Introduction

Here are some common myths surrounding family-run businesses.

‘’It is impossible for a family business to run successfully for more than two generations’’.

‘’Family business means bad decisions, conservative outlook, and slow progress’’.

‘’Most family-run businesses are led badly and are under-governed’’.

Each of the statements above has been proven wrong by the family businesses running in India like the Ambani’s or the Birla’s. However, the Bajaj Group is not to be left behind. The multinational conglomerate was found by Jamnalal Bajaj in 1926 and will complete a century of its significant existence in the coming few years with its legacy.

Incorporation

The multinational conglomerate company, Bajaj group is currently one of the reputed business houses of India. Today, three of Bajaj group firms – Bajaj Finance, Bajaj Auto and Bajaj Finserv, rank among 35 most valuable companies in the country. It is successfully riding on the able shoulders of the members of the fourth generation, Sanjiv Bajaj and Rajiv Bajaj. Rahul Bajaj has smoothly transferred his power to his sons and demarcated their interest. Bajaj Auto is headed by Rajiv Bajaj, while Sanjiv Bajaj leads the financial services company, Bajaj Finance.

Bajaj Finance Ltd. which was previously known as Bajaj Auto Finance was founded in 1987. The company falls under the Specialty Finance Industry, its sub-industry being the Consumer Finance sector.

It was after 11 years in the auto finance market, that the company chose to launch its IPO and was listed in the market. As a new century began, the company expanded and ventured into durables of the finance sector, and then into property loans too. And in 2010, it changed its name to Bajaj Finance Limited.

Bajaj Finance Limited is a Non-Banking Financial Company and is a subsidiary of Bajaj Finserv and holds a 57.28% stake in it. BFL is a deposit-taking NBFC (Non-Banking Financial Company), dealing with Consumer Finance, Small and Medium Enterprises and Commercial Lending, and Wealth Management.

Ever since its incorporation its growing brick and brick and is now one of the largest NBFC in India.

The Company – Bajaj Finance Ltd.

In one of our previous blogs, we had expressed our positive sentiments regarding NBFC in spite of the economic headwinds and slow growth of the economy that was happening before we got hit by Covid-19.

The importance of NBFC was recognized by our Prime Minister before Corona Phase and certain policy announcements like Credit Guarantee Fund Trust for Micro and Small Enterprises Scheme were carried out to promote it.

NBFC will grow owing to it’s stand in retail finance, growth in public deposits, instrumental reach in rural Micro Finance Institutions, and most importantly government support. However, the extension of the moratorium of loans is hurting NBFC, especially the smaller ones. RBI should restructure it so that there is no substantial impact on NBFC. Lakewater still belives that NBFC will keep its ball rolling and especially Bajaj Finance. Due to BFL’s healthy structure, the company is placed better than most of the other NBFC companies to capitalize on the opportunity that the Government would provide. Currently, it is present in 2,392 locations and is one of the leading NBFC in India with standalone AUM of Rs 116,102 crore. As of 31st March’20, BFL’s capital-to-risk weighted asset ratio (CRAR) is 25.01%. This makes it well-capitalized and makes it one of the most capitalized NBFC.

Consistently, Bajaj Finance has been generating growth in AUM and has an average of 44% over a decade. This speaks about its intensity and ability. Even, there has been strong growth in EPS over the last 10 years with an average of 51%.

Bajaj Finance has shown tremendous growth in the last 5 years and FY2020 to record a growth in terms of New Loans, AUM, PAT, et al. Despite the lockdown in one of the crucial weeks which escalates the growth.

The first quarter of FY21 showed the obvious profit downfall due to the Covid pandemic and consequent lockdown. June 30 recorded a 19.40% year-on-year fall in consolidated net profit. However, there was an increase in AUM year-on-year. The company also increased contingency provision for Covid-19 during this quarter to Rs 2,350 crore.

Even though the last quarter posted weak growth metrics, Lakewater strongly believes it’s just a phase and bullish on it. Furthermore, we believe that there are certain opportunities that can be booked and revive growth again. We shall discuss this in one of our segments later.

Spread of Bajaj Finance

Bajaj Finance has a strong leadership position and is omnipresent in both offline and online industries. With a focus on geographic diversity and customer additions, Bajaj Finance’s granularity and pricing power is being aided. Large customer base and geographic diversity have also helped it to diversify risk, which helps it to maintain the high velocity that comes with such a business.

Further, Bajaj Finance is one of the few NBFC that has access to deposit and built up a substantial scale. It is expected that0 deposits will be ~20% of its funding in Q4 of FY2020. This upward slope clearly depicts its strong execution and its presence of the brand.

Bajaj Finance has continued to spread its wings despite cyclical ups and downs and has been delivering consistently despite challenges in the NBFC sector. It will rise back post the Covid19 phase too and recharge the fuel.

Opportunities

Home quarantined, discretionary purchases refrained, job layoffs, have embarked worst fears for Bajaj Finance. However, the growth rally is a bit delayed than shrugged off. Bajaj Finance is here to stay. The strong management is already trying it’s best to keep a check on its asset quality and seeing results.

Let’s discuss further on how the momentum shall be started:

New Demands

Looking at the job layoff, discretionary spending is questionable. However, again looking at the current scenario, certain spending will be treated as essential and not discretionary. It is believed that Covid-19 will open new avenues of demand as trends are changing.

- Corporates are looking to go forward with Work from Home.

- Change in spending pattern. Spending is more in-house related. Like, there is an increase in usage of Electronic Appliances to reduce burden.

- Online training. This is leading to demand electronic devices.

No-cost EMI

No-cost EMIs as always been a stimulating factor. And in this slowdown phase, this will furthermore act as a catalyst for the manufactures. No-cost EMIs have helped in financial penetration over the last few years.

