SILVER AS AN ASSET CLASS

Silver has historically played a dual role in global finance as both a precious metal and an industrial commodity. Its unique characteristics make it a compelling alternative asset for retail investors seeking diversification, inflation protection, and exposure to commodity cycles. According to one report, Indian households purchased a cumulative 15,000 tonnes of silver in bars and coins over the past decade.

Unlike equities or bonds, silver is a tangible asset with intrinsic value. While it is similar to gold—often serving as a hedge during periods of high inflation or geopolitical tension—it is also deeply entrenched in industrial applications. More than 50% of global silver demand comes from industries such as electronics and semiconductors; solar photovoltaics (PV); automobiles and electric vehicles; and 5G networks and batteries.

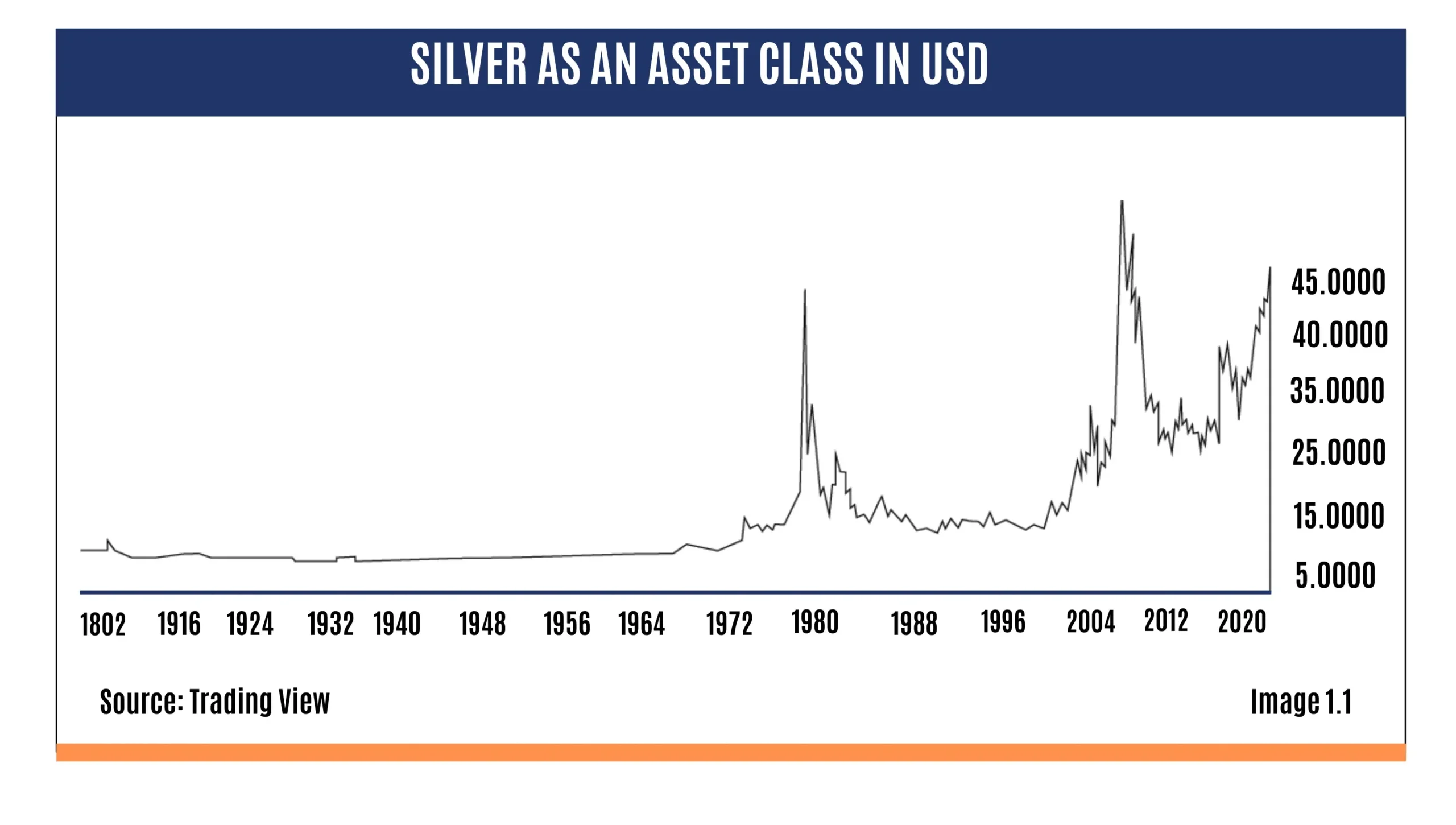

Over the past two decades, silver has experienced multi-year bull and bear cycles. Notable spikes include:

- 2010–11: Touched a high of ~US$48/oz amid global economic uncertainty.

- 2020: Rallied over 40% after the COVID crash, driven by stimulus and safe-haven demand.

