HIGHLIGHTS

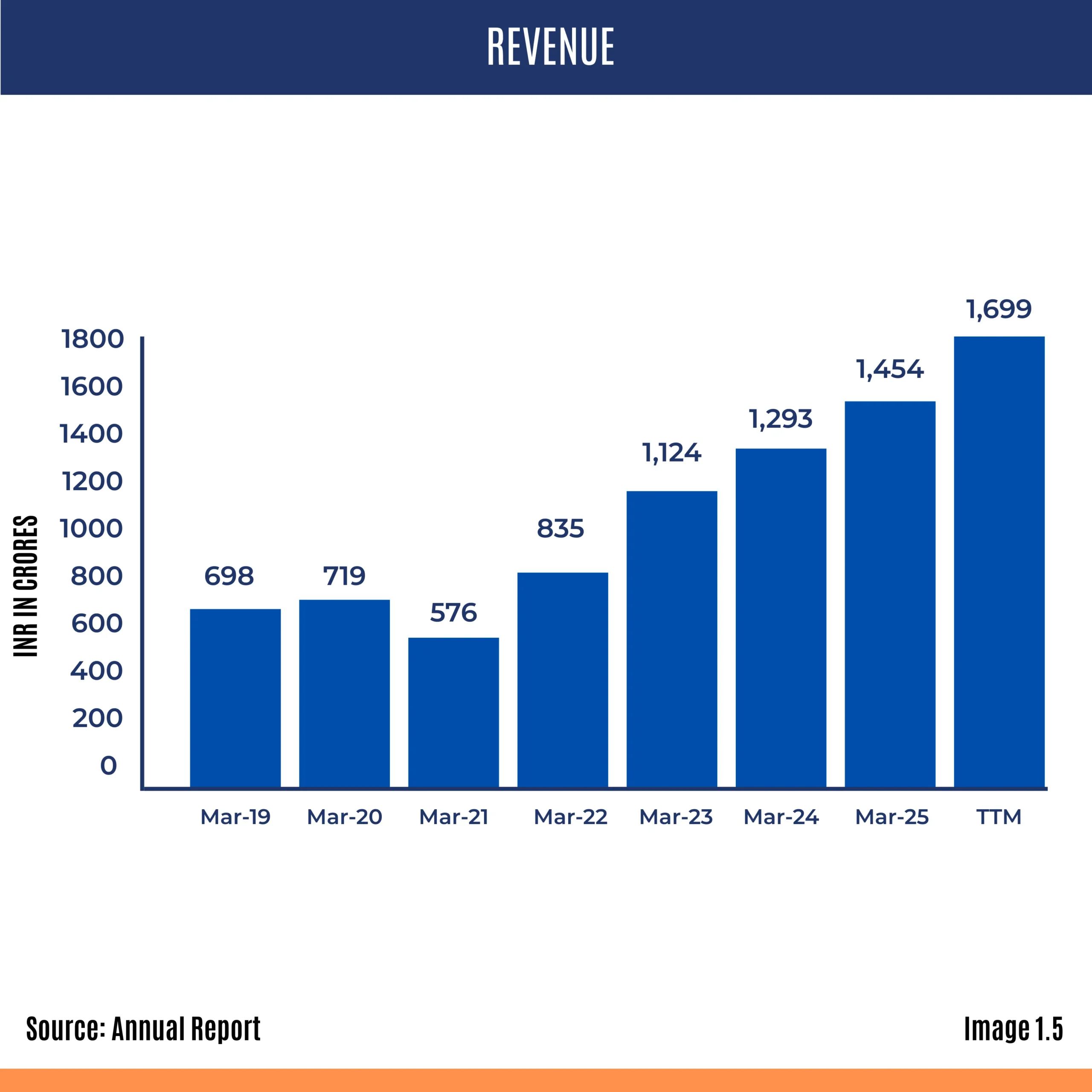

- The company has been performing remarkably well, growing its annual revenue consistently since FY2022, with a Compounded Annual Growth Rate (CAGR) of 20.6% over the last 3 years and 26.05% over the last 5 years.

