HIGHLIGHTS

- Ola Electric achieved 1 million EV production milestone at its Futurefactory in Krishnagiri (Sep 2025).

- Q1 FY26 revenue stood at ₹828 crore (+35.5% QoQ), with 68,192 deliveries. Auto business turned EBITDA-positive in June 2025.

- FY25 revenue: ₹4,645 crore (vs ₹5,126 crore in FY24); Deliveries: 359,221 units (vs 329,549 in FY24).

- Filed a ₹400 crore PLI claim under the Government’s scheme in Sep 2025.

INDUSTRY OVERVIEW

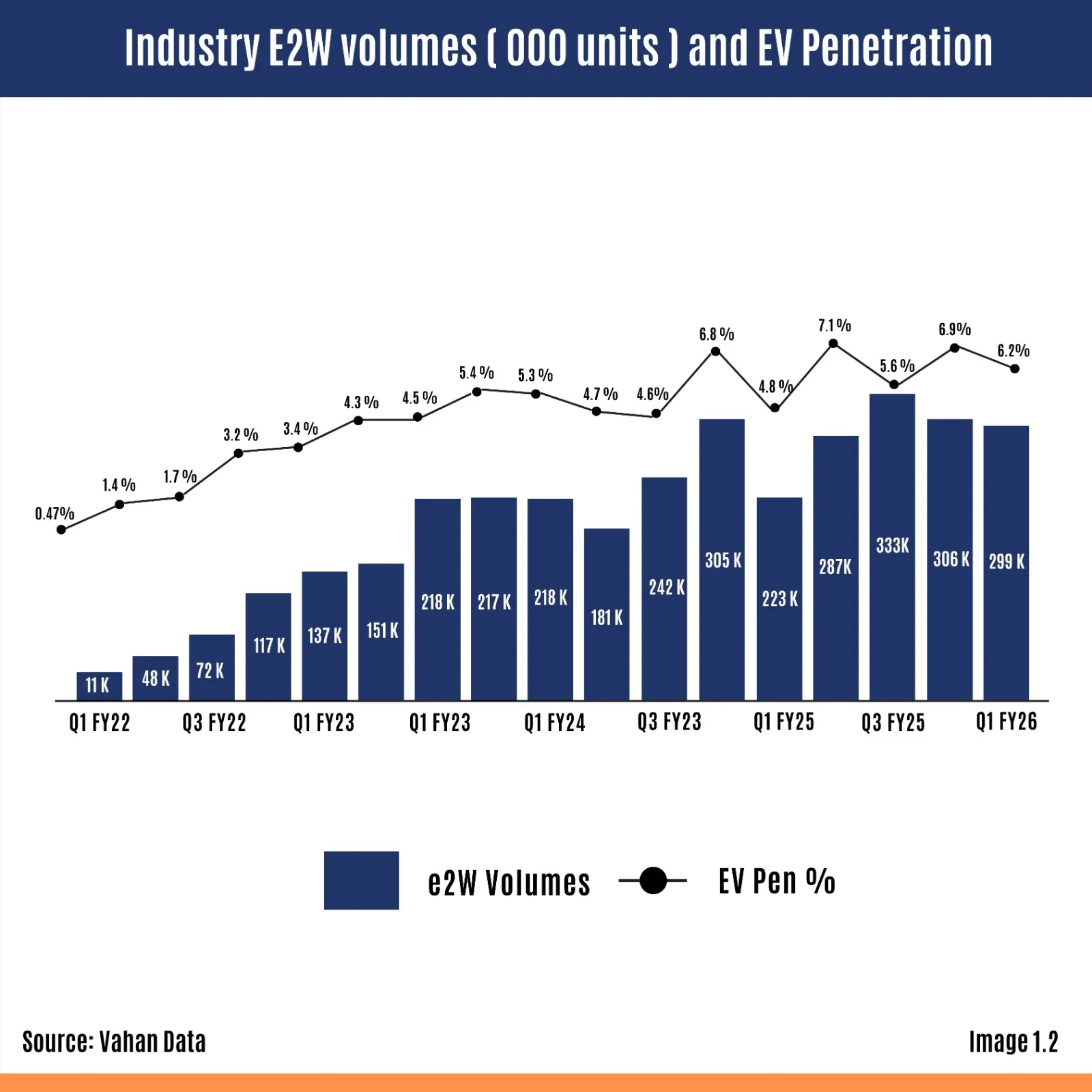

The Indian electric two-wheeler industry has grown rapidly in the past few years, supported by government policies, rising consumer interest, and increasing environmental concerns. India is now considered one of the fastest-growing EV markets globally, with scooters and motorcycles forming the backbone of demand. Incentives such as FAME-II and the Production Linked Incentive (PLI) scheme for the auto sector have provided strong support for domestic manufacturing, encouraging companies to localize battery production and reduce reliance on imports. However, competition in the sector is intensifying. Established players like TVS and Bajaj, alongside startups such as Ather Energy and Simple Energy, are pushing new EV models, often at competitive prices. This heightened rivalry has led to aggressive discounting and pressure on margins. Moreover, customer behaviour in India remains highly price-sensitive, with adoption closely tied to cost-of-ownership benefits. In this context, companies that can achieve economies of scale, develop localized technology such as ferrite motors and battery cells, and differentiate through digital platforms stand to build a longterm competitive edge.

COMPANY OVERVIEW

Ola Electric, founded in 2017 by Bhavish Aggarwal, has positioned itself as a leading player in India’s EV revolution. Headquartered in Bengaluru, the company’s product lineup includes the Ola S1 scooter family, Roadster electric motorcycles, and the proprietary MoveOS operating system. Its Krishnagiri Futurefactory in Tamil Nadu, marketed as the world’s largest two-wheeler EV plant, symbolizes its scale-first strategy. The company emphasizes vertical integration to gain control over its value chain, with initiatives around in-house battery cell development (4680 Bharat cells) and ferrite motor technology. Ola Electric is also investing heavily in its MoveOS software platform to enhance user experience, connectivity, and long-term monetization opportunities. The company’s roadmap revolves around expanding product categories, achieving cost leadership, and transforming mobility through integrated hardware and software solutions.