In India, silver prices rose from ~₹20,000/kg in 2010 to ~₹1,00,000/kg in 2025, underscoring its long-term potential despite short-term fluctuations.

Silver ETFs in India let investors buy silver in digital form, eliminating the need to handle the metal physically. Each unit usually represents 1 gram of 99.9% pure silver, stored securely in vaults by the fund.

By SEBI guidelines, silver ETFs in India must invest the majority of their assets in real silver. Specifically, a silver ETF must invest at least 95% of its assets in physical silver (bars with 99.9% purity) and silver-related instruments.

Silver futures are traded on exchanges (ETCDs). There are restrictions: Silver ETFs may invest up to 10% of their assets in silver futures (derivatives) if they do not intend to take physical delivery. However, if the ETF uses futures solely to take physical delivery of silver—rather than rolling the contract—the 10% cap does not apply.

Here’s how buying a silver ETF works:

Fund house buys silver and stores it in secure vaults → Investors buy ETF units on the stock exchange (like shares) → The unit price tracks real-time silver prices in India → The silver is held with SEBI-registered custodians (e.g., Brinks or Sequel).

TYPES OF SILVER ETFs

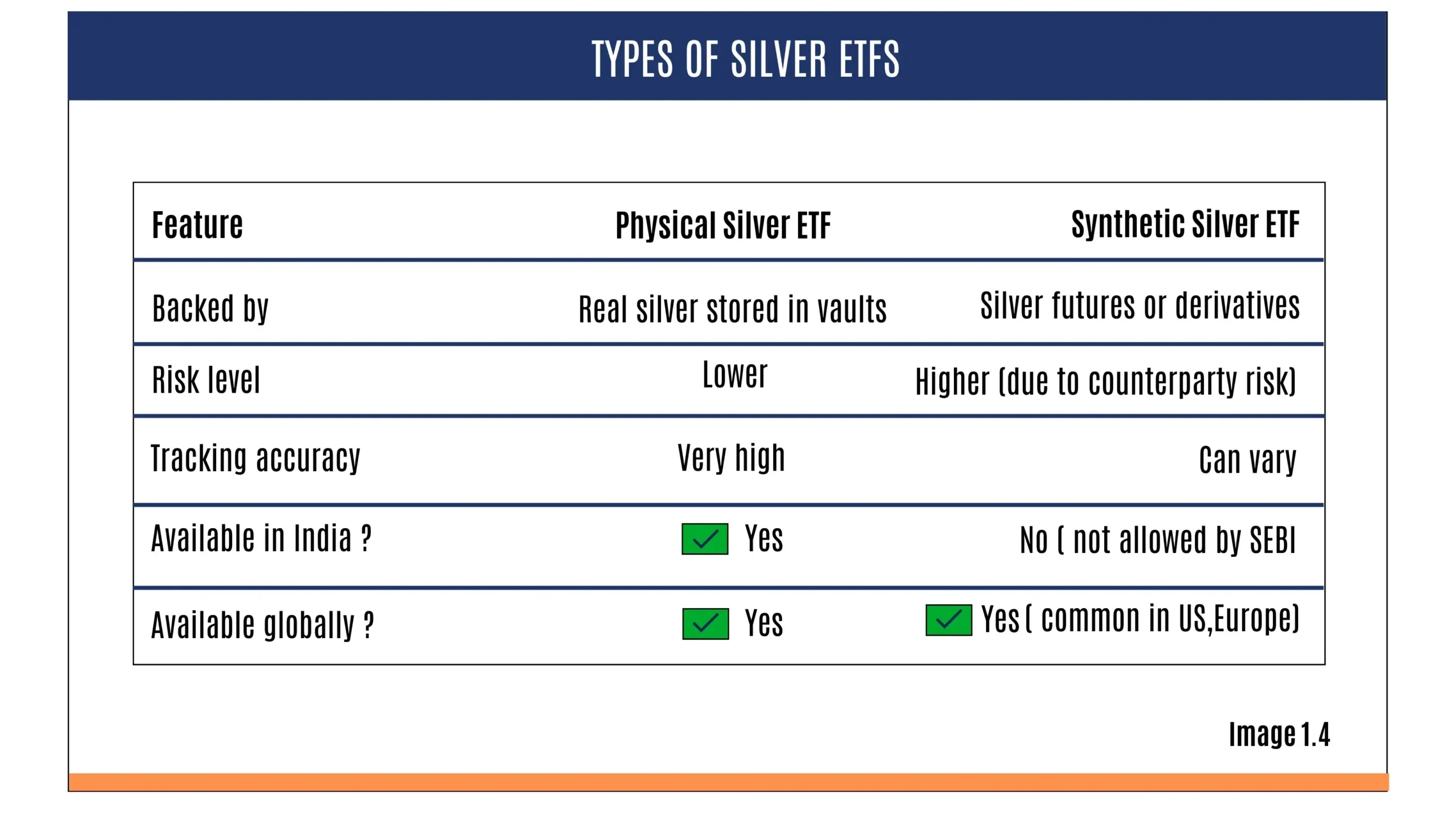

All silver ETFs aim to track the price of silver, but they do so in different ways. Broadly, there are two types:

- Physical ETFs are backed by actual silver stored in secure vaults. When you buy units, the fund purchases an equivalent amount of physical silver on your behalf.