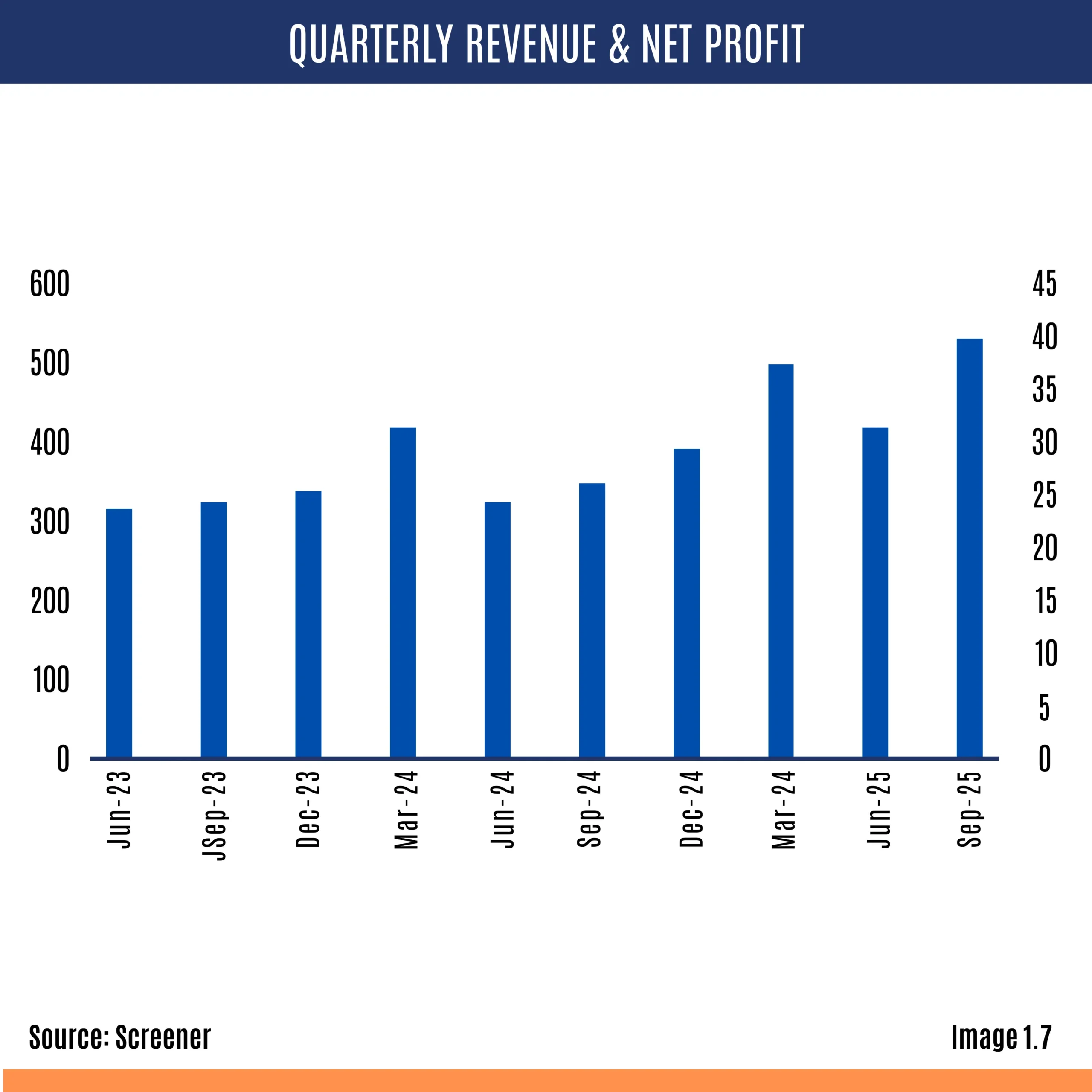

- Interarch Building Solutions Ltd. achieved its highest-ever quarterly revenue in Q2 FY26, with total revenue reaching Rs. 491 crores, nearing its coveted Rs. 500 crore milestone.

- EBITDA margins in Q2 improved YoY from 7.8% to 8.5%, along with a modest increase in PAT margins from 6.4% to 6.6%.

- In the latest quarter, the company secured several new orders from key customers, including Rungta Mines, Havells India, Jindal Stainless, among others.