FINANCIAL OVERVIEW AND ANALYSIS

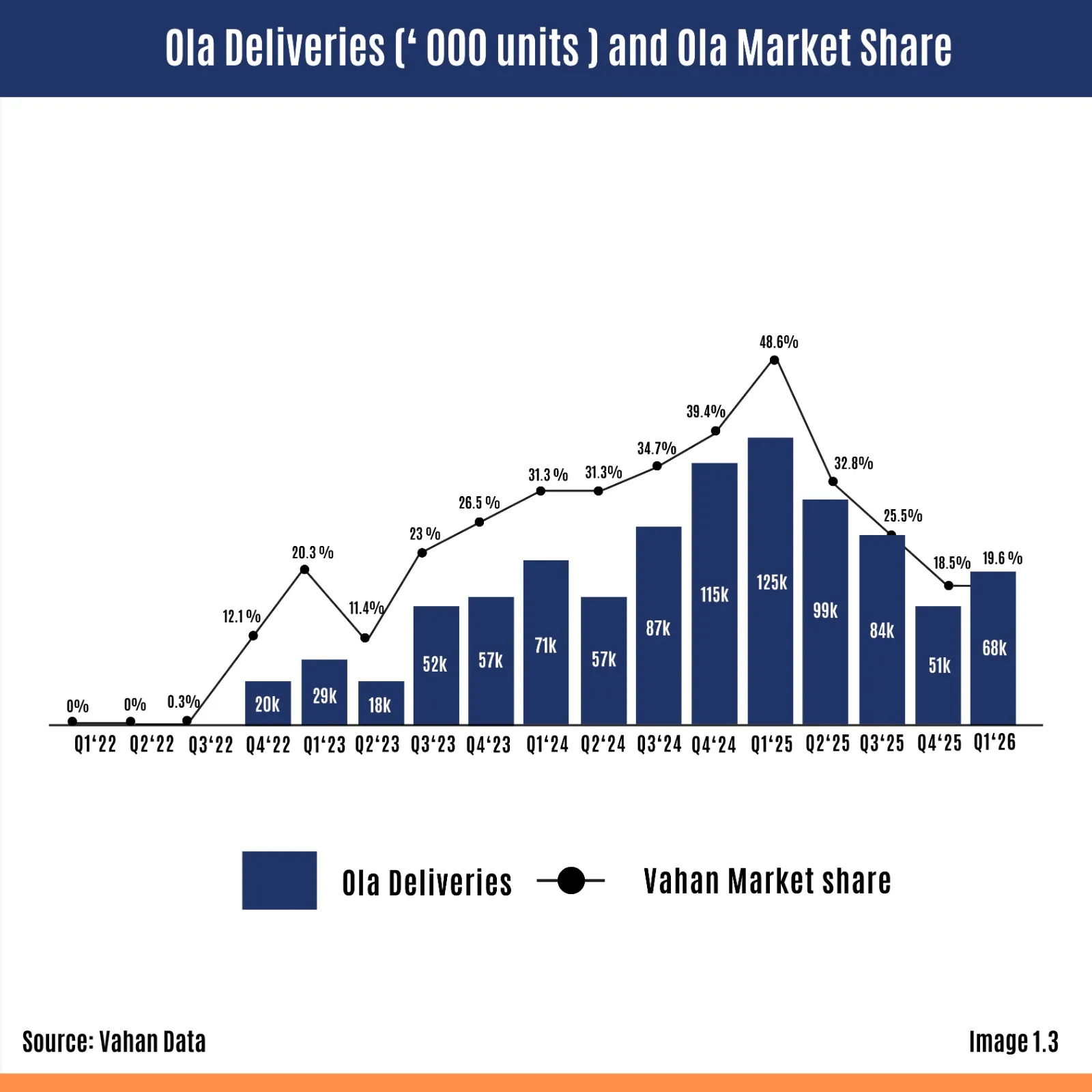

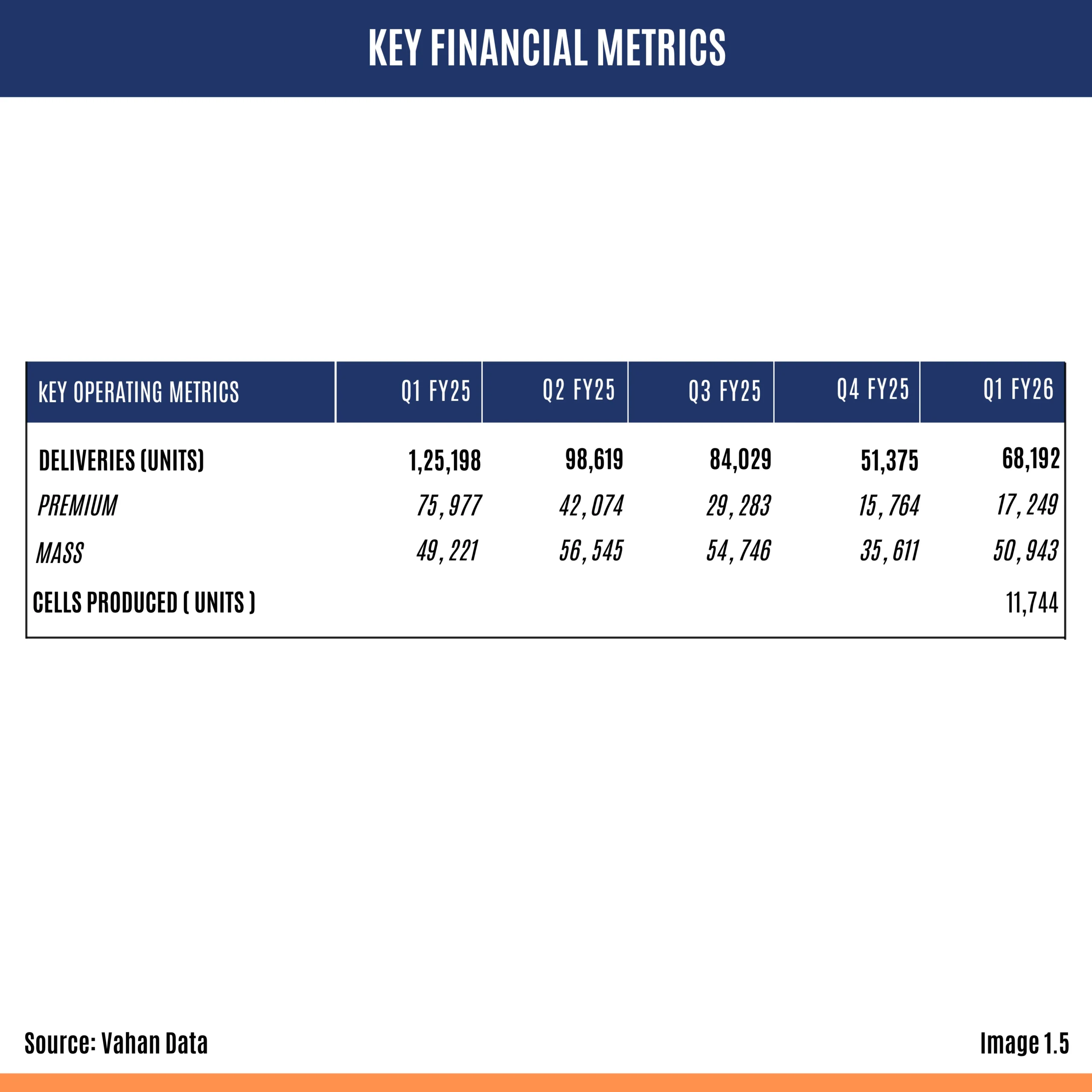

Ola Electric has experienced significant revenue growth since FY23, although profitability has remained elusive. The company reported revenues of ₹2,782.7 crore in FY23, which jumped to ₹5,243.3 crore in FY24. However, FY25 saw a decline to ₹4,645 crore, despite higher vehicle deliveries of 359,221 units compared to 329,549 in FY24. This drop highlights the impact of lower average selling prices (ASPs) and industry-wide discounting.

In Q1 FY26, Ola reported revenues of ₹828 crore, marking a 35.5% sequential increase, alongside deliveries of 68,192 units. Importantly, the auto segment turned EBITDA-positive in June 2025, signalling early success from cost optimization measures under Project Lakshya.

From an analytical perspective, Ola’s financials reveal a mixed picture. While scale has been achieved with over one million vehicles produced, sustaining profitability remains a challenge. The company’s ability to achieve positive operating cash flow in the auto segment by FY26-end, as guided by management, depends on maintaining cost discipline, reducing import dependence through in-house technology, and securing timely government incentives like the ₹400 crore PLI claim. The persistent net losses indicate that Ola’s battery cell ventures and R&D spending continue to weigh heavily, but these investments are critical for long-term competitiveness. Investor sentiment post-IPO has been cautious, given the volatility in financial performance, and sustained profitability will be the key determinant for future capital raising and valuation support.