- Synthetic ETFs use derivatives—such as silver futures or swaps—to replicate the price of silver instead of holding the metal. These are more common in global markets.

MAJOR SILVER ETFs: GLOBAL & INDIAN (BY AUM)

Globally Leading Silver ETFs

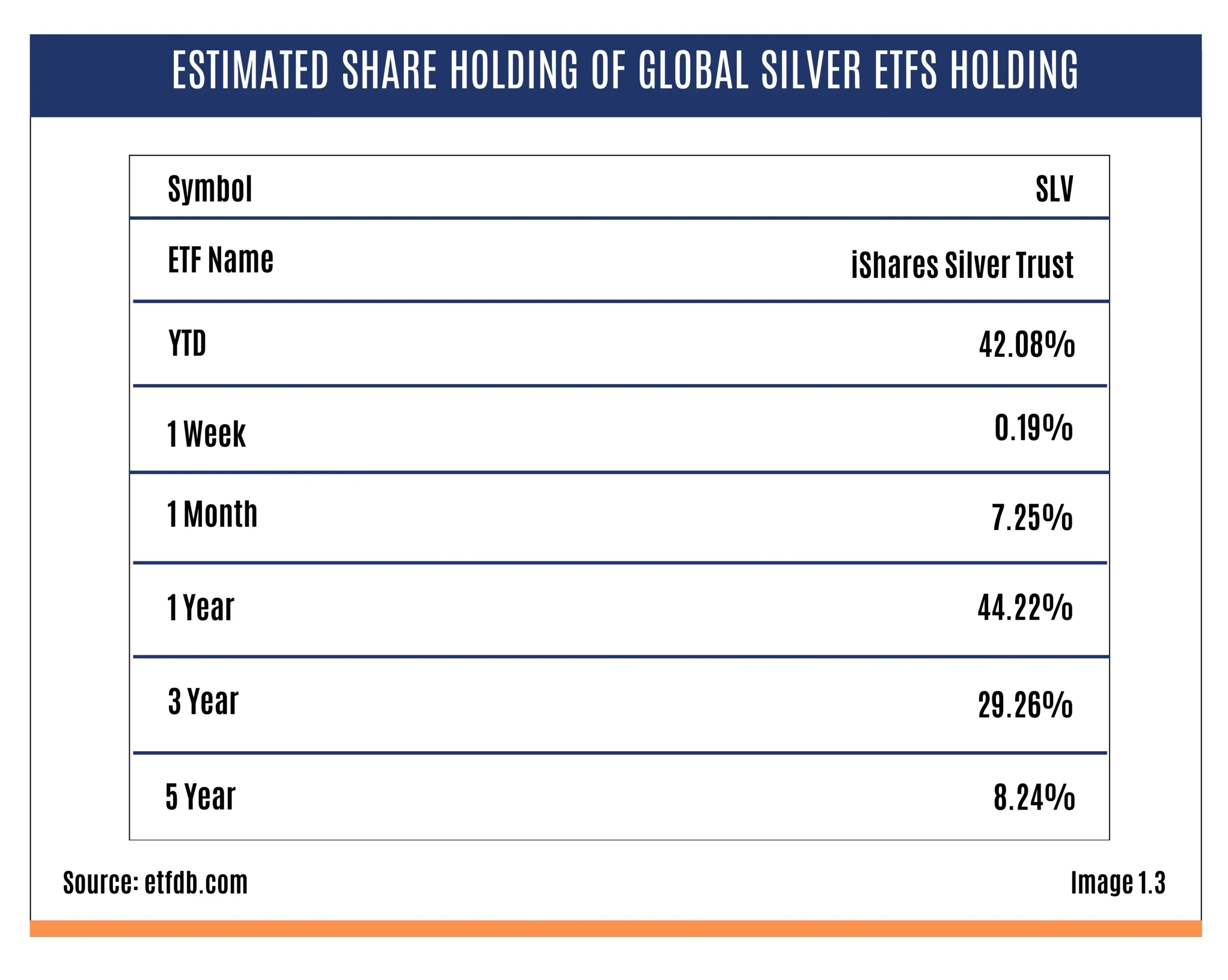

- iShares Silver Trust (SLV) — the world’s largest silver ETF, launched in 2006, physically backed and holding over $18.9 billion in assets under management (AUM).