INDUSTRY OUTLOOK

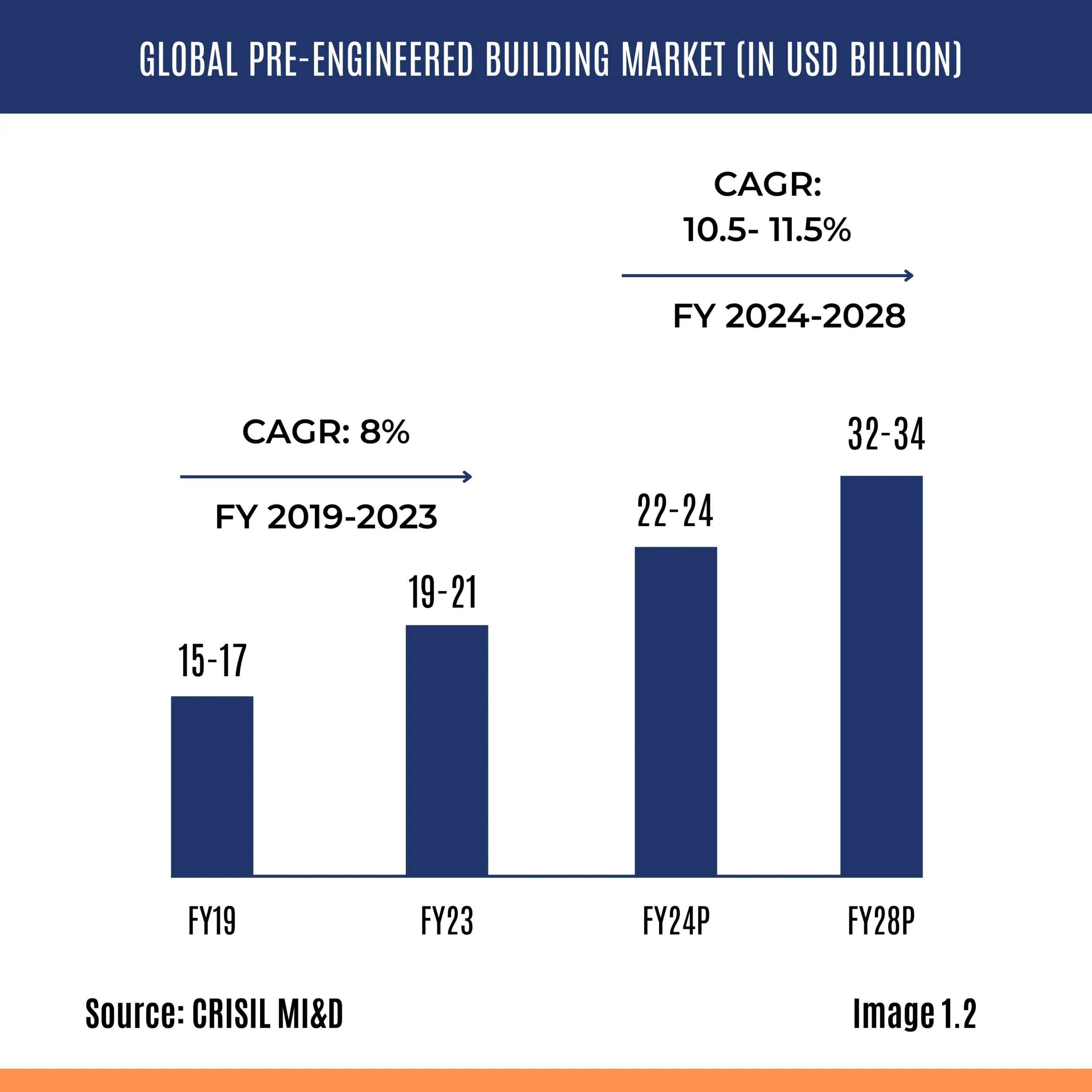

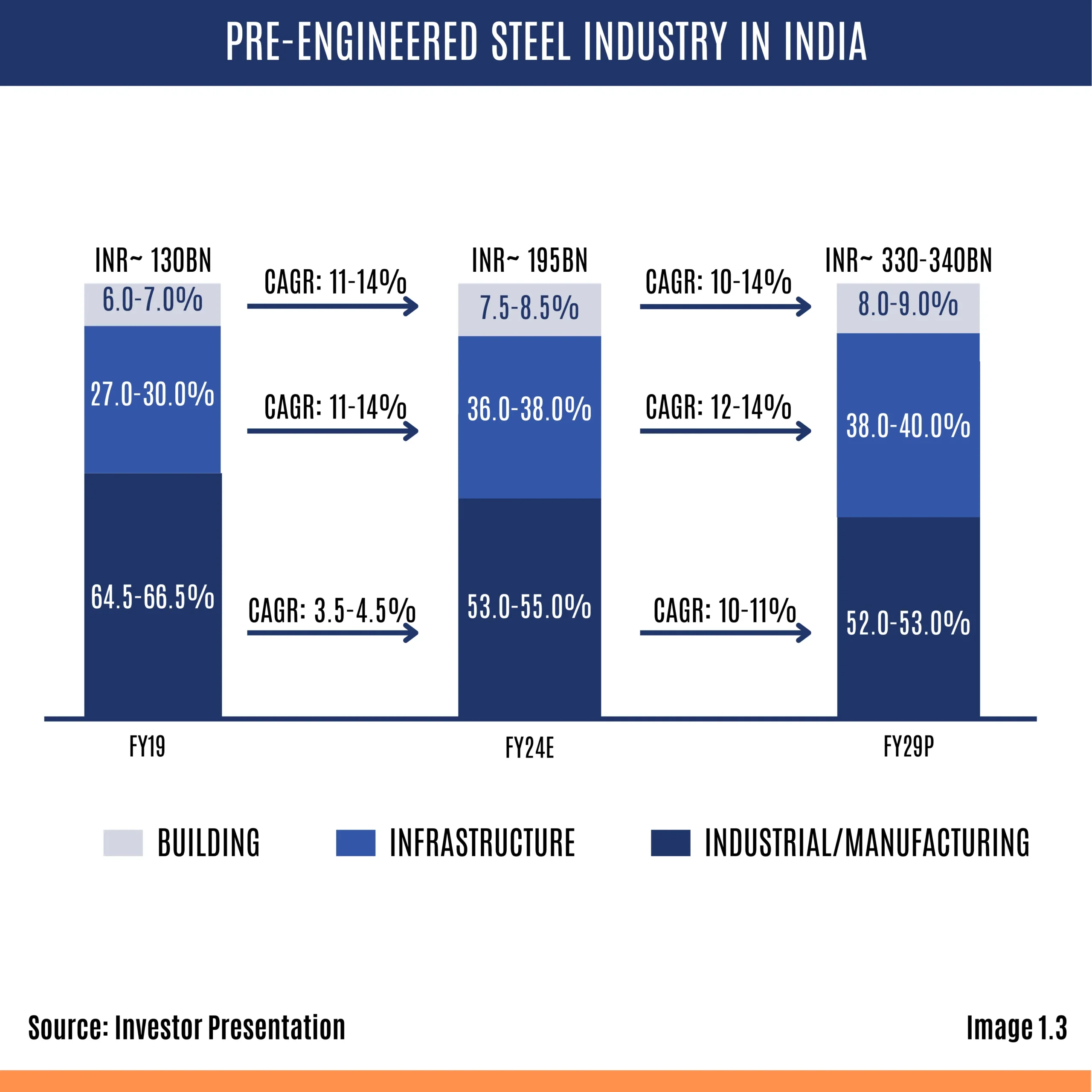

The Indian economy grew at 6.5% in FY 2024–25, outperforming most major global economies. India’s construction and infrastructure ecosystem is undergoing a transformative shift, driven by government-led infrastructure spending, rapid industrialization, and urbanization. According to recent forecasts, India’s construction market is expected to reach $1.4 trillion by 2025, making it one of the largest construction markets in the world. Within this landscape, the Pre-Engineered Building (PEB) and steel construction sector has emerged as a critical enabler of India’s manufacturing ambitions.

According to a CRISIL report, the global PEB industry is projected to reach $32–34 billion by FY 2028, showcasing the immense growth potential of this sector. In India, the PEB market is expected to grow at a CAGR of 11–12% from FY 2023, reaching an estimated $ 4 billion by FY 2028–29, opening up vast opportunities. The industry is currently witnessing unprecedented momentum due to factors such as:

- Increased industrial capex and planned capacity expansion

- Shift from traditional construction methods to modern steel-based solutions

- Growth of multi-storeyed buildings

- EV manufacturing boom and semiconductor industry investments

- Expansion of data centre capacity

- Rising renewable energy infrastructure

Compared to traditional construction, PEBs offer several advantages in terms of speed, cost efficiency, and sustainability. Their relatively low adoption rate in India further strengthens the sector’s multi-year growth trajectory. With India’s per capita steel consumption rising and more companies adopting ESG frameworks, the long-term structural demand for PEB solutions is set to accelerate.

