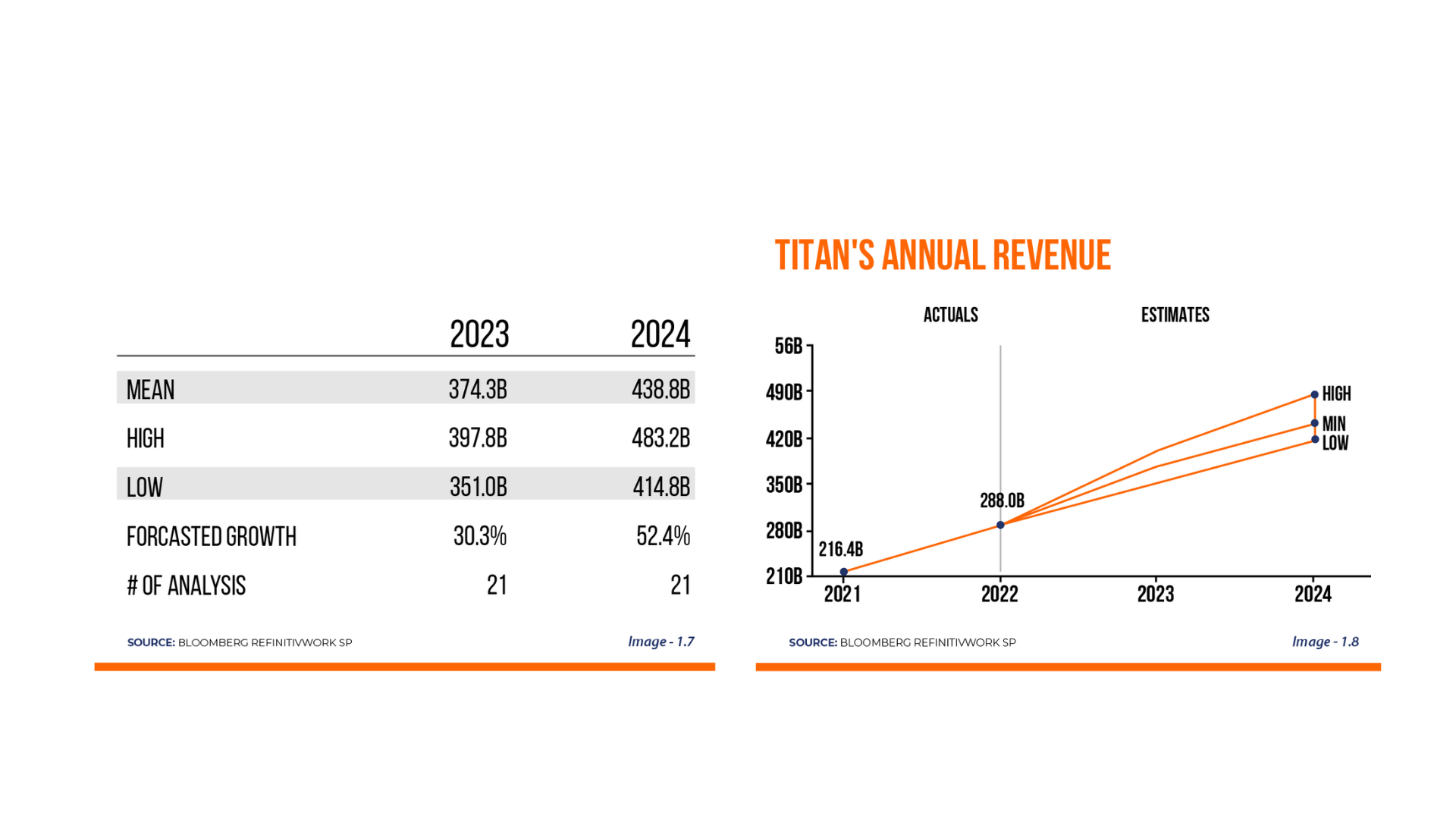

The Company recently declared the Q3FY23 results in January, which has reported robust sales growth on a high base. The festive season resulted in ~12% growth in combined sales YoY across Company’s standalone business. The watch and wearable segment grew by 14% on a Y-o-Y basis as the Company added 48 net new stores taking the total store count to 953. The Jewellery segment reported a growth of 11% in revenue, supported by demand on account of the festive season during the quarter. During the quarter, the segment added 22 net new stores leading to a store count of 510 for the segment. Other segments like Caratlane, Fashion etc. too reported positive growth rate during the period. Given in image 1.5 is the gist of Q3 growth rates along with total net stores position as of Q3FY23.

Business –

Titan has been focusing on its growth strategy by foraying into the international market. The store count in the domestic market has also been increased on an aggressive basis. Tanishq will soon mark its imprint in multiple locations of West Asia and North America. The jewellery division faces stiff competition from the unorganized segment as they dominate the regional market. The Jewellery and Watch segment continues to contribute to the highest shares in profit and revenue for the Company.

Recent Events –

On 10th of Jan, the company’s bank loan rating letter was released which allotted a AAA/Stable/A1+ (highest rating) to the company.

On 6th of Jan 2023, the Company declared its Q3FY23 financials(discussed above) which showed improved turnover and aggressive retail store opening strategy adopted by the management.

In Dec 2022, Tanishq opened its first international store in USA-New Jersey taking its international store count to 6 .

In Nov 2022, SEBI disposed the case of insider trading against 58 individuals who were employees of the Company and were involved in insider trading on the script.

Future Expectations –

The projected growth of the Company is on the optimistic side given the aggressive store opening strategy backed by strong parentage of Tata group. Continued pattern of increasing sales with rising EPS will influence a buy recommendation for the stock.

Getting into international business was there in their plan. Keeping this in mind, they are setting themselves up in Dubai and USA for jewellery sector. They are focusing on smart watches more to bring back their watch section in business. Its brand Taneira is getting developed when in comes to garemnts section. When it comes to fashion accessories, “Irth”, a brand for women handbag is being launced recently.

With this growth expansion, one can see that Titan has a positive outlook in 2023-2024.