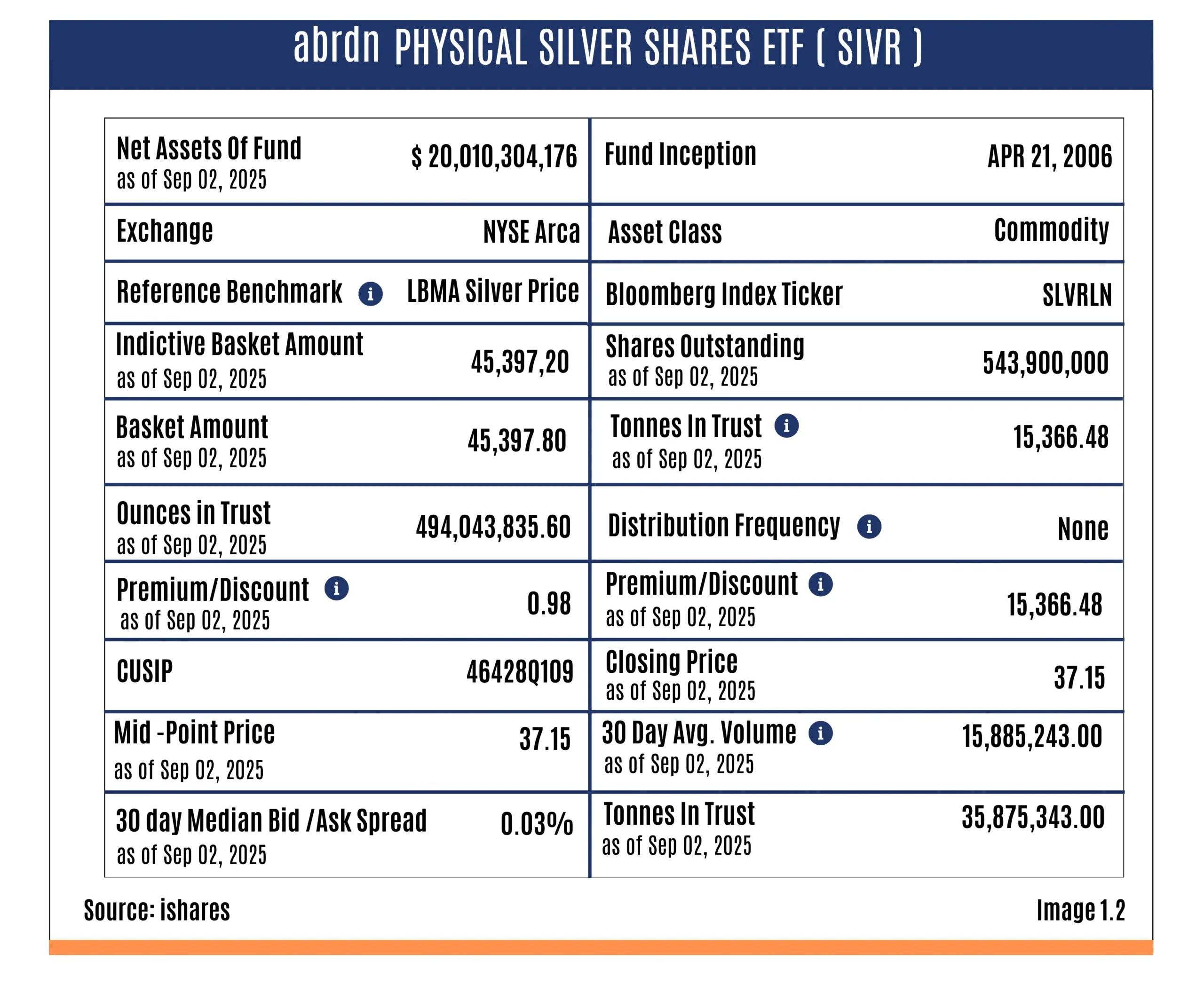

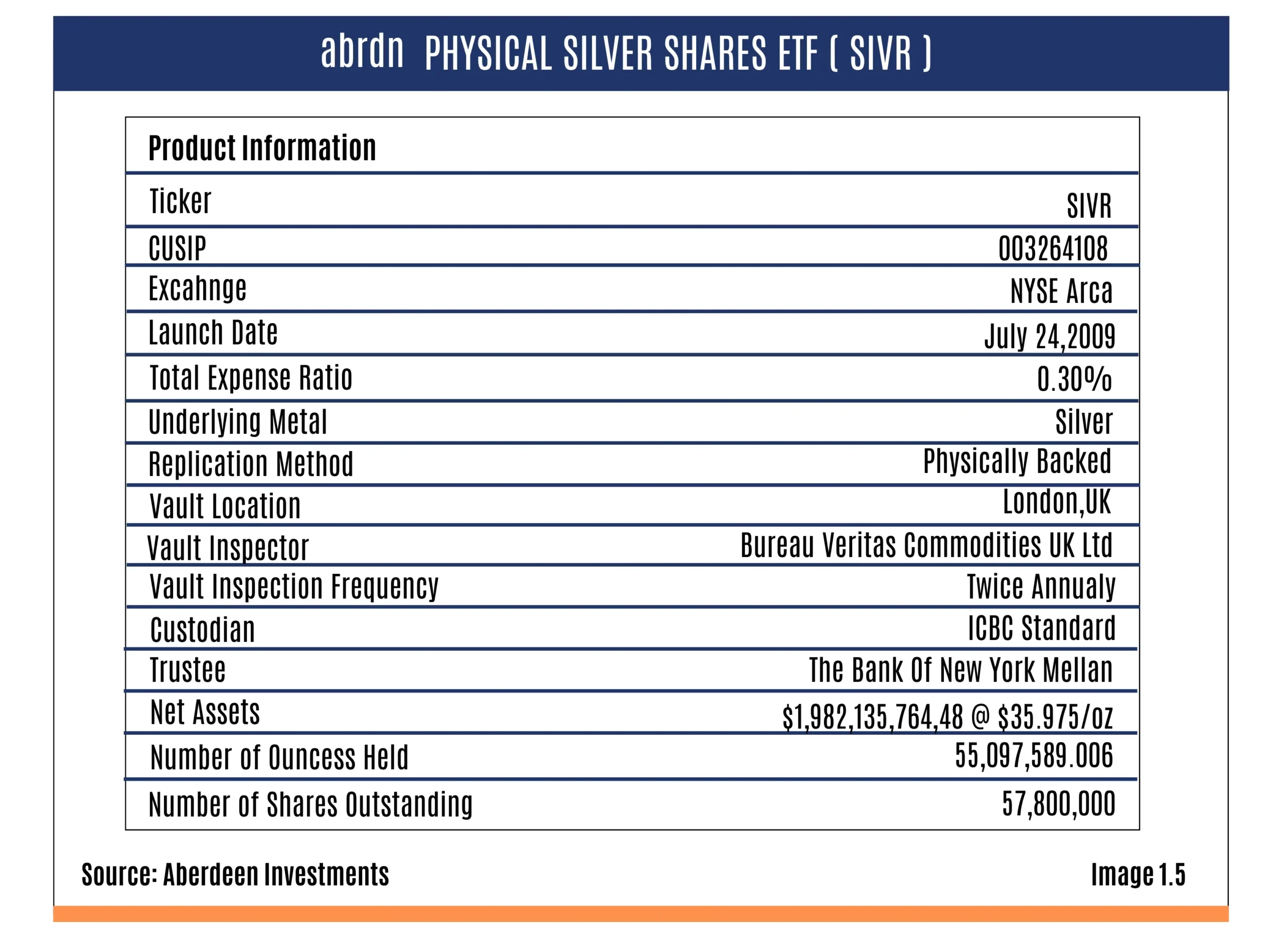

- Abrdn Physical Silver Shares ETF (SIVR) — another major, physically backed fund with about $1.9 billion in AUM and a typically lower expense ratio than SLV.

- Equity-based silver ETFs (e.g., SIL, SILJ) — invest in silver mining companies rather than silver itself, offering indirect exposure and generally higher volatility than physically backed ETFs.

- Synthetic silver ETFs (mainly outside India) — use futures and swaps instead of holding silver, which can introduce tracking error and counterparty risk.