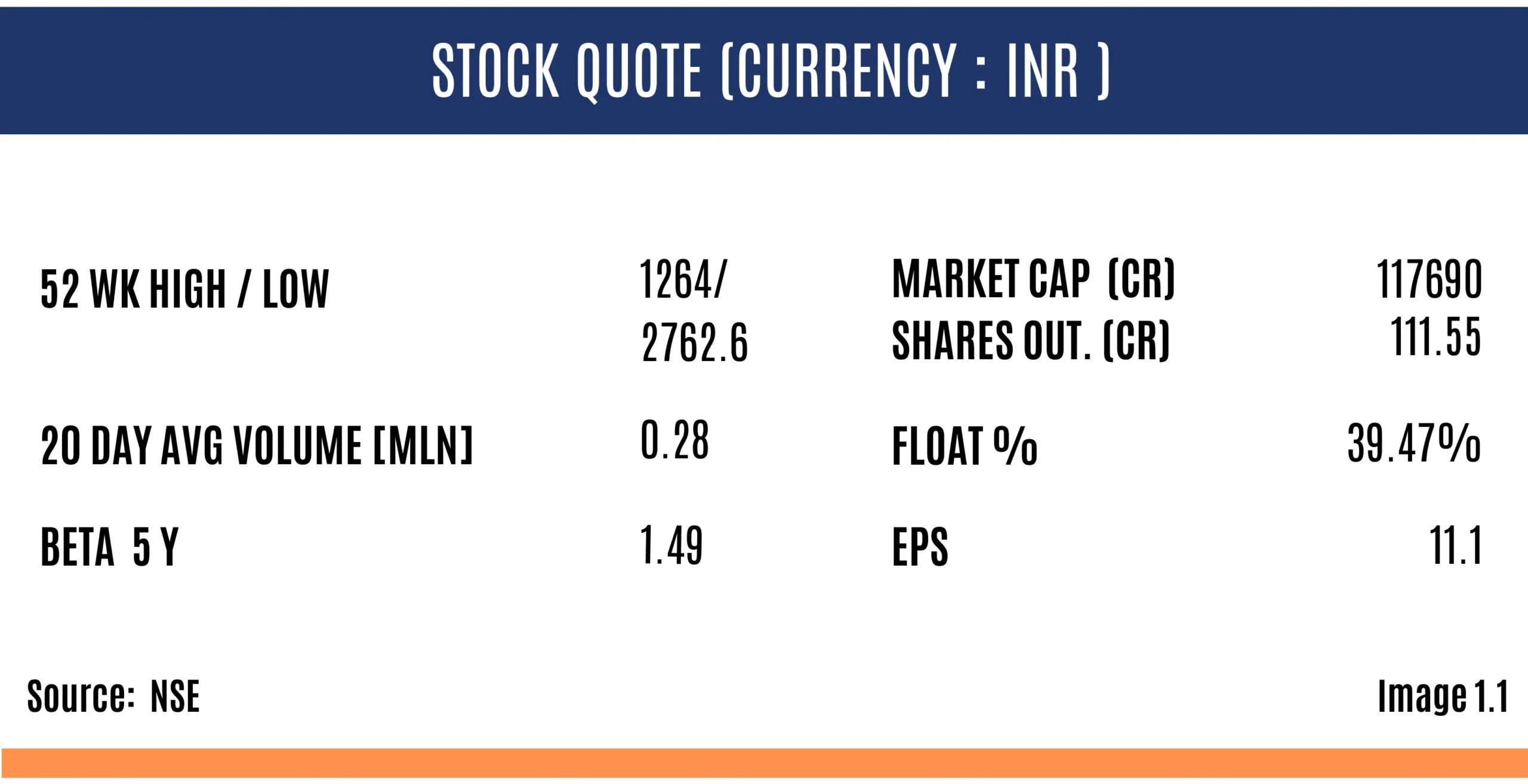

Interarch is a leading PEB and structural steel manufacturer with strong engineering capabilities and decades of industry experience. It is the secondlargest integrated PEB player in India, with an approximate 6.5% market share. Other key players in the segment include Kirby Building Systems India Ltd., L&T, and Pennar Industries. In terms of capacity, Kirby Building Systems is currently the largest player in India.