Consumer Business

The market scenario is unknown, due to this lockdown-unlock phase. However, what is known is that the revival of consumption demand is pivotal. Due to job layoffs, the recovery shall be slower, but it is expected that the government shall focus on the major population, the bottom of the pyramid.

Corporate demand may still take time to revive and surely, consumer business is a better position than others. And Bajaj Finance being a player in the retail (consumer + SME) segment should build a profitable scale post this crisis.

Mediator-Catalyst

Financiers and manufacturers can work together to tweak and develop products in order to stimulate consumer demands. Given Bajaj Finance’s strong position, it has a healthy relationship with manufacturers and an effective business model in the small-ticket consumer loan segment. Along with this, BFL has the pricing power owing to its dominant position and reach. We believe that it will be able to curb this opportunity and emerge stronger in consumer financing space post the curren1t situation.

It has underperformed in FY2020 and FY2021 will be a tough year, but a sharp elevation is expected in FY2022. And as they say, nothing lasts forever. The AUM under moratorium has already been reduced to 15.5% in June from 27% in April.

Competitors

Bajaj Finance is no exception to the companies that got hit by the pandemic. Yet, we have a strong belief that it’s up there. With a capital adequacy ratio of ~25%, Bajaj Finance has the strongest Balance Sheet among other NBFC. Even the cost of funds is lower than its peers as the leverage ratio is between 4-5.

Last year, while this was one of the top performers, its peer faced a drop amidst the crises of bad loans and defaults. It is outright favorite of international as well as domestic investors. Unlike other NBFC, Bajaj Finance has diversified its business has limited the company’s exposure. It is clearly demarcated from the rest of the NBFCs in terms of Market Cap, AUM, clients, and all other parameters. It has been a decade that it has a high ROE business with active management. Its large customer base and inherent pricing power will help it rule the NBFC market.

Nanoo Pamnani – The man who was substantial for the meteoric rise

Before, we conclude, Lakewater pays homage to the veteran banker and would like to acknowledge his achievements. Nanoo Pamnani, was the Vice Chairman of the Company, Chairman of the Audit Committee and Risk Management Committee and mentor to all at Bajaj Finance. Just like an experienced sailor who charts the course of a ship and takes it to its destination skilfully, Late Mr. Pamnani held the reins of the company and brought about extraordinary success to it.

In the year 2008, Sanjiv Bajaj was about to lead the financial services business. He probably took the best decision in roping in Nanoo Pamnani, who had just retired from Citibank where he was India’s head. The trio of Pamnani, and the two brothers have given a meteoric rise.

In a 2017 interview to Forbes, Sanjiv Bajaj says this about his guide and mentor, Nanoo Pamnani

‘’ Without him, we’d not be anywhere near where we are. Not just me, the team will tell you that’’.

The death of the veteran banker is an inevitable loss to Bajaj.

Conclusion

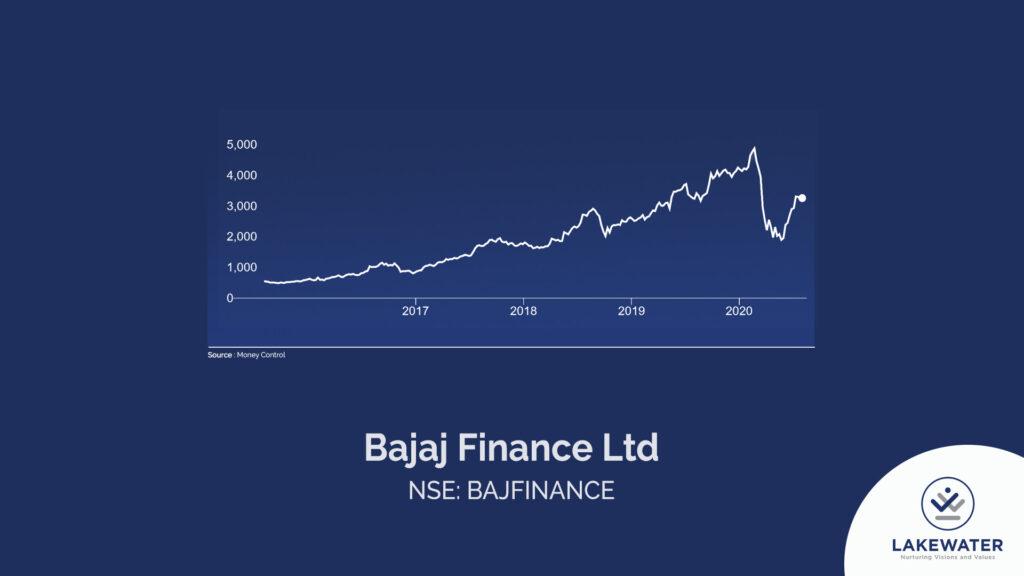

Bajaj Finance was a multi-bagger until the Covid turmoil and loan moratorium took place. One of the most valued company hit its 52 weeks low of Rs 1,783.10 on 27th May. However, the stock is picking back its momentum and is in the house of 3000 range again.

As the condition improves, Lakewater expects Bajaj Finance to cement its growth. In our previous report, we had stated that we are strong about NBFC. And in NBFC, we have bullish about Bajaj Finance. Valuation is attractive as it is continuously growing while facing challenges of the NBFC segment. Bajaj Finance has a strong track record and will emerge as a winner in NBFC, while the other player sinks. We expect that Bajaj Finance will be one of the fastest to recover in the financial sector.

The near-term volatility cannot be ruled out, but as we say the market is about the long-term players; Bajaj Finance is about the long-term opportunity.

References

https://www.bloomberg.com/profile/person/3342121

https://www.magzter.com/article/Business/Forbes-India/Serving-Up-An-Ace