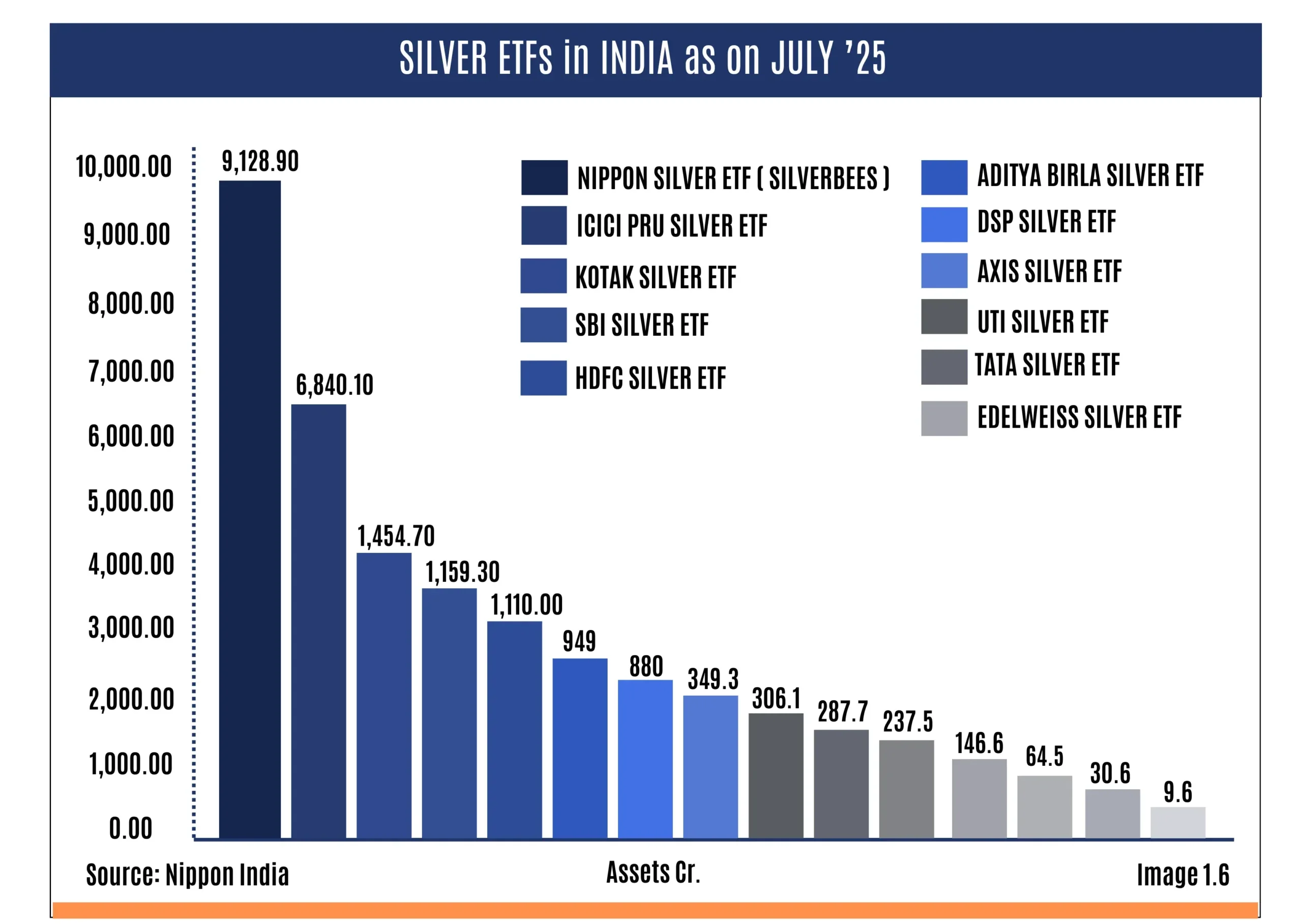

Top Silver ETFs in India (as of mid-2025):

- From January 2022 to January 2025, total investments in silver ETFs grew to over ₹13,500 crore. With more than 6 lakh investor accounts (folios) as of January 2025, it’s clear that many Indians are now adding silver to their portfolios.

- Nippon India Silver ETF (SILVERBEES) — the largest in India, with AUM of over ₹9,129 crore. It has delivered one of the best recent track records, with 1-year returns of over 38.58% and a 3-year CAGR of over 101%.

- ICICI Prudential Silver ETF — the second-largest fund, with over ₹6,800 crore in assets.

- Other options — HDFC, SBI, Aditya Birla, Axis, Tata, UTI, Edelweiss, DSP, Mirae, Zerodha, and Groww also offer silver ETFs, typically managing between ₹300 crore and ₹1,100 crore each. As of 2025, there are 12+ silver ETFs, making this one of India’s fastest-growing commodity ETF segments.

INVESTMENT RATIONALE FOR INVESTMENT IN SILVER

What if one could invest in something that’s both a precious metal and a key material for the future? That’s silver. It’s not just old coins or jewellery; it’s a powerful asset that offers both protection and growth. In today’s digital world, silver stands out as a real, limited resource. Silver must be mined. Like gold, silver has been trusted for centuries. But while gold is more popular, silver is still affordable and has more potential to rise when metals rally.More than half of silver demand comes from industries like electric vehicles, solar energy, and electronics.