BUSINESS DESCRIPTION

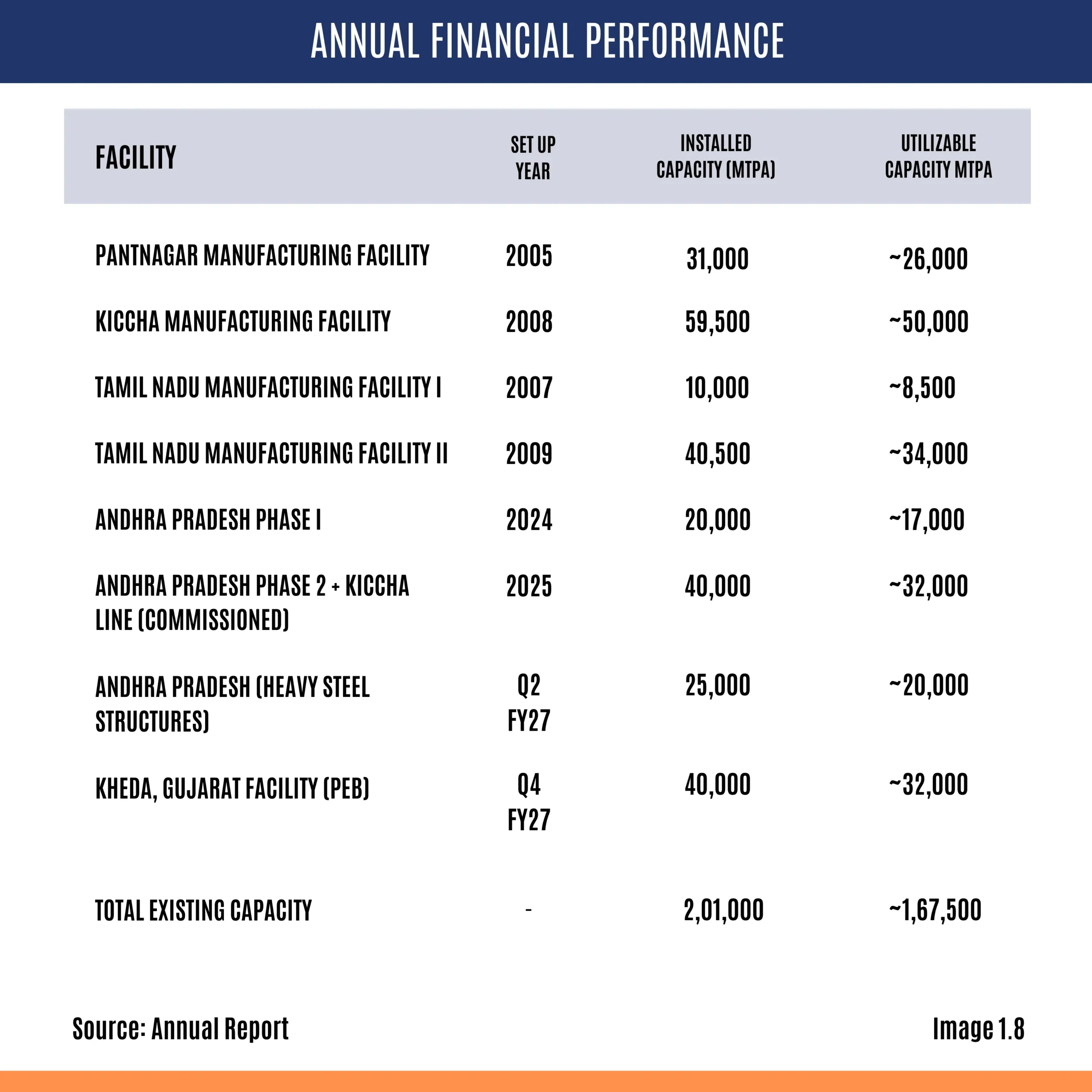

Established in 1984, Interarch Building Products Ltd. is one of India’s leading and pioneering manufacturers of Pre-Engineered Buildings (PEB) and integrated structural steel solutions. Headquartered in Noida, Uttar Pradesh, the company has played an instrumental role in modernizing India’s construction landscape. It operates five manufacturing facilities across Uttarakhand, Andhra Pradesh, and Tamil Nadu, with one additional facility planned in Gujarat. The company also has eight Marketing and Sales offices in India along with three Design Centres. Interarch has the second-largest aggregate installed capacity in India, at 2,01,000 metric tonnes per annum.

Interarch is one of the country’s leading turnkey pre-engineered steel construction solution providers, offering capabilities in design, engineering, manufacturing, and on-site project management for the installation and erection of PEBs. The company employs 155+ qualified structural design engineers and detailers, along with 90+ project managers. With over 40 years of industry experience, Interarch has successfully executed 756 PEB contracts from FY2015 to FY2025.