CURRENT DEVELOPMENTS & FUTURE EXPECTATIONS

- 1M Production Milestone : Ola produced its one-millionth EV in September 2025, reflecting rapid scale-up capability. This milestone demonstrates operational execution and brand adoption, but profitability sustainability is still the main challenge.

- PLI Claim (~₹400 crore) : The company filed a ₹400 crore claim under the government’s Production Linked Incentive scheme. If approved, this will provide near-term liquidity and strengthen its localization strategy for cells and motors.

- Foray into Energy Storage (“Ola Shakti”) : Recent reports suggest Ola will unveil a non-vehicle product named Ola Shakti on October 16, 2025. This likely indicates entrance into energy storage or battery services, expanding beyond just mobility.

- Technology Roadmap : Ola is developing its own 4680 Bharat cells and ferrite motor designs. These innovations aim to reduce import dependence, cut costs, and enhance longterm margins while MoveOS upgrades strengthen the software ecosystem.

- Cost Management (Project Lakshya) : Project Lakshya has delivered early success with auto EBITDA turning positive in June 2025. Sustaining cost discipline is critical for achieving free cash flow positivity in FY26.

- Competitive Landscape : Competition remains intense from incumbents like TVS and Bajaj, and startups such as Ather Energy. Aggressive pricing strategies across the industry continue to challenge Ola’s margins.