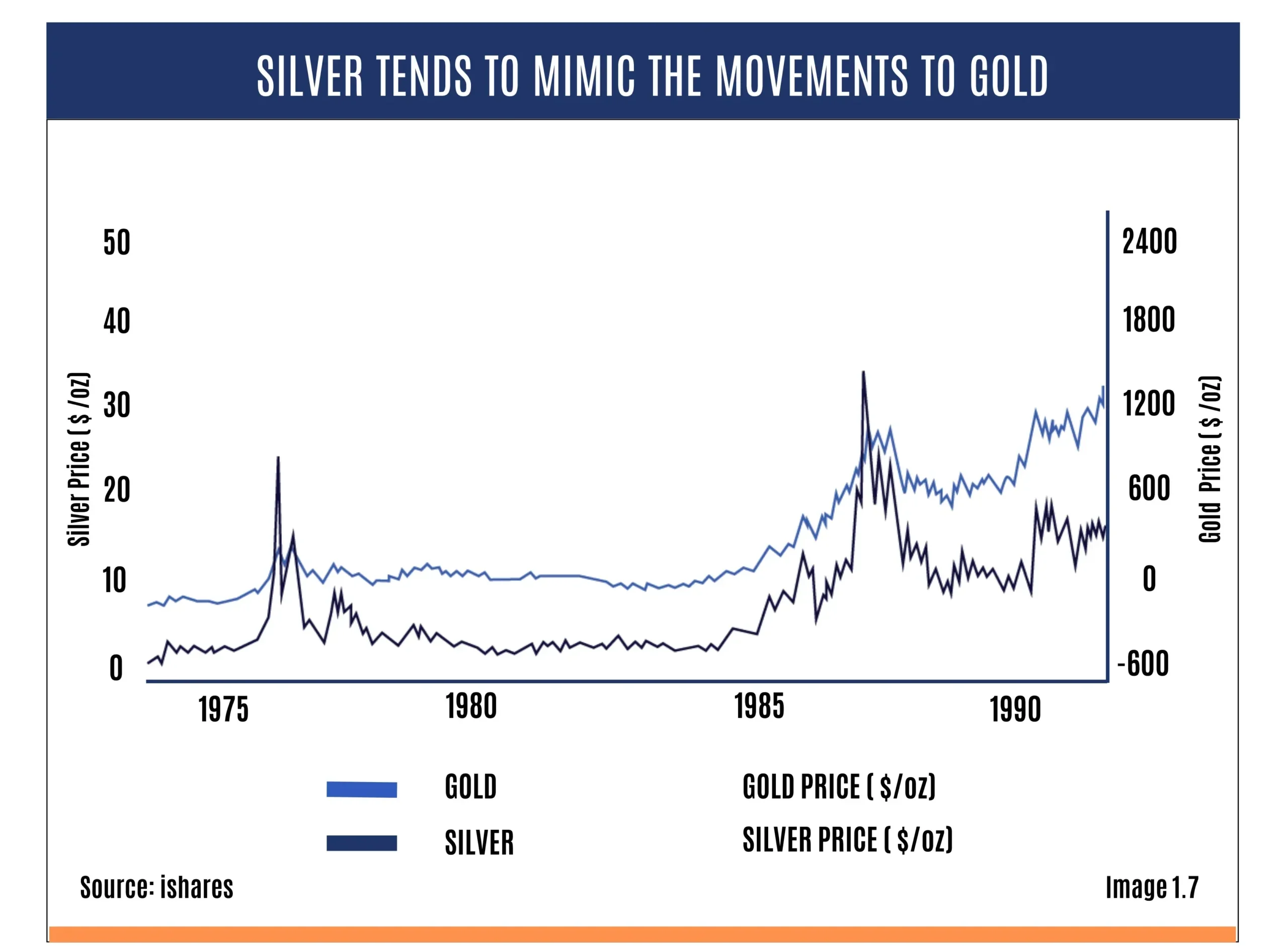

Every EV uses up to 50 grams of silver. From solar panels to 5G and AI chips, silver is an essential material for the future. So when these industries grow, demand for silver—and its price—tend to rise. Silver acts as a safety net during inflation, currency declines, or market stress. It tends to hold value when money loses purchasing power. For example, silver rose over 40% in 2020 during global economic uncertainty. Silver is more volatile than gold, as shown in the image. But that also means it can rise faster when the market turns positive. If you’re comfortable with short-term ups and downs, silver can offer stronger gains— especially through ETFs that remove storage and purity concerns.

Silver doesn’t always move in sync with stocks or bonds, making it a useful addition to a portfolio. Even a small 5–10% allocation can help balance risk and improve long-term returns.

Silver ETFs offer a smarter, more convenient way to invest. You don’t have to worry about storage, purity, or theft—your investment is safe, regulated, and backed by physical silver held securely in vaults. Unlike buying jewellery or coins, there are no making charges, no GST on purchase, and no hassles of physical handling. You can buy or sell anytime through a demat account, just like a stock. For larger amounts, silver ETFs make it easy to gain full exposure to silver without the risks and costs of holding it physically. It’s a clean, cost-effective, and reliable way to benefit from silver’s price growth.

RISKS & LIMITATIONS OF SILVER & SILVER ETFs

Silver offers many compelling investment characteristics, but it’s important to recognize that, like any investment, silver and silver ETFs carry distinct risks and limitations. Silver is a highly volatile commodity—over the trailing 14 days (as of July 2025), the average daily price move has been roughly ₹1,900–₹2,000—which can be challenging for risk-averse investors. As an asset class, it is generally more volatile than other precious metals and many commodities. Silver prices are also heavily influenced by macroeconomic factors such as inflation, interest rates, central-bank policies, and economic growth, all of which can be unpredictable. Silver as an asset class does not provide investors with cash flows or yield.