FINANCIAL ANALYSIS

A brief overview of Interarch Building Solutions Limited’s financial performance over recent years is shown in the image below.

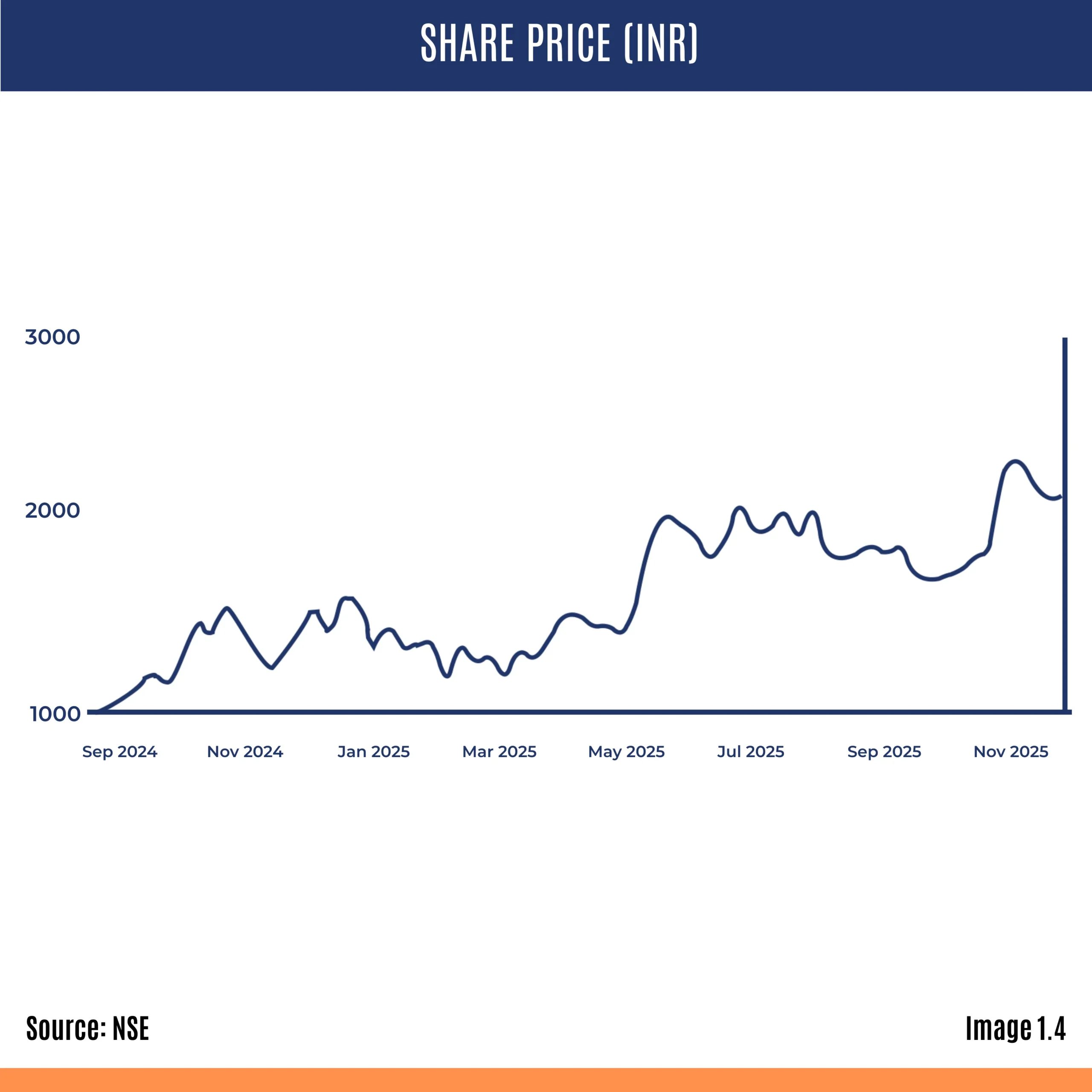

Interarch delivered stellar results in FY24, achieving its highest-ever revenue. It has nearly tripled its revenue from Rs. 575.96 crores in FY20–21 to Rs. 1,453.83 crores in FY24–25. Its topline has grown at a CAGR of 26.05% during this period. With management now focusing on international expansion—particularly in high-growth regions such as Central and West Asia, Southeast Asia, and Africa— the company is well-positioned to sustain its growth trajectory. In FY25, 82% of revenue came from repeat customers, and 27% of revenue was contributed by its top five clients. This indicates strong customer stickiness while also highlighting the opportunity to diversify the customer base further.