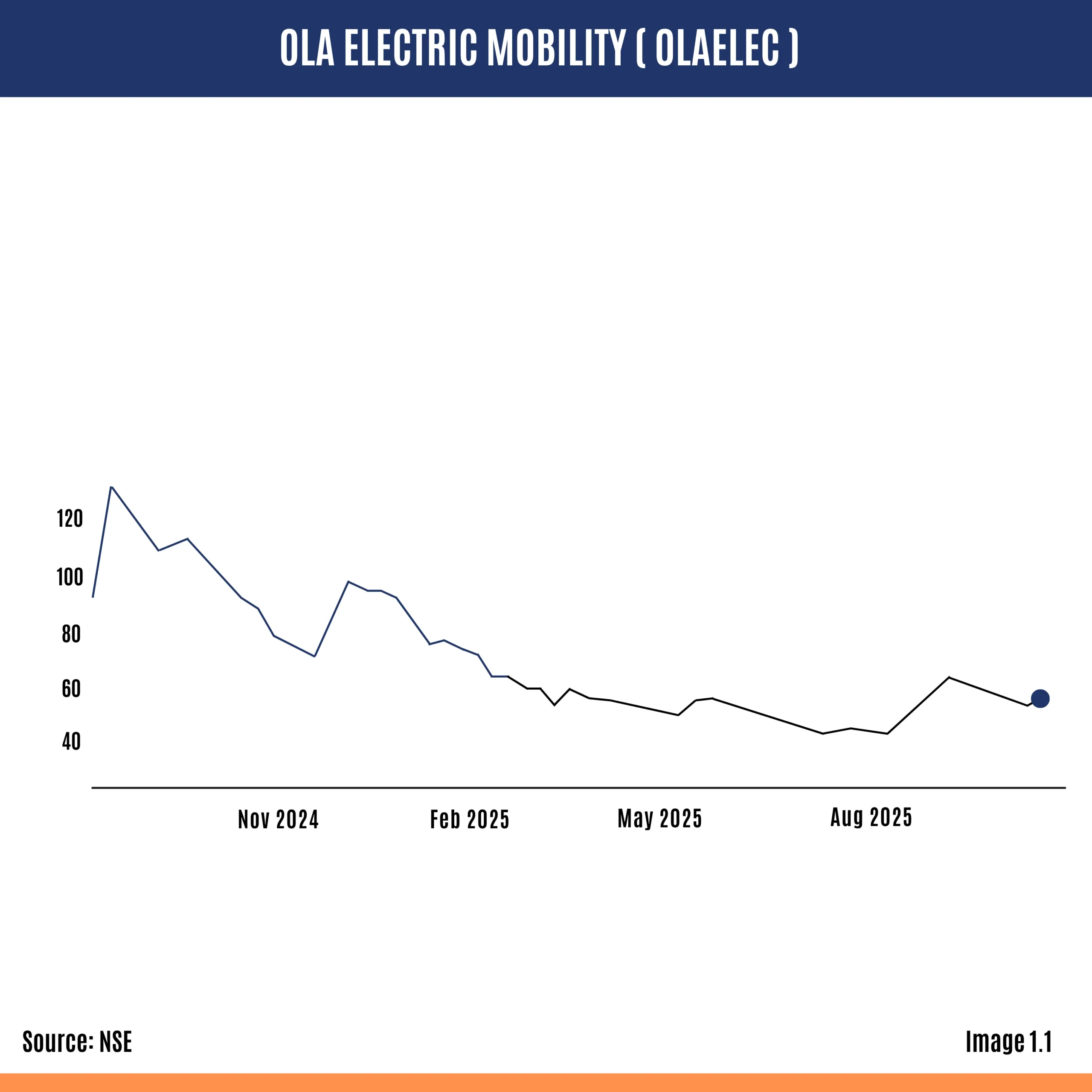

- Capital Market Sentiment : Since its 2024 IPO, Ola’s stock has been volatile. Delivering profitability and cash flow stability will be key to restoring investor confidence and securing funding for large-scale battery ventures.

RECENT EVENTS

Aug 2024 – IPO and Market Volatility

Ola Electric went public with a highly anticipated IPO that drew significant investor attention. However, post-listing, the stock has been volatile, reflecting market concerns about profitability and execution risks .

FY25 (Mar 2025) – Revenue Slowdown

During FY25, the company reported a decline in revenue to ₹4,645 crore despite higher deliveries. This was primarily due to pricing pressures and discounts, which eroded average selling prices and margins.

June 2025 – Auto EBITDA Turns Positive

The auto segment achieved EBITDA positivity in June 2025, marking a milestone in Ola’s cost optimization journey under Project Lakshya. This was an early indication of improving operational efficiency.

July 2025 (Q1 FY26) – Revenue Rebound

In Q1 FY26, revenue rose to ₹828 crore, up 35.5% QoQ, with deliveries of 68,192 units. The company narrowed its net loss to ₹428 crore, signaling improved financial discipline.

Sep 2025 – 1M Milestone and PLI Claim

Ola celebrated the production of its one-millionth EV at the Krishnagiri Futurefactory. Simultaneously, it filed a ₹400 crore claim under the government’s PLI scheme, aimed at boosting domestic manufacturing and cash flows.

Oct 2025 – Announcement of “Ola Shakti”

Ola scheduled a launch (Oct 16) for a new energy product. The market reacted positively, pushing shares into upper circuit. Business Standard+2Business Standard+2

2025 Stake Exits

Hyundai exited its entire 2.47% stake; Kia trimmed its holding. SoftBank also trimmed its stake, reducing exposure.

CONCLUSION

Ola Electric has achieved scale unmatched in the Indian EV two-wheeler industry, but its financial profile shows a delicate balance between growth and profitability. The company’s immediate focus is on sustaining cost reductions, executing its localized cell and motor roadmap, and securing government incentives. If successful, Ola could transition to free-cash-positive auto operations by FY26, enhancing investor confidence and solidifying leadership in India’s EV landscape. However, persistent pricing pressure, execution risks in battery manufacturing, and market volatility remain key watch factors.