Unlike bonds and equities, which provide payouts in the form of interest or dividends, silver ETFs rely solely on capital appreciation for returns. Therefore, for investors seeking regular payouts or relying on cash flows from their investments, silver may not be appealing in that context. While silver ETFs are generally efficient investment vehicles, they are subject to tracking error—the divergence between the ETF’s actual return and silver’s performance. Factors contributing to this divergence include the ETF’s expense ratio, roll costs in synthetic ETFs, and deviations in the fund’s NAV. Investors should consider these factors before investing in silver ETFs, as doing so can help them optimize returns.

PERFORMANCE OVERVIEW OF SILVER & SILVER ETFs

Between 1979 and 2025, the silver spot price delivered positive returns in 277 of 557 months—approximately 50% of the time. On a yearly basis, it ended higher in 21 of the past 46 years. Over the last decade, the best month was July 2020, when silver surged by 27.5%. More recently, the white metal has risen for three consecutive quarters, averaging roughly 9.85% per quarter. Silver has also appreciated in the October quarter in six of the last seven years, indicating a modest positive seasonal trend heading into this year’s October quarter. In India, SEBI permitted mutual fund houses to launch silver ETFs only in the second half of 2021.

SEBI allowed mutual fund houses to launch silver ETFs only in the second half of 2021. Despite this late start, silver ETFs have gained popularity among Indian investors, and demand is expected to rise as awareness and investor education grow. That said, during rate-hiking cycles in major economies, silver as an asset class tends to come under pressure. A global economic slowdown can also weigh on prices. As of mid-2025, India’s largest silver ETF, the Nippon India Silver ETF, posted a 1-year return of approximately 12.9% and a 3-year CAGR of around 10.8%.

FUTURE OUTLOOK

Silver has experienced a sharp rally in prices over the past few quarters, with a Year-to-Date return of approximately 30.8%. This rise is supported by strong sectoral tailwinds that are likely to persist in the medium to long term. As mentioned, silver has widespread usage in industrial products. The accelerating global transition towards green energy and digital electrification, along with the speed at which this shift is happening, has created a structural transformation in silver’s demand landscape. This paradigm shift represents one of the strongest long-term tailwinds for silver.

The market share of electric vehicles (EVs) has increased across continents and countries, including developing nations, and this trend is expected to continue for the foreseeable future. Compared to traditional internal combustion engine vehicles, EVs require approximately 2-3 times more silver, which is expected to exert upward pressure on silver prices.

As countries worldwide push for net-zero emissions, solar power deployment is expanding at a record pace. Each gigawatt of solar capacity added requires 500,000 ounces of silver. Analysts project that the solar industry alone could increase silver demand annually by 15-20% for the foreseeable future, making it one of the fastest-growing industrial segments for the precious metal.

In addition, silver has a strong use case in the development of 5G networks, semiconductors, AI hardware/chips, and advanced medical tools due to its unmatched electrical and thermal conductivity. As these industries scale, demand for silver is expected to remain at elevated levels.

In addition to the solar industry, the Electric Vehicle (EV) market is another rapidly growing segment for silver. According to the IEA, electric car sales grew 25% year-on-year, reaching 17 million units in 2024.

Both demand and supply dynamics are working in tandem to push silver prices higher. However, the supply side of silver is starkly different from the demand side, characterised by rigidity, limitations, and regulatory pressure. The supply of silver is structurally inelastic and faces inherent constraints. Over 70% of global silver production is a byproduct of mining other base metals like lead, zinc, and copper. As a result, silver output is largely dependent on the production levels and economic viability of these other commodities.

In addition, ore grades have declined in quality over time, and to achieve the same silver output, more ore needs to be processed, making it increasingly difficult to meet demand. Environmental regulations and ESG (Environmental, Social, and Governance) pressure are also making it harder to obtain permits for new mining projects, thereby increasing both the time and capital required to bring new silver supply online. This combination of rising demand and limited supply creates a bullish structural setup for long-term silver prices.

Another tailwind in the making is the potential for lower interest rates and a weaker USD. Historically, silver prices have had an inverse correlation with interest rates. Any monetary easing or increase in fiscal spending by the United States could further push silver prices upward.

TAXATION OF SILVER ETFs IN INDIA

Silver ETFs are considered capital assets and are treated as debt securities. An individual’s investment in bullion attracts longterm capital gains tax if held for more than 36 months, taxed at a flat rate of 20%. However, if the investment is held for less than 36 months, it is considered a short-term investment. In such cases, the gains will be added to the individual’s regular income and taxed according to the applicable tax slab.

CONCLUSION

Silver’s use cases and limited supply are the primary drivers of its future performance. Since 2019, the global market has experienced a silver supply deficit relative to demand, and this trend is unlikely to reverse anytime soon, exerting increased pressure on prices. According to the dot plot, the FED is expected to cut rates in the coming months, which could further support silver’s performance. Despite a few limitations and potential pullbacks, silver presents an intriguing case for investors, both for the present and the future.