As the business expands, the company’s balance sheet is also strengthening. Although the business model has high entry barriers due to the technical expertise and execution capabilities required, it is not highly capital-intensive. FY25 marked the first time the company paid dividends, signalling strong cash flows and the management’s intent to reward shareholders. EBITDA margins improved to 9.4% in FY25. The company’s average order size increased from Rs. 3–4 crores to Rs. 10–11 crores, contributing meaningfully to margin expansion. Interarch has been growing significantly faster than the overall industry growth rate of 8.5%. While Return on Capital Employed (ROCE) has declined over the past two years, it remains close to its five-year average of 18.25% as of FY25. The company maintains a strong cash position and has the capability to self-fund its growth plans, enabling it to scale operations and respond swiftly to emerging market opportunities.

The current and quick ratios indicate that the company’s short-term liquidity position has improved compared to the previous year. Interarch is net-debt-free and continues to generate healthy operating cash flows. The cash flow-to-asset ratio stood at 4.81% in FY25. Additionally, zero promoter pledge and stable promoter shareholding further reinforce confidence in the company’s longterm prospects among equity shareholders.

CURRENT DEVELOPMENTS & FUTURE EXPECTATIONS

Financials – Interarch delivered a very strong quarter, recording its highest-ever revenue at ₹491 crore, up 52% YoY. The growth was driven by improved order execution and higher production across its plants. This momentum also boosted profitability — EBITDA grew 65% YoY to ₹42 crore, with margins improving to 8.5%, while PAT increased to ₹32 crore, up from ₹21 crore last year.

A key highlight of the quarter was the commissioning of Phase 2 of the Andhra Pradesh plant, now the company’s fourth fully integrated PEB facility. With this expansion, total capacity has risen to 200,000 MT, giving Interarch greater flexibility to take on larger orders and accelerate deliveries. The company has also begun work on its upcoming plant in Kheda, Gujarat, further strengthening its long-term expansion roadmap.

The order pipeline remains robust. As of 31 October 2025, the order book stood at ₹1,634 crore, supported by ₹463 crore of new orders secured over the last three months. Notably, 80–85% of these orders came from repeat customers, underscoring strong trust in the company’s execution capabilities. Key clients during the quarter included Rungta Mines, Havells India, Techno Electric, and Jindal Stainless.

Overall, the quarter reflects a company that is steadily scaling — expanding capacity, improving margins, and maintaining a healthy order flow. This positions Interarch strongly as a growing industrial leader within the PEB and structural steel space.

Business and Future Expectations

Interarch has built long-term relationships with its clients, with more than fourfifths of its business coming from repeat orders. This provides strong visibility into future revenues. With the organized sector increasingly capturing a larger share of incremental industry orders, the company is expected to continue growing at 1.5x to 2x the industry growth rate.

The company is focused on expanding its footprint by opening new engineering offices in key regions to enhance design and technical capabilities, while also entering new markets. Management has revised its FY26 revenue growth guidance upward, from 17.5% to 20%. It expects to achieve Rs. 2,400 crore in revenue by FY28.

Volumes reached 41,215 metric tonnes in Q2, reflecting healthy utilization of its manufacturing facilities. The company has also planned capex of Rs. 150 crores over the next 12 months, which is expected to add 40,000–45,000 MT of additional capacity, further supporting its growth trajectory.

Recent events

- The company booked orders worth Rs. 463 crores between 1st August 2025 and 31st October 2025.

- It commissioned Phase II of the Andhra Pradesh facility, making it the company’s fourth fully integrated facility and increasing total installed capacity to 2,00,000 MT.

- The company conducted groundbreaking ceremonies for two of its upcoming facilities, with an estimated capex of Rs. 170 crores.

- The company is strengthening its global focus with a strong emphasis on export-driven growth. To support this, it has entered into a strategic collaboration with Mold-Tek Technologies Ltd. (MTTL), under which it will pay MTTL a commission on export orders generated through MTTL’s efforts.

- The company has also formed a strategic collaboration with Jindal Steel & Power for urban infrastructure projects to enter the multi-storey buildings and heavy building structures segment, offering customers a more comprehensive solution.

Strengths

- The company has over 40 years of experience in the PEB industry and building products. It has a strong track record and an established brand presence with 8 marketing and sales offices across India.

- It has a diverse and loyal customer base, with close to 80% of new orders over the last three years coming from repeat customers, showcasing strong customer confidence in the company’s capabilities.

- The company has vertically integrated manufacturing operations, covering everything from in-house design and engineering to on-site project management and marketing. This provides significant control over the entire supply chain.

- Interarch is a debt-free company with high cash reserves, enabling it to expand future capabilities and enhance its growth potential.

- The company has consistently generated an ROE above 18% over the last three years, with the highest being 22.7% in FY 2022–23.

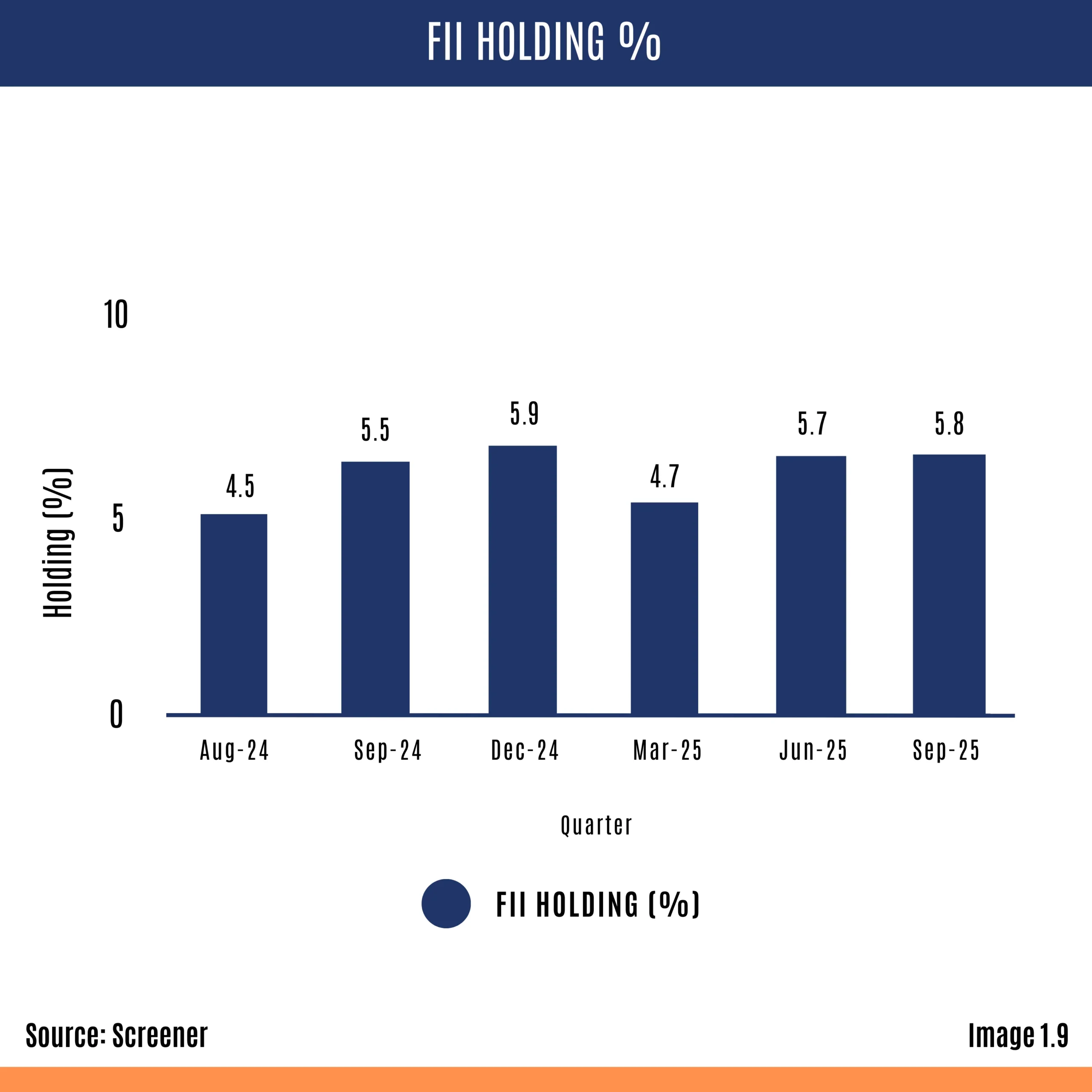

- FII/FPI holdings increased from 5.67% to 5.81% in Q2 2025.

- The company has demonstrated robust momentum, with the stock price surpassing short-, medium-, and long-term moving averages.

- Promoter holding stands at 59.43%, with no shares pledged.

CONCLUSION

Interarch has delivered strong performance in recent years, with revenue growing rapidly and the company consistently achieving new highs. This momentum is supported by a significant share of business coming from repeat clients, reflecting strong customer trust. At the same time, a meaningful portion of revenue remains concentrated among a few large customers, presenting an opportunity for the company to broaden its client base and reduce dependency. With management now focused on expanding into international markets—particularly fast-growing regions across Asia and Africa—Interarch appears well-positioned to continue its growth trajectory while simultaneously strengthening and diversifying its customer mix.